Crude Oil, Canadian Dollar, Coronavirus, Dow Jones, Australian Dollar – Asia Pacific Market Open

- Crude oil prices climbed alongside Dow Jones, eyeing technical breakout

- Markets shrugged off Moderna critique, FOMC minutes offered warnings

- Will the Canadian Dollar advance higher? AUD may rise with stocks next

Growth-oriented crude oil prices climbed to a 10-week high as market sentiment broadly improved over the past 24 hours. The Dow Jones and S&P 500 closed +1.52% and +1.67% respectively as my Wall Street index attempted to make upside progress after idling for the better part of the past 3 weeks. The Canadian Dollar – which can at times be sensitive to swings in crude oil – struggled to capitalize on gains in the commodity.

The upbeat tone in financial markets showed that investors shrugged off recent doubts over the potential viability of a coronavirus vaccine in the works from Moderna. Instead, traders seem to be looking forward to a gradual easing in lockdown measures that should help restart economic growth. This may also explain why oil is spending more time moving in tandem with global equities lately.

Still, challenges may be ahead. Minutes from the FOMC meeting showed that policymakers see ‘extraordinary uncertainty’ and ‘considerable risks’ in the medium term. A few Fed officials also saw a ‘substantial likelihood’ of more Covid-19 waves. Meanwhile an oversight bill sent US-listed Chinese stocks lower as tensions between the world’s largest economies seem to be heating up.

Develop the discipline and objectivity you need to improve your approach to trading consistently

Thursday’s Asia Pacific Trading Session

With that in mind, Asia Pacific equities could echo the upbeat tone from the Wall Street trading session. This could bolster crude oil prices as the Canadian Dollar pressures resistance against an average of its major peers. Rising equities may also support the sentiment-linked Australian Dollar. AUD/USD will also be eyeing commentary from RBA Governor Philip Lowe.

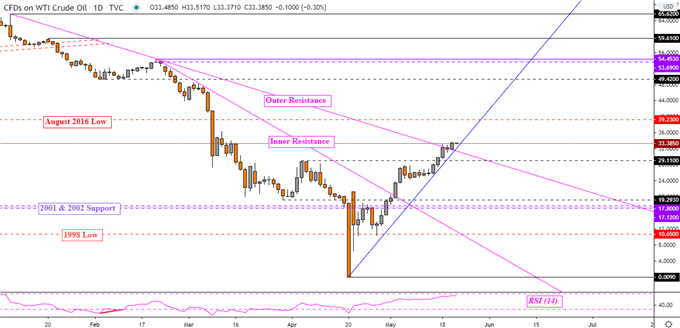

Crude Oil Technical Analysis

On a daily chart, WTI crude oil prices have broken above ‘outer’ resistance from the beginning of this year. Follow-through at this point is absent. Rising support from April’s bottom is also guiding the commodity higher – blue line. This has ultimately exposed former lows from August 2016 which could stand in the way as new resistance. A turn lower places the focus on resistance-turn-support at 29.11.

WTI Crude Oil – Daily Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter