US Dollar Outlook, EUR/USD Analysis – Talking Points

- US Dollar could gain on risk aversion if PMI data sours sentiment

- Data for March will give a better picture for impact of coronavirus

- EUR/USD may retest crucial support: will a break catalyze a selloff?

ASIA-PACIFIC RECAP

The New Zealand Dollar was aiming higher early into Asia’s Tuesday trading session while the British Pound was uniformly trending lower vs its G10 counterparts. Prior to the release of Chinese PMI data, AUD/USD briefly dipped 1.50 percent heading into the release before modestly recovering after the statistics printed better-than-expected readings. Read the full alert here.

US DOLLAR ANALYSIS AHEAD OF CHICAGO MNI PMI DATA

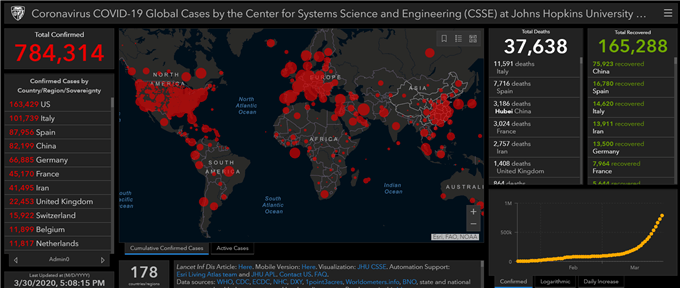

The US Dollar may rise if MNI Chicago PMI data for March misses the already-low estimate of 40, which is significantly weaker than the prior 49.0 reading. Consequently, demand for liquidity may surge and bring the Greenback with it if the statistics reinforce the notion of a severe recession from the coronavirus. At the time of writing, the total number of confirmed cases currently stands at 780,000 with the majority in the US now.

Chart Showing Coronavirus Infections

Source: Johns Hopkins CSSE

This risk-off dynamic may be amplified by the publication of Conference Board Consumer Confidence data which is scheduled to be released 15 minutes after the PMI report. Analysts are estimating a 110.0 reading amid a nationwide job layoff – as seen in last week’s employment figures – and weaker consumption habits as would-be purchasers stay at home.

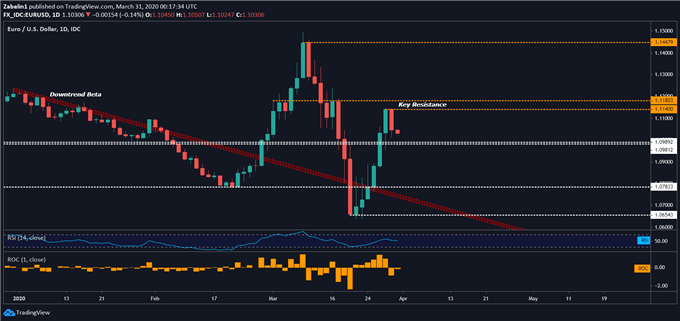

EUR/USD PRICE CHART

As forecasted, EUR/USD edged closer to testing a key inflection range between 1.0989 and 1.0981 (white-dotted lines). If it’s broken, it could cast a long and dark bearish shadow shortly after the pair peaked above key resistance channels where it was huddled under for several weeks. Furthermore, the downside bias towards EUR/USD is reinforced by the fundamental circumstances that are supportive of a strong US Dollar.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

US DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter