DAX 30 Index, Covid-19 Second Wave, ECB, PEPP, Italian-German Yield Spread:

- Risk appetite firmed during the Asian trading session as President Trump U-turned on his decision to halt stimulus talks.

- A weakening fundamental backdrop and sluggish consumer price growth may force the hand of the European Central Bank.

- DAX 30 index rebound at risk as it carves out a bearish Head and Shoulders topping pattern.

Asia-Pacific Recap

Equity markets moved higher during Asia-Pacific trade, as President Donald Trump reversed his decision to halt stimulus negotiations hours after the news hit the markets.

Japan’s Nikkei 225 index rose 0.96% and Australia’s benchmark ASX 200 index soared 1.09%.

The haven-associated US Dollar and Japanese Yen continued to lose ground against their major counterparts while the risk-sensitive Australian Dollar climbed back above 0.7150.

Gold nudged marginally higher alongside silver as US 10-year Treasury yields dipped 2 basis points.

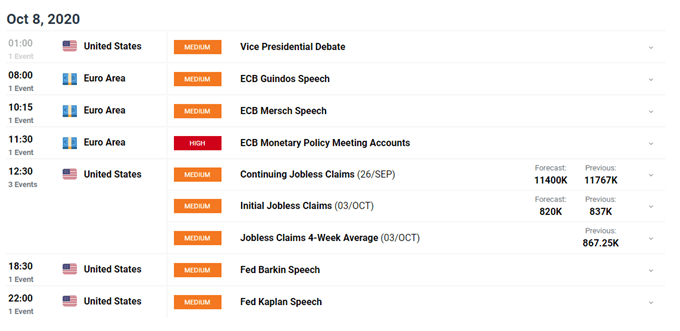

Looking ahead, the minutes from the European Central Bank’s monetary policy meeting headline the economic docket ahead of US initial jobless claims data for the week ending October 3.

Deflationary Pressures May Sway ECB, Underpinning DAX 30 Index

As mentioned in previous reports, sluggish consumer price growth and a ‘second wave’ of Covid-19 infections in several Euro-zone nations could prompt the European Central Bank to do more to support the trading bloc’s nascent economic recovery, as Chief Economist Phillip Lane stresses that “weak demand and rising economic slack have added to disinflationary pressures in an environment that is already characterised by low inflation”.

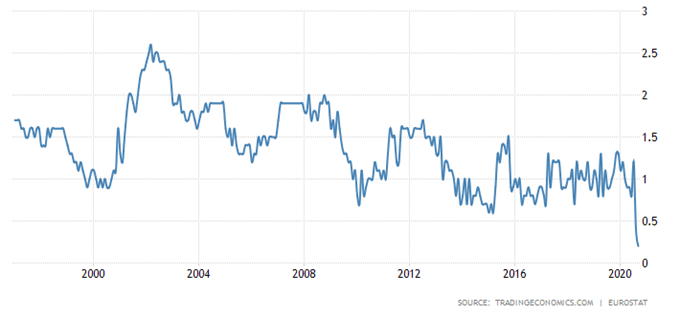

Euro-area headline inflation is expected to sink to -0.3% and the core inflation rate to drop to a record low of 0.2% in September.

Indeed, Lane’s recent comments seem to suggest that the central bank may look to recalibrate the size and duration of its €1.35 Pandemic Emergency Purchase Program (PEPP) in the near-term, given the Chief Economist’s belief that its would be “a less costly and more prudent approach to boost inflation momentum [and] reconnect it to the pre-pandemic inflation path”.

Euro-Area Core Inflation Rate

Of course, there have been suggestions by some Governing Council members that current monetary and fiscal policy measures are sufficient, with Bundesbank President Jens Weidmann vehemently opposing the provision of additional stimulus given the region’s economy is bouncing back “somewhat more quickly than expected”.

Nevertheless, with the trading bloc’s Markit Composite PMI release showing only a minimal expansion in private sector activity and construction PMI out of France and Germany continuing to track in contractionary territory in September, the need for more accommodative monetary policy settings may intensify in the near-term.

Under that assumption, regional markets may begin to price in an adjustment from the ECB before the end of the year and in turn put a premium on regional risk-associated assets.

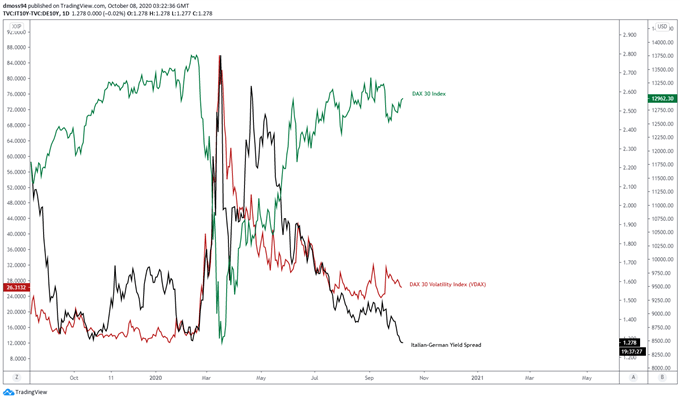

Tightening Yield Spreads Indicate Firming Sentiment

Italian-German yield spread daily chart created using TradingView

In fact, the notable tightening of the risk-gauging yield spread between Italian Government bonds and German Bunds could validate this hypothesis, considering France just reported a record number of daily coronavirus cases and Italy registered its largest daily increase since April 16.

Moreover, the marked rise in infections has so far had little effect on market volatility, with the DAX 30 Volatility Index (VDAX) spiking higher temporarily in September before trekking back towards the post-crisis lows.

Therefore, the minutes of the ECB’s monetary policy meeting will be intently scrutinized by regional investors, with a more hawkish than expected outlook probably resulting in a significant discounting of Germany’s benchmark DAX 30 index.

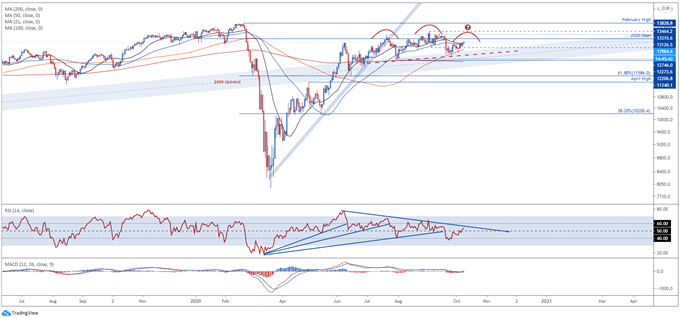

DAX 30 Index Daily Chart – Head and Shoulders Top in Play?

DAX 30 index daily chart created using TradingView

From a technical perspective, Germany’s benchmark DAX 30 index could be at risk of extended losses, as price begins to carve out a potential Head and Shoulders reversal pattern just shy of key resistance at the post-crisis high (13464.2).

Although a push to test the 13300 level looks likely in the coming days, the path of least resistance seems skewed to the downside.

Failure to close above the yearly open (13126.5) would probably form the right shoulder of the bearish reversal pattern and intensify selling pressure, with a break back below the trend-defining 50-day moving average (12904) needed to bring confluent support at the neckline and September low (12333.5) into focus.

Conversely, a daily close above the July high (13315.6) could signal the resumption of the primary uptrend and generate a push to test the record high set in February (13828.8).

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss