Europe Open, FOMC, COVID19, GBP/USD, OECD Talking Points:

- Optimism evaporated during the Asia-Pacific session after surge in US COVID-19 cases

- Dovish outlook from the FOMC compounded risk-off shift

- OECD urges UK to extend Brexit transition period

- GBP/USD fails to enter overbought territory after surge to monthly high. Is this the end of the line for Cable?

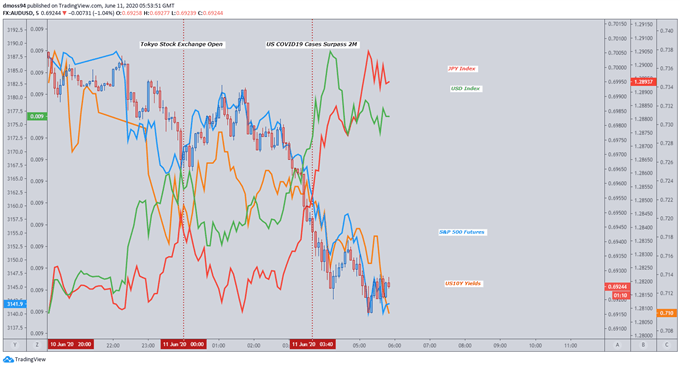

Asia-Pacific Recap

Risk appetite evaporated during Asia trade with Dow Jones futures plunging over 1.5%, as the number of confirmed COVID-19 cases in the United States surpasses 2 million.

The haven-linked US Dollar and Japanese Yen soared as the risk-sensitive Australian Dollar collapsed back below 70 cents.

US Treasury yields fell as the Federal Reserve announced it will continue to purchase bonds and mortgage-backed securities.

Looking forward, US Jobless Claims and PPI data headline the economic docket, with worse-than-expected figures possibly continuing to fuel the risk-off environment.

Source - Trading View

FOMC Spooks Markets with Dovish Outlook

Overnight comments from Chair Jerome Powell have taken the sting out of the recent rally in risk assets, dismissing the better-than-expected Non-Farm Payrolls (NFP) report showing a record 2.5 million jobs added in May as “clear evidence of just how uncertain things are”.

Keeping the target rate for the federal funds rate at 0 to 0.25%, the FOMC is “not even thinking about raising rates” as they remain “strongly committed” to doing “whatever we can for as long as it takes”.

Expanding its balance sheet “at least at the current pace” through Treasury purchases of $80 billion a month and mortgage-backed securities of $40 billion, it’s clear that the central bank doesn’t believe the worst has passed as there are still “considerable risks to the economic outlook over the medium term”.

OECD Recommend Further Policy Action for UK

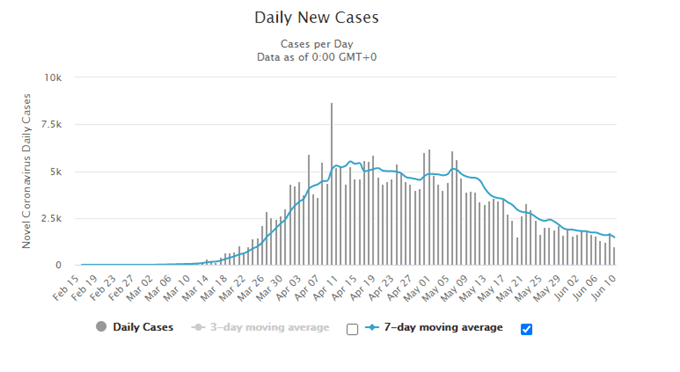

The United Kingdom is in the midst of a severe economic contraction, with the OECD forecasting GDP to shrink as much as 14% in 2020 “if there is a second virus outbreak later in the year”; in line with the ‘double-hit scenario’.

A recovery absent of a secondary outbreak, classified as the ‘single-hit scenario’, could still see “GDP fall sharply by 11.5%” as the service-based economy suffers from the ‘stay-at-home’ measures which may have “reduced output directly by one-third”.

With the UK’s death toll (41,128) second only to the United States (115,130), and almost 300,000 confirmed cases, both scenarios are “equally likely” as the 7-day moving average remains elevated at roughly 1,500 new COVID-19 cases daily.

Although daily cases have been trending downwards, recent protests may lead to a surge in new cases, similar to what is currently being seen in several states in the US.

Source – Worldometer

Therefore, the OECD recommended that current economic measures “should be kept in place as long as needed” and “fiscal policy should remain supportive” as unemployment is expected to exceed 10% and “remain elevated throughout 2021”.

Furthermore, the economic organization urged the United Kingdom to agree to a temporary arrangement with the European Union “to stay in the EU Single Market beyond 31 December 2020”.

Given Prime Minister Boris Johnson’s determination to deliver Brexit by year end, this remains highly unlikely.

However, with the EU’s chief negotiator Michel Barnier confirming the Union is “in favour of an extension, particularly given the current circumstances” there is still time, before the July 1 extension deadline, for the PM to reconsider.

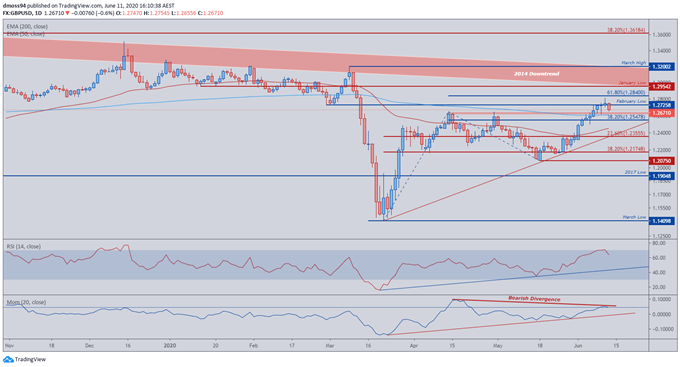

GBP/USD Daily Price Chart

Source – Trading View

Psychological resistance at the 1.28-handle proved too much for GBP/USD as a Spinning Top followed by a Bearish Engulfing candle may signal the reversal of a 10-day ‘bull run’.

Breaking through the April high (1.2643) earlier in the month, price continued its surge above the February low (1.2726) before sellers took over just shy of the 61.8% Fibonacci (1.2840).

Bearish divergence between price and momentum highlights a level of exhaustion in the recent rally, with RSI dipping prior to overbought territory providing further bearish bias.

The 200-day moving average (1.2610) may provide temporary support for GBP, however the sharp correction in RSI suggests strengthening downside momentum that could propel price back to 12-week trend support.

A break and close below trend support and the 23.6% Fibonacci (1.2355) may carve out a path back to the May low (1.2075), with RSI snapping its constructive trend possibly signalling a resumption of primary downtrend.

-- Written by Daniel Moss

Follow me on Twitter @DanielGMoss