EU Stoxx 50 Index, European Lockdowns, European Central Bank, Covid-19 – Talking Points:

- Asian equity markets followed the lead of their European and US counterparts overnight.

- A wave of national lockdowns in Europe look set to continue weighing on regional sentiment.

- Upcoming ECB monetary policy meeting may exacerbate the EU Stoxx 50 index’s declines.

Asia-Pacific Recap

Asian equity markets tumbled during Asia-Pacific trade after US and European equities plunged overnight, as a record surge in coronavirus cases and the announcement of several national lockdowns spooked market participants.

Australia’s ASX 200 index dropped 1.6% and Japan’s Nikkei 225 fell 0.37%, as the Bank of Japan revised down its GDP projection for 2020.

Surprisingly, sentiment appeared to firm in FX markets, as the cyclically-sensitive Australian, New Zealand and Canadian Dollars outperformed their haven-associated counterparts.

Gold pushed back above the $1880/oz mark and silver recovered lost ground as yields on US 10-year Treasuries held relatively steady.

Looking ahead, the European Central Bank’s monetary policy meeting headlines the economic docket alongside US initial jobless claims data for the week ending October 24.

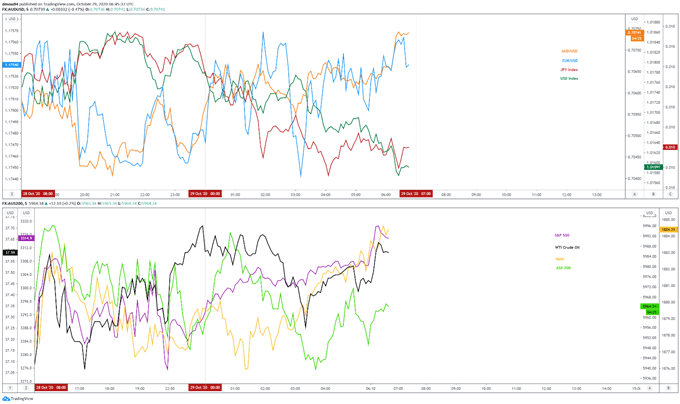

Market reaction chart created using TradingView

Wave of Coronavirus-Enforced Restrictions to Drag on EU Stoxx 50

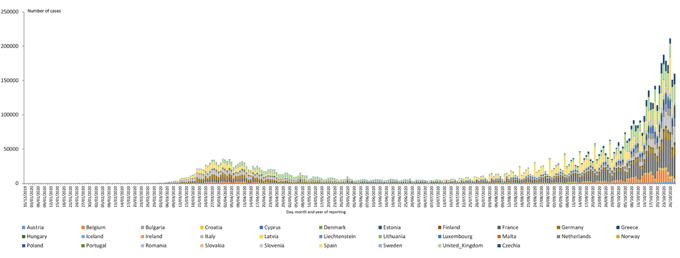

As noted in previous reports, the resurgence of the coronavirus across Europe is threatening to upend the trading bloc’s nascent economic recovery and in turn drastically undermining the price of regional risk-associated assets.

The European Union’s two largest economies, France and Germany, have announced nation-wide lockdowns scheduled to last for at least a month, while Italy has introduced its strictest restrictive measures since emerging from a national lockdown in May.

With France’s 7-day moving average of Covid-19 cases climbing to 39,000 and the number of deaths beginning to notably rise, President Emmanuel Macron warned that “the virus is circulating at a speed that even the most pessimistic forecast didn’t see [and] the measures we’ve taken have turned out to be insufficient to counter a wave that’s affecting all of Europe”.

This staggering surge in cases is likely to heap pressure on the European Central Bank to do more to support the regional economy, with the Governing Council set to meet later today.

European Covid-19 Cases

Source – European Centre for Disease Prevention and Control

Indeed, several members of the ECB have made the case “for keeping a ‘free hand’ in view of the elevated uncertainty, underpinning the need to carefully assess all incoming information, including the euro exchange rate, and to maintain the flexibility in taking appropriate policy action if and when needed”.

However, the provision of additional monetary support seems fairly unlikely given the suggestion by some committee members that the “flexibility of the pandemic emergency purchase programme (PEPP) suggested that the net purchase envelope should be considered a ceiling rather than a target”.

Moreover, less than half of the €1.35 trillion PEPP has been spent so far, which suggests that the central bank need not make any further policy adjustments in the near term.

With that in mind, the absence of additional monetary support could intensify haven inflows and in turn fuel further losses for the European benchmark EU Stoxx 50 index.

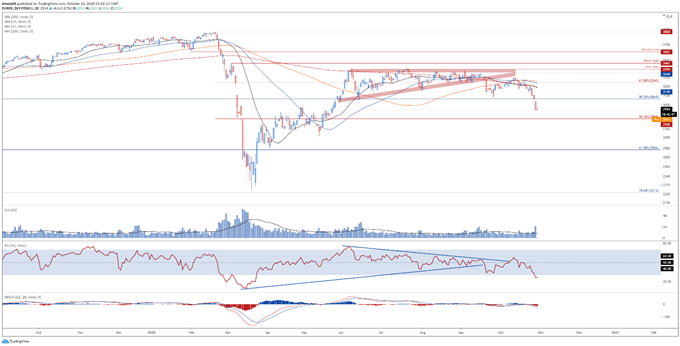

EU Stoxx 50 Index Futures Daily Chart – Oversold Readings Hint at Further Losses

EU Stoxx 50 index futures daily chart created using TradingView

From a technical perspective, the EU Stoxx 50 index’s outlook seems skewed to the downside, as price gapped below key support at the 38.2% Fibonacci (3063) and continues to track below all four moving averages.

The development of the RSI hints at swelling bearish momentum, as the oscillator slides into oversold territory for the first time since March.

Moreover, a significant rise in volume appears to confirm the bearish move lower and suggests further losses could be in the offing.

With that in mind, a daily close below the May 19 high (2945) would probably signal the resumption of the primary downtrend and carve a path back towards the May low (2690).

Conversely, the EU Stoxx 50 could rally back towards the 38.2% Fibonacci (3063) if support successfully suppresses selling pressure, with a close back above the 3100 mark needed to bring the sentiment-defining 200-DMA (3191) into focus.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss