British Pound Analysis Ahead of BoE Rate Decision, Bond Purchase Program, US Jobless Claims Data – TALKING POINTS

- British Pound may face severe selling pressure ahead of BoE rate decision

- Gloomy US jobless claims data may catapult USD higher on haven demand

- GBP/USD could capitulate ahead of key resistance as it trades at 1985 lows

ASIA-PACIFIC RECAP

The Australian and New Zealand Dollars plunged over one percent against the Greenback along with US equity futures early into Asia’s Wednesday trading session. The catalyst appeared to be concern about delays regarding the implementation of a $2 trillion fiscal plan from the government overseeing the largest economy in the world. Sentiment in Asia was also soured by dismal advanced GDP data from Singapore.

BANK OF ENGLAND RATE DECISION, BOND PURCHASING PROGRAM

The British Pound may fall on commentary from the latest Bank of England policy meeting . The benchmark lending rate is anticipated to stay at 0.10 percent with the bond purchasing program (QE) remaining at GBP645 billion. The BOE increased the QE limit by GBP200 billion at an emergency meeting on March 19.

The UK central bank will be conducting another Contingent Term Repo Facility (CTRF) operation on April 2. Even if interest rates remain unchanged, the size of the CTRF and commentary from officials may pressure the GBP. This comes despite massive stimulus measures announced by Chancellor of the Exchequer Rishi Sunak which involve paying 80 percent of wages to those unable to work during the coronavirus pandemic.

US JOBLESS CLAIMS: WHAT TO EXPECT

The US Dollar may recover some of its losses vs the British Pound and its G10 counterparts if US jobless claims data – with estimates for March at 1,640,000 – spurs haven demand and pushes the Greenback higher. However, risk aversion from the employment data may be offset by the ratification of a $2 trillion fiscal stimulus plan if both the Senate and House are able to find common ground.

GBP/USD TECHNICAL ANALYSIS

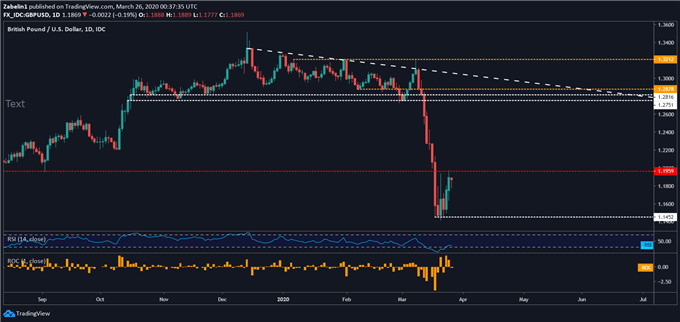

GBP/USD may shy away from testing former support-turned-resistance at 1.1959 and may even plunge below the 1985 swing-low at 1.14512. The upcoming fundamental factors may be the necessary inputs to catalyze an aggressive selloff in GBP/USD after the pair got some respite from a weakened US Dollar. However, that dynamic may quickly shift and push Cable into uncharted territory.

GBP/USD – Daily Chart

GBP/USD chart created using TradingView

BRITISH POUND TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter