Saudi Aramco's Bold Bet On The Future Of Petrol Engines

In an era where electric cars are making headlines, Saudi Aramco, the world’s largest oil company, is betting on the long-term relevance of internal combustion engines (ICEs). This stance is highlighted by their recent investment in Horse Powertrain, a company dedicated to producing fuel-based engines.

Investment in Horse Powertrain:

Last year, Saudi Aramco earned $500 billion from producing and selling crude oil. Recently, they invested €740 million for a 10% stake in Horse Powertrain. This company, formed by merging Geely and Renault’s engine and transmission divisions, aims to produce traditional engines at scale. Geely and Renault predict that as more companies cease designing their own engines, they will turn to third-party suppliers like Horse.

Yasser Mufti, the executive vice-president of Saudi Aramco, believes ICEs will remain vital for a long time. He argues that completely eliminating these engines would be very costly and that factors like affordability will ensure their continued presence.

Industry Trends and Future Outlook:

Despite commitments from major carmakers like Ford, General Motors, and Mercedes-Benz to phase out petrol and diesel engines by 2040, the reality appears more complex. Slowing electric vehicle (EV) sales and rising trade protectionism mean that ICEs might remain relevant longer than anticipated.

Matias Giannini, CEO of Horse Powertrain, anticipates that by 2040, a significant number of vehicles will still use ICEs, hybrids, or plug-in hybrids. This outlook provides an opportunity to consolidate engine production.

Market Strategy and Expansion Plans:

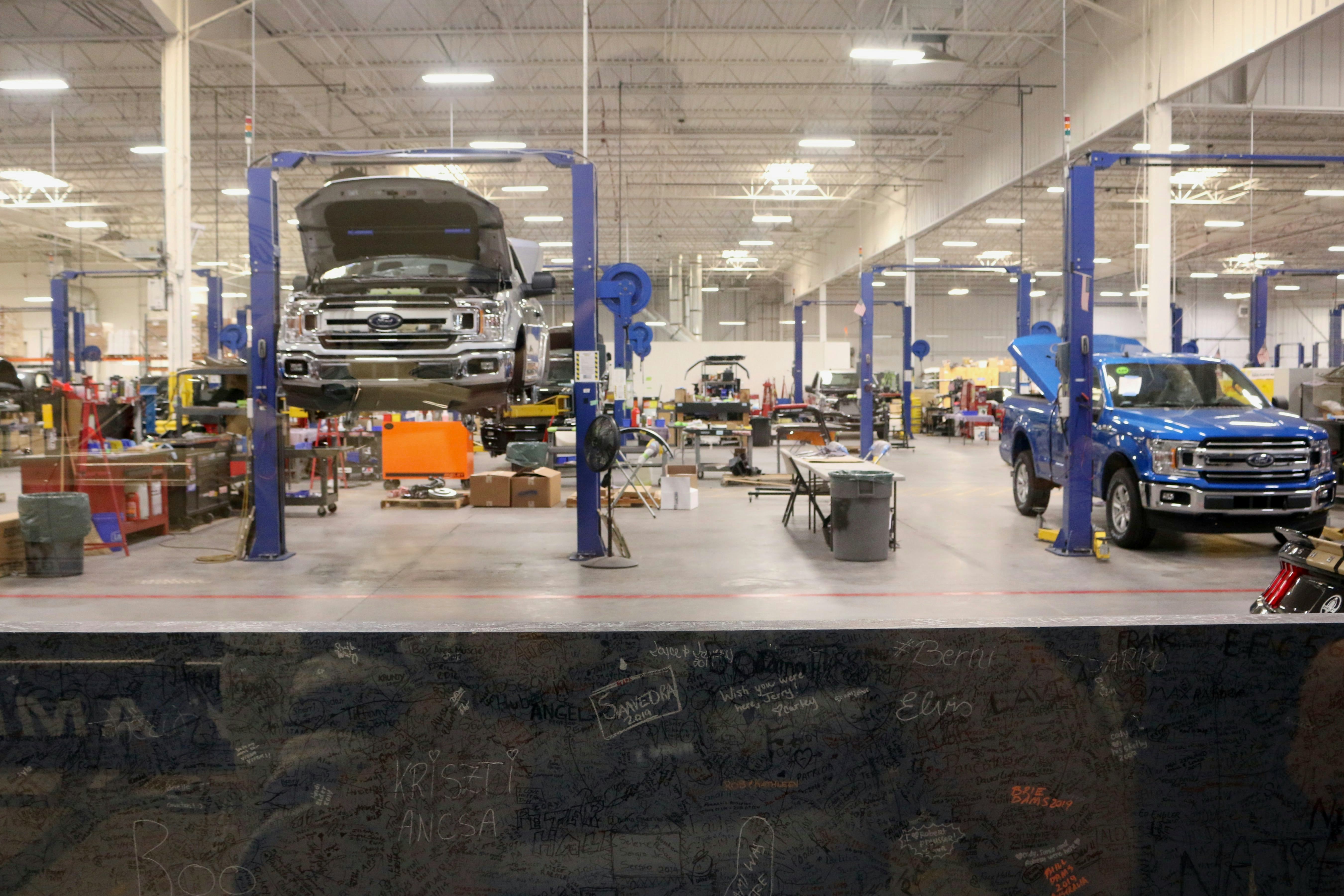

Horse Powertrain, with its 17 factories worldwide, aims to increase production from 3.2 million to 5 million units per year. This expansion would place them alongside giants like Stellantis. Giannini sees a niche for Horse, offering car manufacturers hybrid engines without requiring significant investment in new technology.

Philippe Houchois, an automotive analyst at Jefferies, notes that the transition to EVs is slower than expected. He believes smaller car companies might find Horse’s offerings attractive. Houchois also predicts that Europe will be a key market for Horse’s engines, as other regions like China and the US are less focused on eliminating ICEs.

Innovation and Sustainable Fuels:

While ICEs continue to play a role, Saudi Aramco is also investing in sustainable solutions. They have set up research labs in Paris, Detroit, and Shanghai to develop low-carbon and synthetic fuels. Ahmad al-Khowaiter, Aramco’s technology and innovation chief, emphasizes that synthetic fuels could significantly reduce carbon emissions.

Additionally, Saudi Aramco is expanding its network of filling stations. With 17,200 stations mainly in the US, China, and Japan, they are now targeting emerging markets like Chile and Pakistan, where demand for petrol and diesel cars is expected to last longer.

Challenges and Competitive Edge:

The success of Horse Powertrain will depend on convincing other car manufacturers to adopt their engines. Giannini acknowledges that the company must communicate its independence and value proposition effectively. However, Mufti is optimistic, citing that carmakers often outsource components and that Horse’s cost-effective and efficient engines will appeal to them.

Saudi Aramco’s investment in Horse Powertrain signifies a strong belief in the enduring relevance of internal combustion engines. While the push towards electric vehicles continues, the company’s strategy highlights the complexities and transitional nature of the automotive industry. As EV growth faces challenges and ICE technology evolves, Saudi Aramco is positioning itself to navigate and capitalize on this dynamic landscape.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more