Mexican Peso, US Dollar, USD/MXN Price Forecast:

- USD/MXN is breaking down to a fresh monthly low to start this week.

- With an extremely weak US Dollar in focus on Wednesday for the FOMC rate decision, the big question is one of continuation potential in the pair.

- A major inflection point for USD/MXN sits just below current price action, around the 21.50 spot on the chart, currently constituting the four-month-low in the pair.

- As discussed as part of the Core Perimeter Trading Model, Mexican Peso trends are often at the mercy of US economic trends.

USD/MXN Sets Fresh Monthly Low

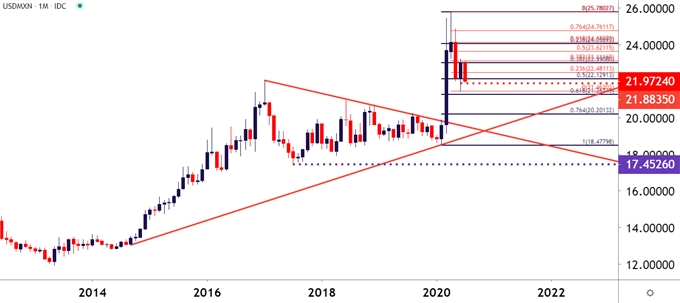

As the US Dollar breaks down to a fresh two-month-low, USD/MXN has been unable to avoid the carnage as the Dollar-Peso pair continues to sell-off. The bearish move appears a bit more mild, however, because while the US Dollar is hitting a fresh two-year-low, USD/MXN will have to settle for a fresh monthly low, at least for now. The four-month-low, the same level that stymied sellers in June sits just below around 21.50, so that may soon be in-play; but for USD/MXN to match the US Dollar’s two-year-lows, the pair is going to need to continue moving south on the chart until the 17.50 level can come into play, and that may take a while.

Notably, and to put this recent dynamic to some reference – today sees price action cross below the 50% marker of the bullish 2020 move in USD/MXN for the first time in over a month. Meanwhile, both EUR/USD and AUD/USD are trading higher than they were at the 2020 open after watching the entirety of the US Dollar’s bullish move get priced-out. Clearly, EMFX are underperforming, even with an extremely weak US Dollar in the mix.

USD/MXN Monthly Price Chart

Chart prepared by James Stanley; USDMXN on Tradingview

Can EMFX Outperform the US Dollar?

One of the big fears as the coronavirus was getting priced-in earlier this year was what might happen to Emerging Market currencies. While the US, Europe, Japan and China had considerable flexibility for unconventional monetary policy, lower rates and liquidity programs – emerging market Central Banks don’t often enjoy such latitude. And with the threat of coronavirus in these areas, the damage from slowdowns, social distancing and coronavirus restrictions could make a much stronger impact with fewer tools at the respective Central Bank to offset the pain. This helps to explain the bullish flare in USD/MXN from February to April of this year; and likely, this also explains why the corresponding pullback in the pair has been a bit more mild.

As pairs like EUR/USD and AUD/USD fly to fresh highs, USD/MXN’s sell-off has been more calm and milder. But, as noted by Dimitri Zabelin as part of his work on the Core Perimeter model, Mexico’s economy is often at the mercy of the US, and this means that future trends in USD/MXN are likely going to have a heavy drive from what happens north of the border.

This also means that if there is another flare of USD-strength, similar to what was seen in mid-March, USD/MXN could be a very interesting market to be following. Conversely, the short-side of the move may prove as challenging, especially considering the fact that there may be other USD-pairs that could be more amenable to a backdrop of US Dollar strength.

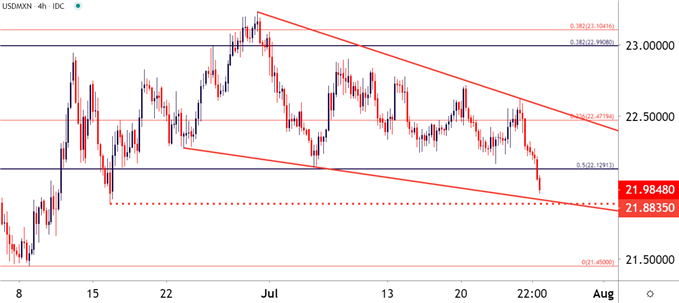

USD/MXN Four-Hour Price Chart

Chart prepared by James Stanley; USDMXN on Tradingview

USD/MXN Strategy Moving Forward

At this point, it may be difficult to line up USD reversal scenarios given just how weak the currency has been. But – it’s important to keep in mind this week’s economic calendar, with the FOMC sitting in the middle with what’s expected to be a widely-watched rate decision. While it’s unlikely that the Fed will talk up rate hikes or tighter policy, they may not yet be ready to prod the currency lower, especially after the Q3 weakness that’s already shown; and, at the very least, it does present the opportunity for a pullback in that theme.

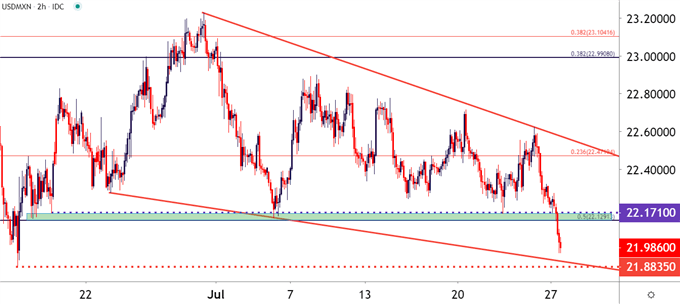

This could be relevant in a couple of different ways for USD/MXN. For those looking to on-load bearish positions, a pullback from these fresh monthly lows could open the door for such. Such an approach could follow prior supports around 22.1291 for follow-through resistance in a continuing bearish trend. Conversely, for those that are looking for USD-reversal plays ahead of FOMC, that pullback theme may present some items of interest, looking for a hold of support above the 21.8835 prior swing-low.

USD/MXN Two-Hour Price Chart

Chart prepared by James Stanley; USDMXN on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX