USD, Euro, CAD, AUD Price Analysis

- There’s stark divergence between social mood, economics and current market activity.

- The US Dollar has recently pushed into a bearish trend, and that’s helped to elicit a strong breakout in EUR/USD. The Canadian Dollar and Australian Dollar have been showing strength in various ways over the past couple of months as commodity currencies continue to outperform.

Stocks, Social Mood Continues to Diverge

The risk on environment continues to shine and stock indices in the US are either nearing or have already eclipsed their yearly open. That’s pretty respectable when we put that in context with historic hit to economic data as the world struggled with a global pandemic. And now we can add in social unrest around a topic that does not look to have a simple or nearby solution, yet the risk-on behavior just continues to drive.

It’s long been said in the post-Financial Collapse backdrop that markets have divorced from economics. And with the numerous instances of ‘bad news being good’ in the recent past, that makes sense. But now – it seems as though markets aren’t reflecting the social mood at all, much less the fear of a continued struggle with covid. And given the mass protests that have taken place and multiple experts voicing fear over another wave of coronavirus as social distancing measures were de-prioritized to a larger cause - there’s a very legitimate prospect of risk punctuating the horizon as the world now struggles with an entirely new risk factor; one that can’t be addressed with a vaccine at the same time as a global pandemic.

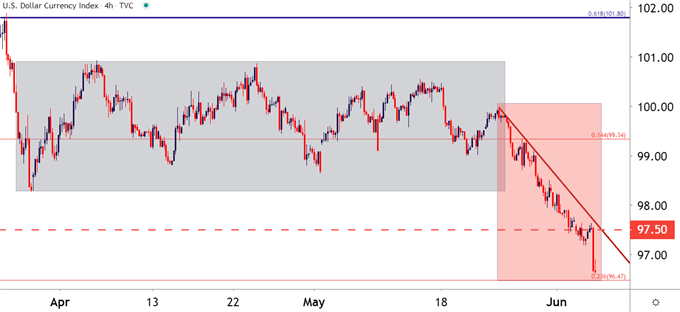

Nonetheless, the risk trade remains in full bloom; and even with all of those risk factors mentioned above, there’s one very important thing that can keep this driving – the prospect of continued government support being served into markets. This has impacted the US Dollar mightily of recent, particularly over the past couple of weeks as the Greenback has broken into a bearish trend after almost two full months of range-bound activity.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

The drive of USD-weakness and that relationship with the continued strength of the risk on trade can make sense: As the US government goes to unprecedented lengths to try to offset the economic destruction that’s come from the coronavirus, hope remains that a ‘v-shaped’ recovery is in the cards; and that as lockdowns area eased business activity will spring back. This would likely entail a continued posture of support from US governments, including all of the FOMC, the Treasury Department and perhaps even Congress.

So, while fear and risk factors remain and while social mood is about as sour as its been in the past fifty years, the unprecedented level of stimulus and accommodation may, in fact, continue to drive risk markets higher as both bond yields erode and confidence is re-gained that economic data will soon begin to turn-higher.

This has had a pretty profound impact on the Euro of recent. While questions have remained around fiscal coordination, a bit of hope on that front has helped to bring more buyers into the Euro, and this morning’s QE announcement only drove that theme further with bulls pushing EUR/USD up to fresh two-month-highs; and of particular note above a zone of previously key support/resistance that only produced a subtle pause in this recent bullish trend. There is still potential turbulence ahead, however, as the yearly high that was set in March shows in a huge area of potential resistance, running from 1.1448 up to the 1.1500 psychological level.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

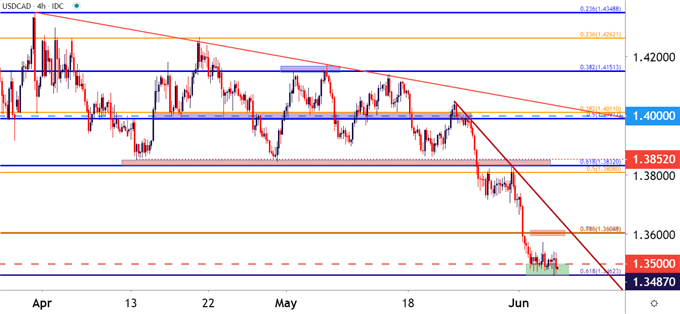

USD/CAD Support Holds the Lows

Compared to the Euro, the Canadian Dollar has been downright tame so far today; and that statement can even be stretched to include yesterday’s price action, even with a Bank of Canada rate decision earlier in the morning. That likely has to do with a few factors, one of which is the major psychological level of 1.3500 which, so far, has proven tough to break. But also of consideration are tomorrow’s jobs reports out of both the US and Canada along with the fact that, over the past couple of weeks, bears have already pushed the pair down by about 500 pips, breaking below a descending triangle formation in the process.

As looked at in Tuesday’s webinar and again in yesterday’s article, confluent resistance potential exists around the 1.3600 area; so if bears remain unable to break-below that 1.3500 spot, a pullback to resistance could be a way of imparting some strategy into the matter.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

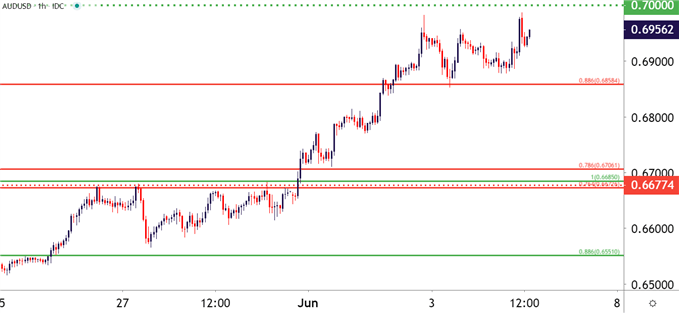

AUD/USD Moves Up Towards the .7000 Handle

Of all the major currency pairs, I think AUD/USD has had the most impressive show of trend over the past couple of months with the pair gaining almost 1500 pips from the March low. Adding some context into the matter – this comes after AUD/USD had pushed down for a fresh 17-year-low, even breaching below the .6000 spot that had helped to hold support during the financial collapse.

But, over the past couple of months, that hard bearish trend has turned into an aggressively bullish trend, and now the pair is nearing the test of another major psychological level that bulls don’t appear ready to yet encounter. The .7000 big figure looms large as this same price helped to hold the highs at the end of 2019. At this point, buyers have now pulled up just shy of a re-test at that level twice over the past two days. If buyers are able to break-through and if they are able to stretch up to the .7000 handle, will they have much left in the tank for even more?

AUD/USD Hourly Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX