Russell 2000 Index, US Small-Caps, Federal Reserve, Covid-19 – Talking Points:

- The US Dollar clawed back lost ground during the Asia-Pacific trading session ahead of US second quarter GDP.

- The Federal Reserve looks set to continue underpinning equity markets, potentially driving the Russell 2000 to fresh post-crisis highs.

Asia-Pacific Recap

A slight risk-off bias was seen in Asia-Pacific trade as the US Dollar pegged back lost ground against its major counterparts.

The ASX 200 slid lower as Victoria, Australia’s second most populous state, recorded a further 732 cases of Covid-19.

Gold and silver pulled back alongside copper prices, whilst yields on US 10-year Treasuries dipped back below 0.58%.

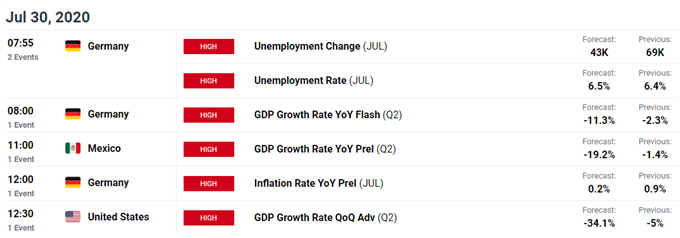

Looking ahead, US second-quarter GDP highlights the economic docket alongside second quarter corporate earnings from Apple, Amazon and Alphabet.

Fed ‘Plan for The Worst’ Amid Rising Cases of Covid-19

As expected, accommodative monetary policy looks set to stay for the foreseeable future as Federal Reserve Chairman Jerome Powell reiterated the central bank’s commitment “to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals”.

Although “economic activity and employment have picked up somewhat in recent months”, Chair Powell stressed that “the path forward for the economy is extraordinarily uncertain and will depend in large part on our success in keeping the virus in check”.

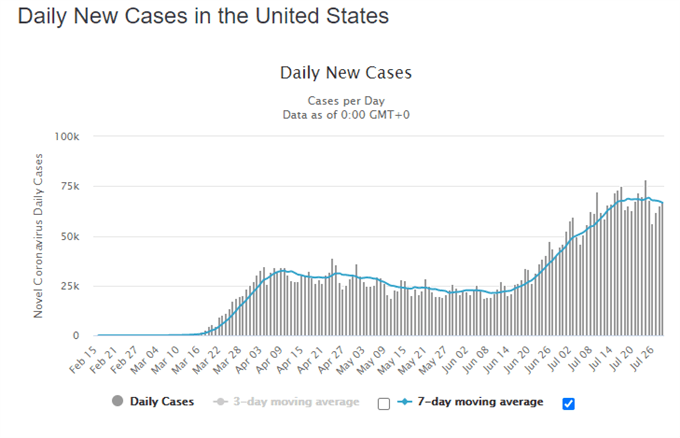

Source – Worldometer

With the number of infections in the United States soaring above 4.5 million and climbing at a daily rate of over 65,000 new cases, the central bank’s dovish forward guidance seems entirely justified.

In response to this “ongoing public health crisis” the Federal Reserve “will increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities at least at the current pace [to] support the flow of credit to households and businesses”.

Furthermore, Chair Powell assured the central bank isn’t relying on a vaccine to save the American economy, stating that “our job is not to plan for the upside case, we’ve got that covered”.

With that in mind, investors may discount the upcoming update to the US GDP report, with the economy facing its biggest contraction since the data series began in 1947, as the central bank stands at the ready to underpin equity markets.

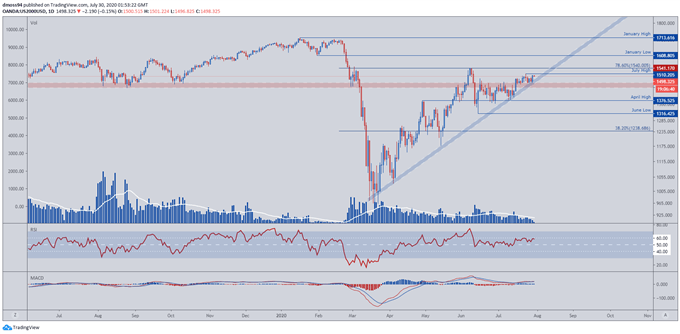

Russell 2000 Daily Chart – Fading Volume, RSI Divergence Hints at Potential Trend Break

Russell 2000 Small-Cap Index daily chart created using TradingView

From a technical perspective, the Russell 2000 small-cap stock index looks set to pull back to 5-month trend support, as fading volume and RSI divergence suggest underlying exhaustion in the recent rally from support at the April high (1,377).

Although a temporary correction seems more than likely, the outlook for the Russell 2000 remains positive as yesterday’s bullish candle signals investors may continue to adhere to a ‘buy-the-dip- mentality, should price slide to support at the psychologically pivotal 1,450 level.

With that in mind, a push to retest the post-crisis high may eventuate in the coming days, with a daily close above the 78.6% Fibonacci manufacturing a route for the US small-cap benchmark index to climb toward key resistance at the January low (1,609).

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss