EUR/JPY, Italian-German Yield Spread, Manufacturing PMI – Talking Points:

- Global equity markets climbed throughout Asia-Pacific trade as investors dismissed growing Covid-19 concerns

- Expansionary Euro-zone manufacturing PMI could underpin the Euro against its major counterparts

- The EUR/JPY exchange rate looks poised for a short-term pullback as technical divergence suggests the recent rally may be running out of steam.

Asia-Pacific Recap

Global equity markets climbed throughout the Asia-Pacific trading session, with the ASX 200 jumping back above the 6,050 mark after the Reserve Bank of Australia kept the official cash rate and 3-year yield target steady at 0.25%.

Gold and silver prices stalled just shy of their respective monthly highs as the haven-associated US Dollar attempted to claw back lost ground against its major counterparts.

S&P 500 futures pushed to fresh post-crisis highs whilst yields on US 10-year Treasuries hovered around 0.55%.

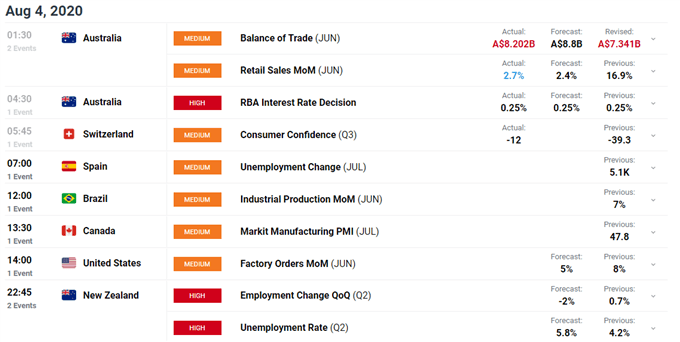

Looking ahead, Canadian manufacturing PMI and US factory orders headline a relatively light economic docket.

Eurozone Manufacturing PMI Expansion may Buoy the Euro

Recording the first expansionary reading in over a year-and-a-half, the IHS Markit Euro-area manufacturing PMI for July showed that “output and demand continued to recover in line with the further easing of restrictions on activity related to the global coronavirus disease”.

With only Greece and the Netherlands registering PMI readings below 50, overall signs are very positive for Eurozone factories as “production grows at the fastest rate for over two years, fuelled by an encouraging surge in demand”.

However, the latest release “marked the fifteenth successive month that employment has fallen, with the degree of job shedding again considerable and historically sharp”.

Euro Area Manufacturing PMI

Source – Trading Economics

Considering the labour market “is likely to be key to determining the economy’s recovery path [and] job losses remain greater than at any time since 2009”, IHS Markit Chief Business Economist Chris Williamson believes “increased unemployment, job insecurity, second waves of virus infections and ongoing social distancing measures will inevitably restrain the recovery”

With that in mind, investors should continue to monitor coronavirus developments within the trading bloc, as a re-imposition of economically devastating lockdown measures may drain investor sentiment and result in a discounting of regional risk assets.

Furthermore, upcoming retail sales data for the month of June may also dictate capital flows, with a better-than-expected increase in consumer spending potentially underpinning European equity markets and the growth-sensitive Euro.

Italian-German Yield Spread 120-Minute Chart – EU Risk-Gauge Turns Lower

Italian-German yield spread chart created using TradingView

Market participants seemed to cheer recent economic data, with the risk-gauging Italian-German yield spread noticeably tightening after the Manufacturing PMI release.

A continuation of this trend may signify improving market sentiment and could coincide with European equity markets climbing to test post-crisis highs.

Conversely, a distinct widening would be reflective of fading risk appetite and may see regional investors scamper into haven-associated assets at the expensive of the growth-sensitive Euro.

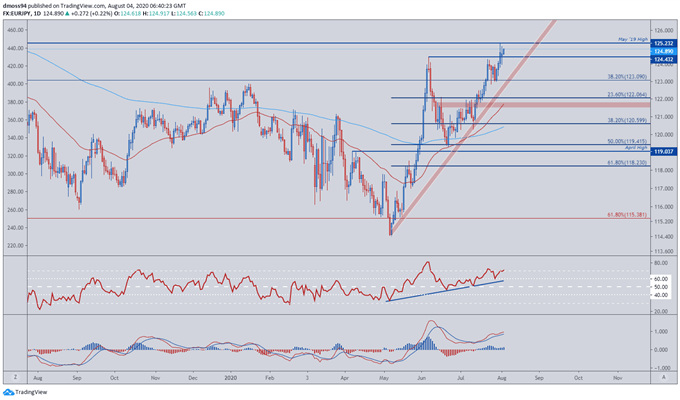

EUR/JPY Daily Chart – RSI Divergence Hints at Short-Term Correction

EUR/JPY daily chart created using TradingView

From a technical perspective, the EUR/JPY exchange rate seems due for a short-term correction as the RSI and MACD indicators fail to follow price to higher highs, indicating the surge to test resistance at the May 2019 high (125.23) could be running out of steam.

Inability to successfully close above the psychologically pivotal 125 level could generate a pullback to 4-month trend support and the 38.2% Fibonacci (123.09).

On the other hand, a break and daily close above the May 2019 high (125.23) could see EUR/JPY continue its five-day surge.

However, technical divergence suggests this may be a step too far for the risk-sensitive exchange rate.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss