Nasdaq 100, US Equity Price Analysis

- The animal spirits were boisterous today as a blowout jobs report defied expectations of continued economic pain and malaise in the United States.

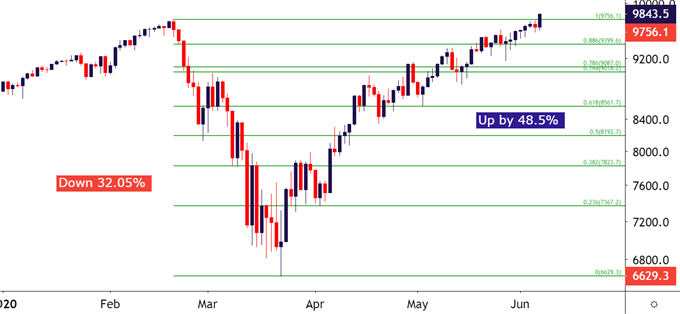

- US equities continue to run higher with the Nasdaq 100 setting a fresh all-time-high, not even three months after giving back almost a third of its value in about a month.

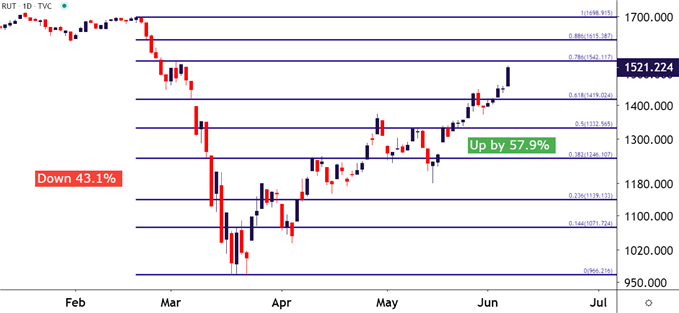

- While the 48.5% run in the Nasdaq 100 has been impressive, it pales in comparison to the 57.9% jump in the Russell 2000 over the same period of time. With tech and small caps leading the charge, there may be continued scope for continuation.

Nasdaq 100 Sets Fresh All-Time-High

Tell me if you saw this one coming: In late March equities were in the midst of a historic sell-off. The world was bracing for something that hasn’t really ever been seen as the largest economies around-the-globe ground to a halt in anticipation of a nasty new virus that had some very frightening albeit barely-known consequences. In the early part of March, the Fed had already yanked rates to the lower-bound while announcing a return of bond buying at the Central Bank – but that seemed to help little as fear dominated both markets and headlines and stocks just continued their descent.

Now – not even a few months later, and the Nasdaq 100 has rallied up to a fresh all-time-high, breaking above that February high water mark that looked so far away just a few months ago. This morning brought a blockbuster jobs report, likely surprising even the most optimistic of analysts as the US economy added more jobs last month than any other month in recorded history. And re-openings have begun, even in the pandemic-plagued city of New York which now has an entirely new risk variable to contend with as social unrest has become the new primary point-of-focus.

In the Nasdaq 100, the run from the March lows into this morning’s high now constitutes a whopping 48.5%. An amazing run for any stretch but considerably more so when given the context of the current climate.

Nasdaq 100 Daily Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

To be sure – considerable government support has helped. Over the past few months in the US that has come from all of the Fed, the US Treasury Department and even Congress. Balance sheets have ballooned even though the Fed hasn’t had to utilize all of the tools at their disposal; a platter which FOMC Chair Jerome Powell had remarked on just a couple of weeks ago when he said that there was ‘no limit’ to what the bank could do with the lending programs available to them.

We are witnessing history, in more ways than one, although the machinations in economics are likely far below the surface of more headline-worthy topics; and likely not garnering much attention at this point as little in that approach has yet proved as problematic.

Dow, S&P Lag Nasdaq but Continue to Exhibit Strength

Outside of the tech-heavy Nasdaq 100, the Dow and S&P 500 continue to lag but the run that’s shown in small caps of recent has been impressive as well. The Russell 2000 index set a fresh three-month-high this morning, a full 57.9% from the March lows. But, to keep this in scope – the hit in March was more aggressive here than the Nasdaq as the Russell 2000 had sold off by 43.1% while the Nasdaq 100 was only off by 32.05% over the same period of time.

Russell 2000 Daily Chart

Chart prepared by James Stanley; Russell 2000 on Tradingview

Tech, Small Caps Leading the Charge

In general, a market in which tech and small caps are outperforming is generally looked at as strong or optimistic. And given the heaps of stimulus that have already been applied to the situation, along with the potential for more and the fact that the Fed has a theoretical put applied when the Chair of the bank says that there’s ‘no limit’ to what they can do, well, there could be even more reason for risk assumption in the days and weeks ahead.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX