IBEX 35, CAC 40, Euro Open – Talking Points:

- Risk appetite waned during Asia-Pacific trade as escalating coronavirus concerns soured investor sentiment

- Spain’s IBEX 35 index struggling to overcome Fibonacci resistance despite RSI strengthening to the upside

- France’s CAC 40 index remains perched at support although waning Momentum suggests a reversal may be on the cards.

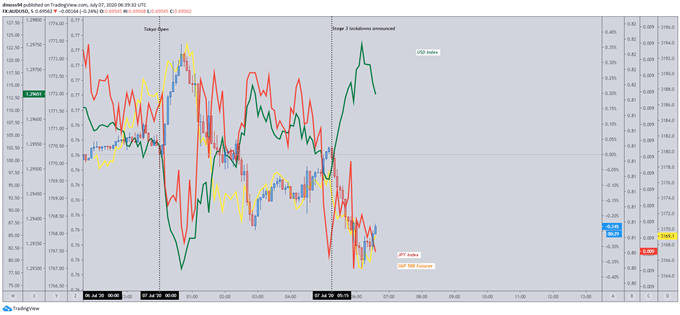

Asia-Pacific Recap

Risk appetite evaporated during Asia-Pacific trade as the imposition of stage-3 lockdown restrictions in Victoria, Australia’s second most populous state, spooked market participants.

The Australian Dollar plunged as Victorian Premier Daniel Andrews announced the 6-week lockdown in response to 191 new cases recorded in the state – blowing past the March record of 111.

Haven-seeking flows fueled the US Dollar as it clawed back against its major counterparts whilst S&P 500 futures reversed just shy of the pivotal 3,200 level.

Crude oil plunged amid weakening fundamentals as investors eye the upcoming EIA crude oil inventory report with expectations of a 3.4-million-barrel draw, following up on last week’s 7.1-million-barrel reduction.

Looking ahead, speeches from several members of the Federal Reserve could provide an insight into the central bank’s view on the current state of affairs, whilst Canadian PMI data may also prove market-moving.

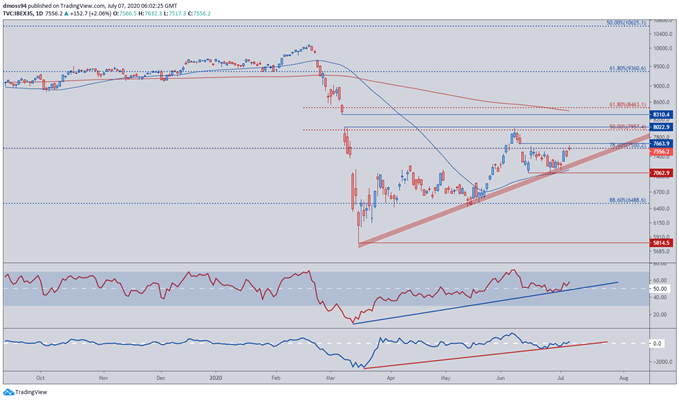

IBEX 35 Index Daily Chart – Struggling at Fibonacci Resistance

Spain’s IBEX 35 Index has grossly underperformed its regional counterparts, climbing a measly 37% from the yearly lows, in comparison to the German DAX index’s 63% recovery and a 43% surge in the French CAC 40.

However, the Spanish benchmark index remains constructively positioned after bouncing off supportive convergence at the 50-DMA (7,127) and the uptrend extending from the March low.

A daily close above the June 10 gap (7,664) may invigorate buyers and carve a path back to the post-crisis high (7,993) with an entry of the RSI into overbought territory potentially fueling a push back to the 200-DMA (8,380).

On the other hand, inability to sustain a push above the 78.6% Fibonacci (7,560) may result in a sharp retreat to support at the 50-DMA (7,127).

IBEX35 index daily chart created using TradingView

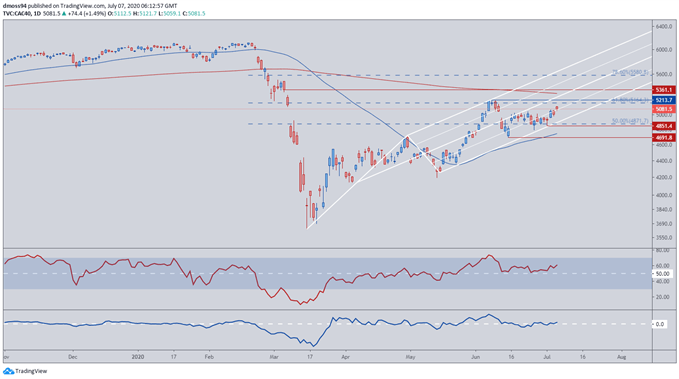

CAC 40 Index Daily Chart – Breakaway Gap a Step Too Far?

France’s CAC 40 Index seems poised to test resistance at the 200-day moving average (5,310) as it continues to track within an ascending Schiff Pitchfork.

The steep incline of the 50-DMA suggests the potential for further upside as price breaks back above the psychologically imposing 5,000 level.

The RSI and Momentum indicators may fuel further buying, remaining perched constructively above their respective midpoints and strengthening into bullish territory.

A daily close above June high (5,213) could ignite a push to test Pitchfork median resistance and the 200-DMA (5,320).

Conversely, failure to convincingly break above the 61.8% Fibonacci (5,164) could see price fall back to parallel support, with the 50% Fibonacci (4,872) standing in the way of a potential collapse back to the April high (4,720).

CAC40 index daily chart created using TradingView

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss