Japanese Yen, US Jobless Claims, Coronavirus – Talking Points

- Japanese Yen may rise if US jobless claims data undermines market mood

- Australian Dollar edged slightly higher after better-than-expected jobs data

- JPY index could be forming a short-term Bull Flag continuation pattern

Asia-Pacific Recap

US equity futures pointed lower heading into Asia’s Thursday trading session in what appeared to be a “risk off” tilt in market mood. This was also reflected in FX markets with the Australian and New Zealand Dollars suffering while the anti-risk Japanese Yen rose. NZD was hit particularly hard after the RBNZ said it would not rule out negative interest rates. Australian jobs data came in better than expected and lifted the Aussie, but AUD/USD struggled to hold onto those gains.

Japanese Yen May Rise on US Jobless Claims Data

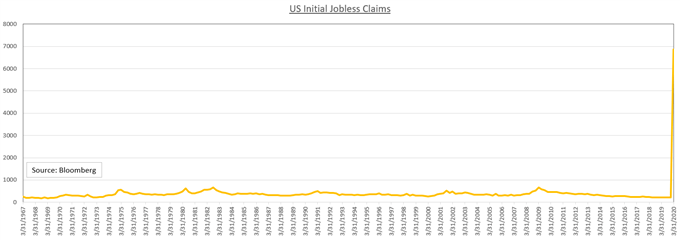

The Japanese Yen may rise if US jobless claims data shows another spike as it continues to record-highs amid the nation-wide lockdown. The severity of the situation can be understood by how it makes the 2008 crisis – which almost plunged the world into a global depression – look like a garden variety downturn. Unemployment is anticipated to continue to rise as business revenue slows and firms lay off employees.

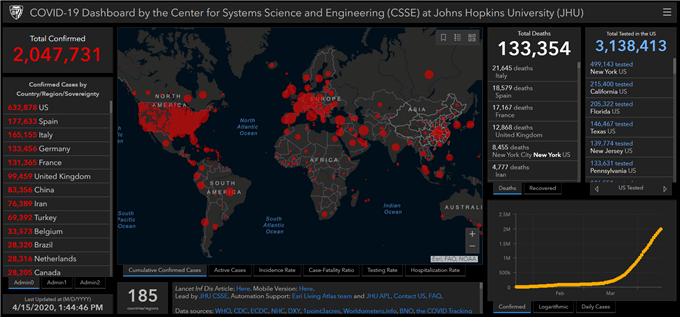

The US has become the new epicenter of the coronavirus with over 630,000 cases. The “Great Lockdown” as IMF Chief Economist Gita Gopinath dubbed it, has caused a cross-continental disruption to economic growth at a time when the global economy was beginning to show signs of stabilization. However, with the virus pandemic wreaking havoc, it is unlikely that the world will soon see a return to “normal” in the next year.

Coronavirus Cases

Japanese Yen Analysis

The Japanese Yen index – using a basket of the currencies composed of the Euro, US Dollar, British Pound and Australian Dollar – appears to be forming a short-term continuation pattern known as a Bull flag. The JPY index may be on the cusp of an upside breaking, potentially catalyzing what could be a rise of the same magnitude and height as the one preceding the congestive period that it is attempting to break out of now.

Japanese Yen Index – Daily Chart

Japanese Yen index chart created using TradingView

JAPANESE YEN TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter