GMs $1 Billion Bet On Lithium: Securing The Future Of Electric Vehicles

General Motors (GM) has made a bold move to secure its place in the future of electric vehicle (EV) production by increasing its investment in a lithium mine to nearly $1 billion. Lithium, a key component in electric vehicle batteries, is in high demand as the automotive industry transitions toward electrification. With the potential for global lithium shortages looming, GM is positioning itself to ensure a stable supply of this critical metal. This article explores the importance of GM’s investment and how it fits into the broader context of the electric vehicle revolution.

The Growing Demand for Electric Vehicles

The global automotive industry is undergoing a significant transformation as governments and companies around the world push for cleaner, more sustainable transportation solutions. As countries set ambitious targets to reduce carbon emissions, the demand for electric vehicles has soared. Automakers are ramping up production of EVs to meet consumer demand and comply with stricter environmental regulations.

Lithium plays a vital role in this transition. It is the core element in lithium-ion batteries, which power the vast majority of electric vehicles on the road today. As EV sales continue to grow exponentially, the need for lithium has become more urgent. Industry analysts warn that by the mid-2020s, the supply of lithium may not be able to keep pace with this demand, leading to potential shortages that could disrupt the production of EVs.

GM’s Investment in Lithium Mining

To address these concerns, GM has significantly increased its investment in a lithium mine, committing nearly $1 billion to ensure its access to this essential resource. This strategic investment is part of GM’s broader plan to electrify its vehicle lineup and meet its goal of producing 1 million electric vehicles annually by 2025.

GM’s investment also reflects the growing importance of securing reliable supply chains for critical materials. Lithium is not only in high demand but also geographically concentrated in a few key regions, making access to this resource increasingly competitive. By investing directly in a lithium mine, GM is taking proactive steps to avoid potential supply disruptions that could arise as demand outpaces supply.

The Importance of Lithium in Battery Production

Lithium-ion batteries have become the standard for electric vehicles due to their energy density, longevity, and cost-efficiency. These batteries rely on lithium to store and discharge energy efficiently, making the metal an indispensable resource for the EV industry.

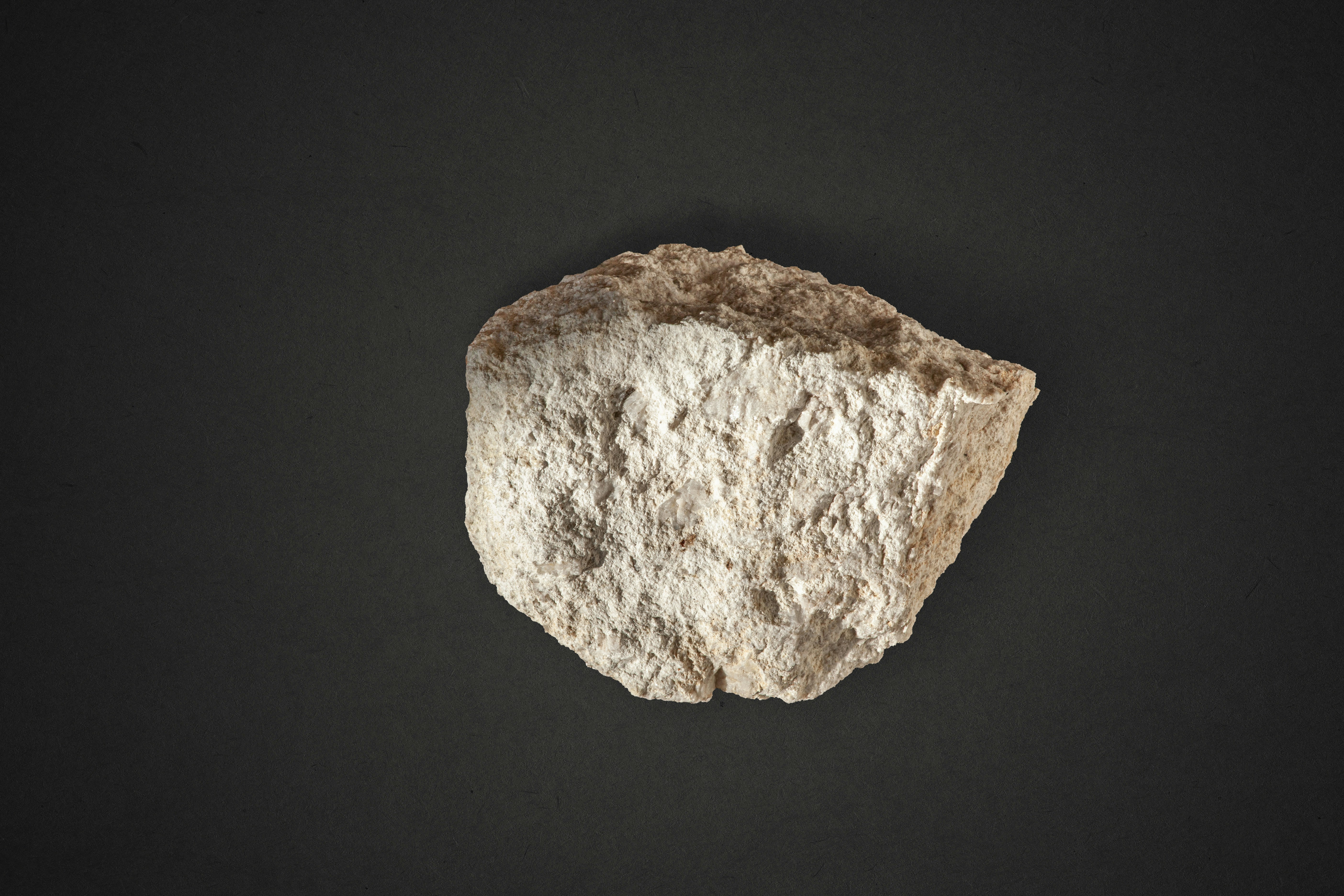

However, sourcing lithium is not without challenges. The extraction and refining processes are complex, and only a few regions, such as Australia, Chile, and Argentina, are rich in lithium deposits. This scarcity has led to concerns about the ability of the lithium supply chain to meet future demand. Despite ongoing research into alternative battery technologies, lithium remains the dominant material for EV batteries, and no viable large-scale alternative is expected to emerge in the near term.

Implications for the Automotive Industry

GM’s investment in lithium mining highlights the increasing competition for access to critical materials in the automotive industry. As more automakers pivot to electric vehicles, the race to secure lithium and other battery metals has intensified. Companies that fail to secure stable supplies risk production delays, increased costs, and an inability to meet consumer demand for EVs.

Lithium prices have already started to rise as demand grows, and this trend is expected to continue. Higher costs for raw materials could impact the overall cost of manufacturing electric vehicles, potentially raising prices for consumers. However, GM’s investment positions the company to mitigate these risks by ensuring it has access to lithium at a stable price, giving it a competitive advantage in the rapidly evolving EV market.

The Environmental Impact of Lithium Mining

While lithium is essential for electric vehicles, its extraction comes with environmental costs. Mining lithium requires large amounts of water, which can strain local water supplies, particularly in arid regions. Additionally, the mining process can lead to habitat destruction and soil degradation, raising concerns about the environmental sustainability of large-scale lithium extraction.

GM has acknowledged these concerns and has committed to pursuing more sustainable sourcing practices. The company is working with its mining partners to minimize the environmental impact of lithium extraction, exploring ways to reduce water usage and ensure that the mining process aligns with its broader environmental goals.

Balancing the need for lithium with environmental responsibility will be a key challenge for GM and other automakers as they scale up EV production. Consumers and regulators are increasingly demanding that companies not only produce green vehicles but also ensure that the supply chains behind them are sustainable.

Conclusion

GM’s nearly $1 billion investment in lithium mining is a strategic move to secure the future of its electric vehicle production. As the demand for EVs continues to rise, lithium will remain a critical resource, and securing a stable supply is essential for automakers to remain competitive. GM’s proactive approach positions the company to navigate the challenges of the lithium supply chain and maintain its leadership in the EV market.

However, the path forward is not without challenges. Rising competition for lithium, environmental concerns, and the potential for supply disruptions will continue to shape the industry in the coming years. By investing early and working toward sustainable practices, GM is betting that it can scale the future wall of demand for electric vehicles while managing the complex realities of sourcing critical materials like lithium.

Author: Brett Hurll

Copper's Comeback: Inside BHP And Lundin's Argentine Asset Acquisition

Copper, often dubbed "the metal of electrification," is experiencing a resurgence in demand due to its critical role in ... Read more

Revitalizing Commodities: How Clean Energy Is Breathing New Life Into A Stagnant Market

The commodities market, traditionally a cornerstone of investment portfolios, has experienced a decade of stagnation. Ho... Read more

European Airports Disrupted By Escalating Climate Protests

Climate activists have escalated their protests at European airports, blocking runways and causing flight disruptions in... Read more

Hungary's Russian Oil Dilemma: Why Brussels Is Cautious In Offering Support

Hungary's reliance on Russian oil has led it to seek support from Brussels to ensure continued access to this crucial en... Read more

Unveiling China's Secret Commodity Stockpiles: What Lies Ahead?

Xi Jinping's extensive reserves of grain, natural gas, and oil hint at future challenges.In a move shrouded in secrecy, ... Read more

Copper Miners Brace For Industry Overhaul As End Users Seek Direct Deals

The copper mining industry is bracing for a significant overhaul as end users, including cable manufacturers and car com... Read more