US Dollar, Consumer Confidence, Coronavirus, Recession – Talking Points

- US Dollar may rise if consumer confidence data reveals optimism has been shaken by virus

- Demand for liquidity, selloff in risk-oriented assets may push haven-linked Greenback higher

- AUD/USD flirting with compression zone as pair approaches resistance: is the uptrend over?

Asia-Pacific Recap

The cycle-sensitive Australian and New Zealand Dollars fell in what appeared to be a risk-off tilt in market sentiment. This sentiment extended into equities as US stock futures aimed cautiously lower along with their Asian peers. The New Zealand Dollar’s selloff accelerated after Prime Minister Jacinda Ardern stresses the need for vigilance and continuing the shelter-in-place measures.

US Dollar May Rise if Confidence Data Underwhelms

The US Dollar may rise if consumer confidence data for April prints a worse-than-expected figure amid a dampened outlook in sentiment as the coronavirus continues to sap economic optimism. Conference Board consumer confidence is anticipated to show an 87.0 print, far below the prior 120.0 reading. The prospect of a deep, virus-induced recession will likely be reflected in the consumer data despite stimulus measures.

The US government and Fed together have pumped over $7 trillion into the world’s largest economy, about 34 percent of US GDP in 2018. A softer reading in consumer confidence could have a multi-iterated impact on key sectors of the US economy that provide a source of growth – like housing. As I wrote in my prior piece:

“Since a house is typically the biggest purchase a consumer will make in his or her lifetime, it serves as a helpful barometer of the prospective homeowner’s confidence”.

As the world’s largest consumer-driven economy, monitoring the behavioral disposition of the purchaser is crucial in calibrating how underlying optimism – or there lack of – is faring in uncertain times. Despite the $1,200 stimulus check – with speculations of another one upgraded to $2,000 – shelter-in-place orders continue to leave millions unemployed and businesses in financial distress.

AUD/USD Technical Analysis

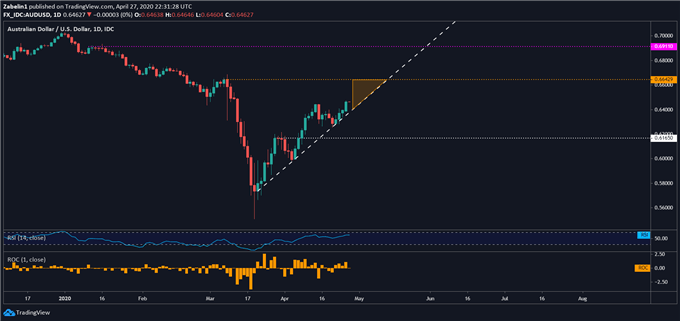

AUD/USD may start trading in a compression zone marked by the parameters of the uptrend (white-dotted line) and resistance at 0.6642 (gold-dotted line). This consolidative interim may give way to a bullish breakout, potentially propelling the pair to retest resistance at 0.6911 (purple-dotted line) . Conversely, capitulation could cast a bearish overhang and cause AUD/USD to fall, though selling pressure may abate around 0.6165.

AUD/USD – Daily Chart

AUD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter