Silver Price, U.S. Stimulus, Covid, Sentiment - Talking Points

- Wall Street trading ends lower Tuesday after Senate stimulus breakdown

- Silver prices drop despite weaker Greenback as inflation expectations ease

- Covid-19 variant from the U.K. identified in the U.S. as hospitalizations hit new record

The S&P 500 and Dow Jones Industrial Average closed in the red after making fresh all-time highs earlier this week, with both indexes dropping 0.22%. Wall Street opened optimistically higher over increased stimulus check prospects after the measure passed a House vote on Monday evening. However, Senate Majority Leader Mitch McConnell snubbed a fast-track measure despite support from President Donald Trump and several other GOP lawmakers.

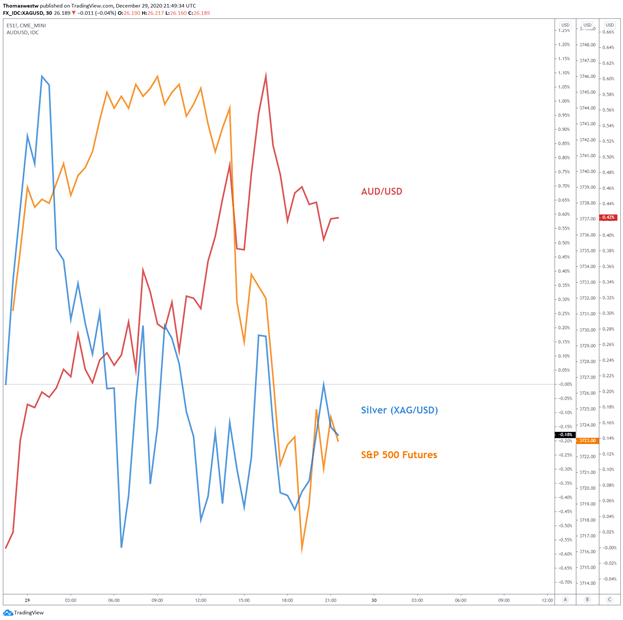

Silver prices fell alongside U.S. equities as the chances for increased fiscal aid hit an impasse and in turn, weighed on inflation expectations. The weakened outlook was reflected in the Treasury market with the 10-year breakeven inflation rate dropping one basis point. The pullback in the US Dollar helped accelerate the risk-sensitive Australian Dollar higher, with AUD/USD rising on the day.

Meanwhile, anti-fiat gold prices managed to rise slightly, with XAU/USD benefiting from weak USD action. The downbeat Greenback failed to support silver prices, however, with XAG/USD dropping 0.02%. The move lower relative to gold is likely a product of silver’s recent outperformance against the yellow metal. The ongoing debate over increased stimulus payments will be front and center with concern to market movements.

Silver, S&P 500, AUD/USD – 30-Min Chart

Chart created with TradingView

Wednesday’s Asia-Pacific Outlook

The Asia Pacific session may see some spillover from Wall Street’s weak showing. But, with a light economic calendar amid the upcoming New Year’s holiday, equities may gyrate near current levels. Japan’s Nikkei 225 index ended Tuesday’s session near 30-year highs following the stimulus news in the United States. That said, a mild pullback may likely manifest in the Japanese index if traders continue to follow the same market theme as the last 24 hours.

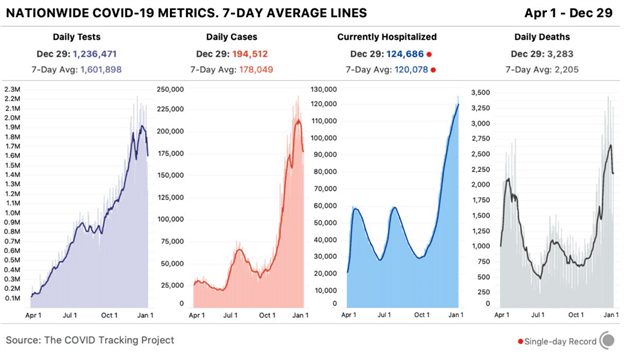

Furthermore, Covid-19 remains a lingering question mark for traders. While vaccine headlines have supported a risk-taking environment across assets since the U.S. FDA gave the Pfizer-BioNTech vaccine an emergency use approval earlier this month, a Covid-induced pullback is certainly not off the table. In fact, a recently identified strain of Covid from the United Kingdom, this one more contagious, was identified in Colorado Tuesday night.

Its introduction may pressure sentiment in the coming weeks if it translates to an identifiable increase in cases. For now, however, markets appear largely immune to the ongoing spread, with U.S. hospitalizations continuing to accelerate. The Covid Tracking Project shows the number of virus patients in U.S. hospitals continues to rise, and December 29 saw a record 124,686 hospitalizations reported.

US Covid-19 Statistics

Source: The Covid Tracking Project

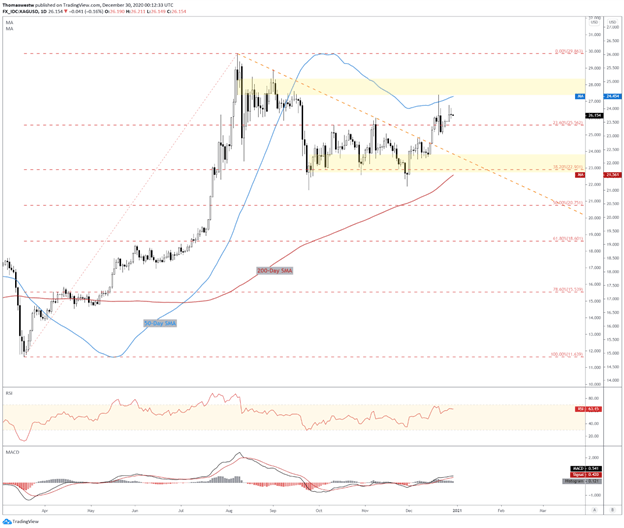

Silver Technical Outlook:

The current pullback in silver may extend further with the 23.6% Fib retracement from the March-August move sitting at 25.562, which could come into play to offer support. Year-end flows with the New Year only days away may skew fundamental price drivers over the next few days. That said, a resumption of the broader December trend higher may likely continue in 2021, but the next few days may have bulls watching from the sidelines.

XAG/USD’s overall bull trend from the Covid-induced March lows appears intact, however, with the 50- and 200-day Simple Moving Averages aimed towards higher ground. An inflection area comes into play above the 26 handle, but a breach above would see bulls challenging the 2020 high which sits just below the 30 handle. For now, consolidation into 2021 appears most likely, but outside of the short-term, higher ground appears to be favored in the technical outlook.

Silver Daily Chart

Chart created with TradingView

Silver Trading Resources:

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter