Europe Open, GBP/JPY, NZD, COVID-19 Talking Points:

- Risk assets fell early in APAC trade as China-India tensions spooked market participants

- New Zealand deploys military in response to new COVID-19 cases

- GBP/JPY eyeing monthly low ahead of Bank of England rate decision

Asia-Pacific Recap

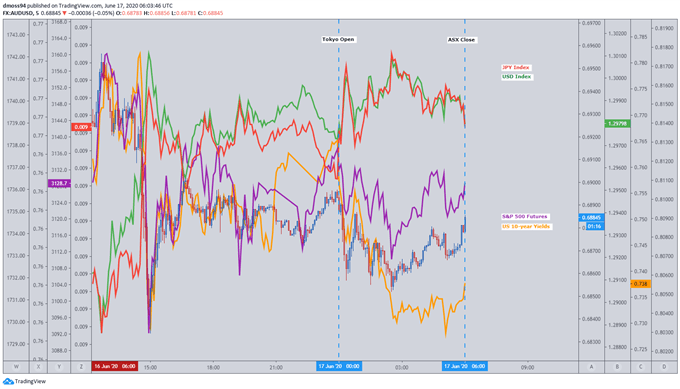

Broad risk aversion was seen during Asia-Pacific trade, as market participants contemplate the fallout of the deadly clash between India and China, with 20 Indian soldiers killed in Ladakh overnight.

The haven-associated Japanese Yen and US Dollar crept higher and the S&P 500 drifted lower.

Australia’s benchmark index climbed as the Westpac Leading Economic Index rose by 0.2% in May, although new homes sales fell to the lowest level since records started in 1999.

A record surge of daily new cases in Brazil and the reimposition of lockdown restrictions in Beijing saw gold nudge slightly higher, with US 10-year Treasury yield dipping back below 0.75bps.

Source – Trading View

Looking forward, Eurozone and Canadian inflation data headlines the economic docket, with Pound Sterling investors turning to the Bank of England Interest Rate Decision tomorrow.

New Zealand Calls for Military Response to Fresh COVID-19 Outbreak

New Zealand announced the recovery of its last infected patient on June 8, allowing Prime Minister Jacinda Ardern to role back all lockdown and social distancing measures last week.

However, the confirmation of two new cases has forced the hand of the Prime Minister, as two sisters returning from the UK were allowed to leave mandatory quarantine early, ultimately coming into contact with at least 320 people.

Representing an “unacceptable failure of the system” the PM has deployed the military to ensure “rigorous, disciplined” controls at “our borders”.

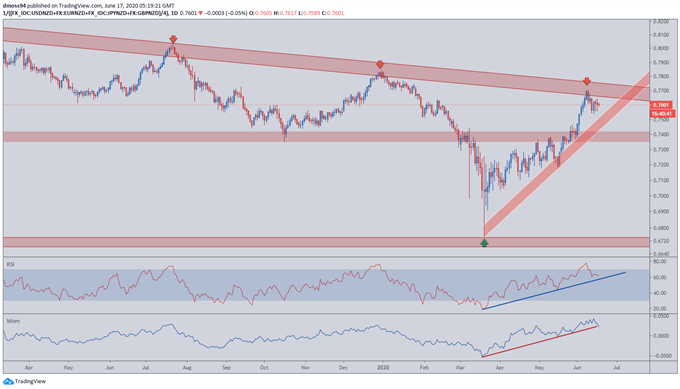

Although two cases should remain manageable for a country that has been exceptional in its suppression of the novel coronavirus, a spontaneous surge in infections may hamper the New Zealand Dollar’s surge against its major counterparts, as it retreats from post-crisis highs.

NZD Index Daily Chart

Source – Trading View

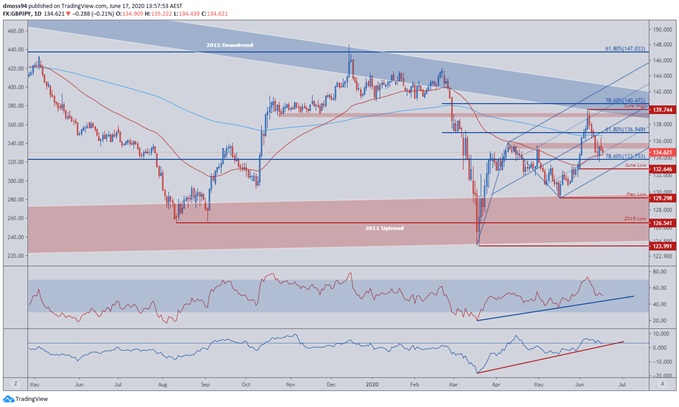

June started constructively for the British Pound against its Japanese Yen counterpart, slicing through the 200-day moving average (136.63) to surge above the March high (139.18).

Psychological resistance at the 140-handle seemed to be a step too far for buyers, as price failed to close above the former support zone extending from the November 2019 lows (138.90 – 139.30).

The RSI seemed to invigorate sellers, as it steeply retraced from its first overbought reading for the year, catapulting price back through the 61.8% Fibonacci (136.95) and 200-MA (136.63).

GBP/JPY remaining confined within an ascending pitchfork still provides a degree of upside bias, as price finds support at the convergence of the 50-MA (134.30) and 50% parallel.

However, as the momentum and RSI indicators retrace to their respective 12-week uptrends, GBP may continue to slide back to the 78.6% Fibonacci (133.75) with the convergence of the 100% parallel and June low (132.65) the last line of defence for buyers.

A close below this pivotal supportive level could signal a change in market sentiment, with prices possibly carving a path back to the May low (129.30) and 2011 uptrend.

GBP/JPY Price Daily Chart

Source - Trading View

-- Written by Daniel Moss

Follow me on Twitter @DanielGMoss