Gold Prices Dip, But Pattern Incomplete To Upside

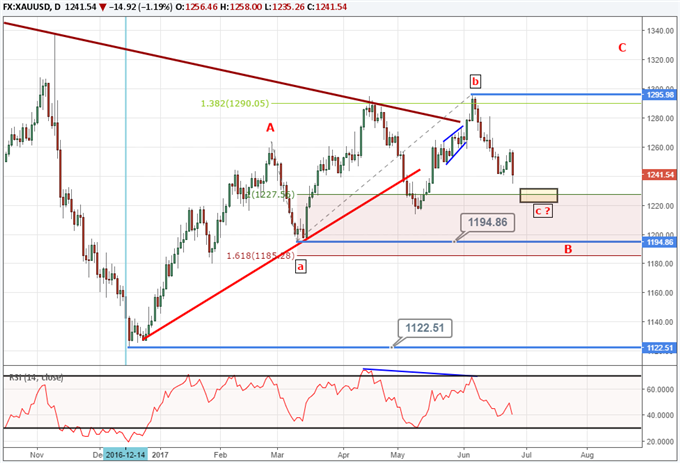

Gold prices continue to consolidate inside a range. The Elliott Wave model we are following hints that we could see an eventual breakout above $1295, though it does call for some shorter term weakness.

According to the model, gold prices are grinding sideways in a ‘B’ wave. This wave could continue to drop towards $1228 and possibly dive towards the March low of $1194.

If gold prices do approach $1194, we think it may find support in the $1180 - $1194 zone. The model we are following does suggest a lower probability outcome for gold prices to break below $1122 and that prices are likely to hold above $1122.

The IG Client sentiment reading for gold is at +3.75. Traders have remained near current positioning levels for the past several weeks. In a way, this makes sense because gold prices have been trading sideways with no real breakout taking place. However, we can use sentiment as a contrarian indicator that suggests there may be weakness in the yellow metal in the shorter term. Follow this live reading and learn how to trade with sentiment at this link.

Bottom line, we are anticipating some losses in gold price and for support to form above $1122. Once support is formed, we anticipate new highs above $1295.

This is a shorter term outlook for gold. Read our quarterly gold price forecast to see what may be influencing the longer term cycles.

---Written by Jeremy Wagner, CEWA-M

Discuss this market with Jeremy in Monday’s US Opening Bell webinar.

Follow on twitter @JWagnerFXTrader .

Join Jeremy’s distribution list.

EUR/USD has stalled. Where might we be in the Elliott Wave cycle? Read more on my EURUSD analyst pick.

Read the recent Dow Jones Elliott Wave article.

USD/JPY advances in impulses and corrects in three’s…see what that hints at for price action.

AUDUSD aims for 77 cents...see key levels to watch.

Copper's Comeback: Inside BHP And Lundin's Argentine Asset Acquisition

Copper, often dubbed "the metal of electrification," is experiencing a resurgence in demand due to its critical role in ... Read more

Revitalizing Commodities: How Clean Energy Is Breathing New Life Into A Stagnant Market

The commodities market, traditionally a cornerstone of investment portfolios, has experienced a decade of stagnation. Ho... Read more

European Airports Disrupted By Escalating Climate Protests

Climate activists have escalated their protests at European airports, blocking runways and causing flight disruptions in... Read more

Hungary's Russian Oil Dilemma: Why Brussels Is Cautious In Offering Support

Hungary's reliance on Russian oil has led it to seek support from Brussels to ensure continued access to this crucial en... Read more

Unveiling China's Secret Commodity Stockpiles: What Lies Ahead?

Xi Jinping's extensive reserves of grain, natural gas, and oil hint at future challenges.In a move shrouded in secrecy, ... Read more

Copper Miners Brace For Industry Overhaul As End Users Seek Direct Deals

The copper mining industry is bracing for a significant overhaul as end users, including cable manufacturers and car com... Read more