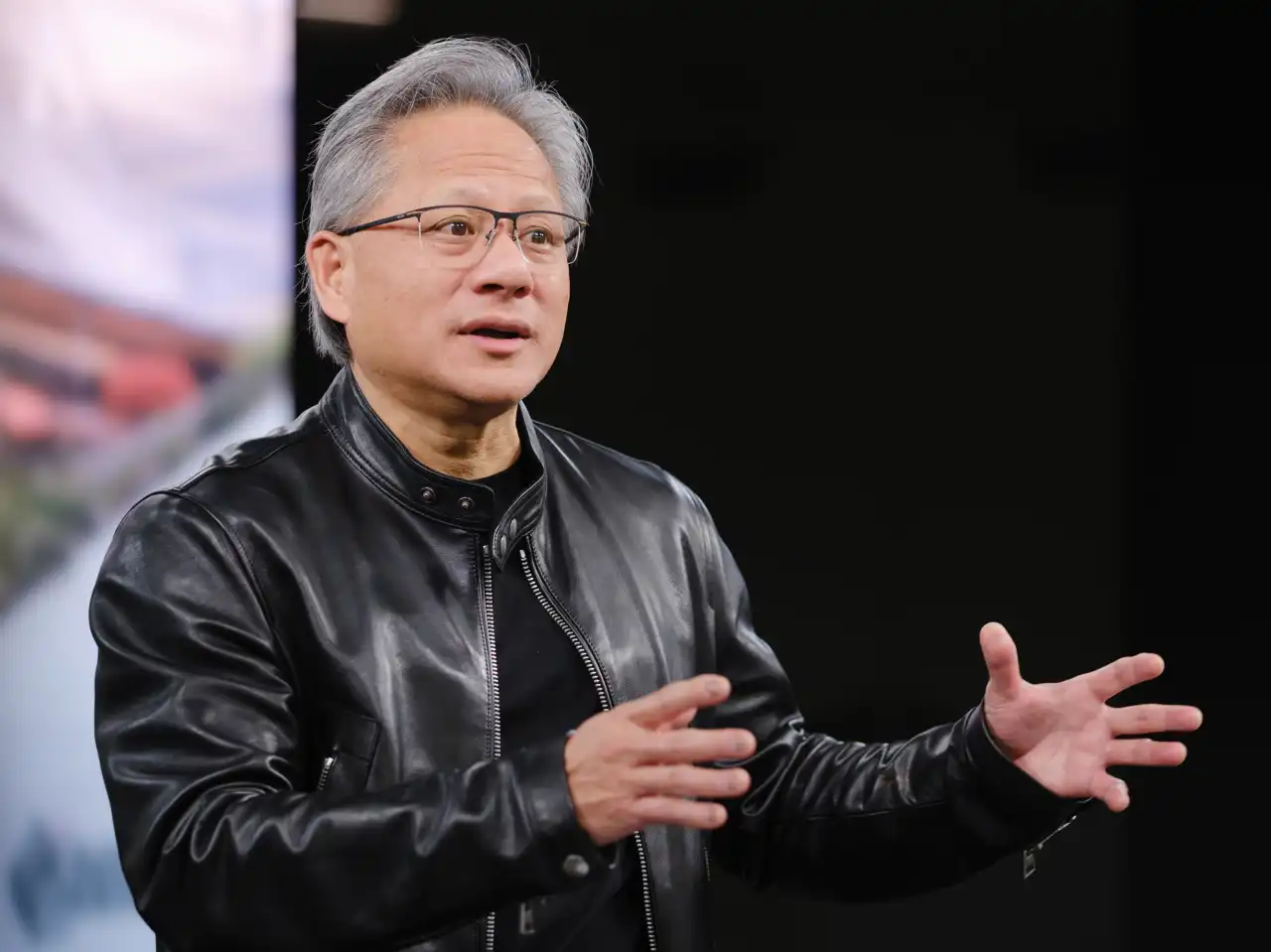

Is Nvidia's Growth Sustainable Or Is It A Bubble?

Nvidia has recently become the most valuable company in the world, surpassing tech giants like Apple and Microsoft. This dramatic rise is largely due to the increasing demand for their AI chips. But the big question is: Can Nvidia keep growing, or is this just a bubble that will burst soon?

Nvidia's Meteoric Rise

Nvidia's stock prices have skyrocketed, and their market value has reached an incredible $1.034 trillion. This happened because many people are excited about AI technology, which needs Nvidia's chips. In just a few months, their stock price jumped up 3.5%, and their revenue saw huge increases of over 260%. Nvidia's journey from a $300 billion company to a $1 trillion giant has been nothing short of amazing.

Evaluating the Demand for AI Chips

AI technology is becoming more important in many areas, from cloud services and gaming to self-driving cars. Nvidia's chips are at the heart of these technologies. Big companies like Google, Microsoft, and Amazon are using Nvidia's chips for their AI projects. If AI continues to grow, Nvidia could see even more demand for their products. However, the future is always uncertain, and we need to consider if this demand will stay strong.

Analysing the Hype and Market Sentiment

Some experts believe that the excitement around Nvidia is driving its stock prices too high. They call this "animal spirits," where people's emotions take over their investment decisions. Nvidia is a great company, but a 40% increase in a month is unusual. Looking back at the tech boom of the late 1990s, we see similar patterns of rapid growth followed by sudden drops. This makes us wonder if Nvidia's growth is truly sustainable.

Potential Risks and Challenges

Nvidia faces several challenges that could impact its growth. Competitors like AMD and Intel are working on their own AI chips, aiming to take some of Nvidia's market share. There are also risks related to supply chains and global politics that could affect Nvidia's production. If the AI market slows down, Nvidia's profits could take a hit. These factors make it crucial to consider the risks Nvidia faces.

Financial Stability and Market Concentration

While Nvidia's financial numbers look strong, there are concerns about the market becoming too concentrated around a few companies. History shows that this can lead to instability, like during the tech bubble in the late 1990s. Some experts warn that the current levels of concentration are similar to those times. This means that while Nvidia's financial health is good, the broader market dynamics might pose risks.

Nvidia's rise to the top is a remarkable story, driven by the excitement around AI technology. However, the sustainability of this growth is uncertain. The combination of market hype, competitive pressures, and potential slowdowns in the AI sector presents significant risks. Investors and analysts need to stay cautious and recognize the potential for change in the fast-moving tech world. Only time will tell if Nvidia can maintain its status or if it will face challenges that could reduce its market value.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more