Quishing Explained: The New Cyber Threat Thats Catching Banks And Consumers Off Guard

A new cyber threat known as "quishing" is making headlines, catching both banks and consumers off guard. This type of phishing scam uses QR codes to deceive users into revealing sensitive information or downloading malware. Recent warnings from major financial institutions like HSBC and Santander, as well as regulators such as the US Federal Trade Commission (FTC), highlight the growing concern over these scams. With quishing on the rise, it is essential to understand how it works, why it is effective, and what can be done to stay protected against this emerging threat.

Understanding Quishing - What Is It?

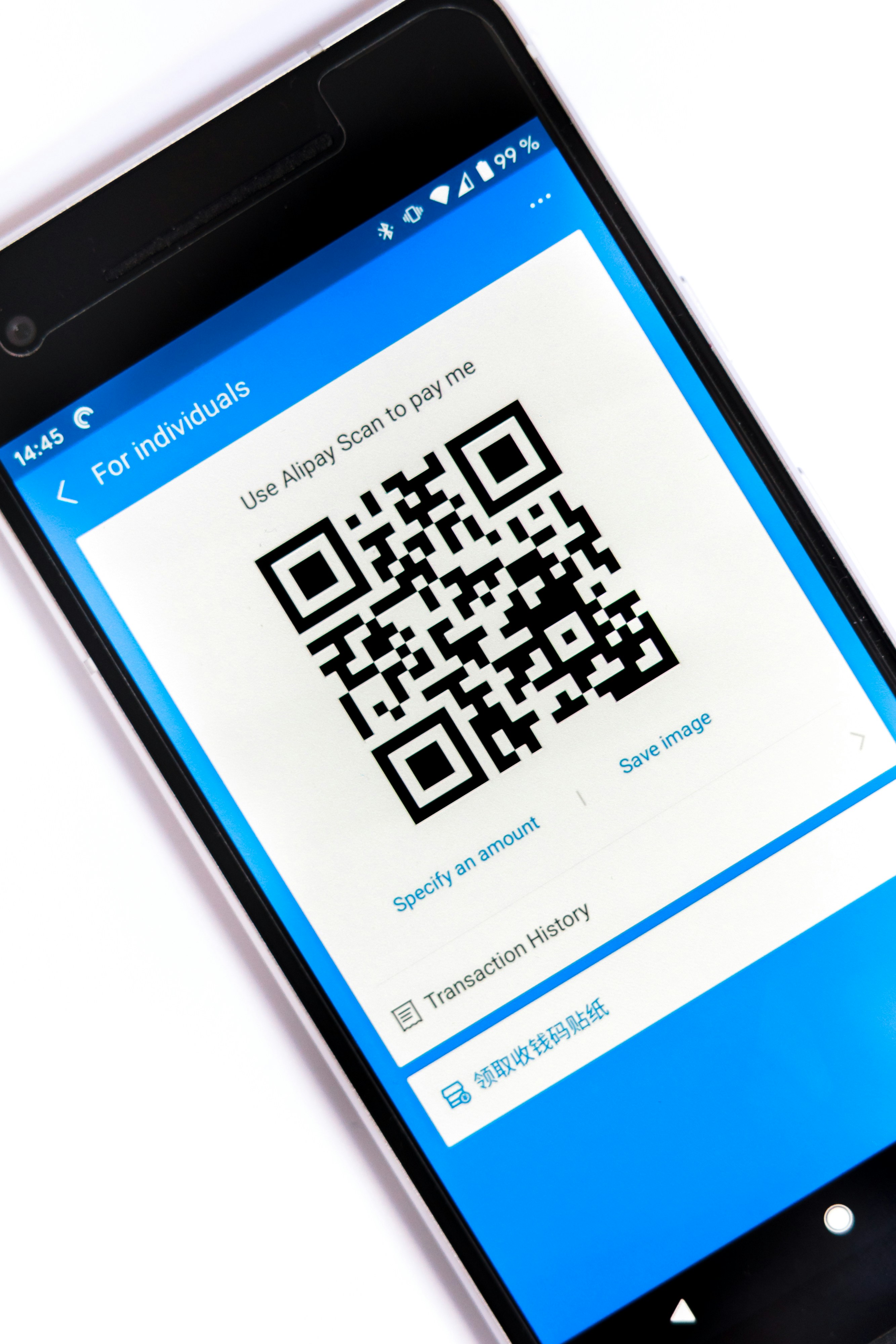

Quishing is a form of phishing that employs QR codes to trick users into performing actions that compromise their security. In traditional phishing, scammers send emails or messages containing malicious links, but quishing involves embedding these links in QR codes. When users scan these codes, they are directed to fraudulent websites that may request personal information or initiate the download of malicious software.

The key difference between quishing and more traditional phishing methods is that QR codes can bypass many of the security filters that detect and block suspicious links in emails. This allows scammers to reach their targets more effectively, posing a significant challenge for cybersecurity systems that have not adapted to this newer tactic.

Why Are Quishing Scams Effective?

Quishing scams have gained traction because they exploit weaknesses in existing cybersecurity measures and capitalize on user behavior.

Bypassing Security Filters: Since QR codes are visual, rather than textual, they can evade the automated systems that typically scan emails and websites for malicious content. This makes it easier for scammers to spread their fraudulent links without being detected.

Exploiting User Trust: QR codes are widely used for legitimate purposes, such as making payments, accessing information, and verifying accounts. Because of this, users may inherently trust QR codes and are less likely to scrutinize them compared to clickable links. Scammers take advantage of this trust by embedding their malicious links in QR codes that look authentic.

Ease of Implementation: Creating and distributing malicious QR codes is relatively simple, allowing scammers to scale their operations quickly. A QR code can be added to emails, printed materials, or even stickers placed in public locations, making it easy for cybercriminals to target a wide audience with minimal effort.

Recent Warnings from Banks and Regulators

The growing threat of quishing has prompted major banks and regulatory bodies to issue warnings to the public. HSBC and Santander have both raised concerns about the rise of these scams, advising their customers to exercise caution when scanning QR codes, particularly those received via email. The US Federal Trade Commission has also stepped in, warning consumers about the dangers of quishing and recommending best practices for avoiding these scams.

In recent months, there have been numerous reports of quishing incidents targeting bank customers, where fraudulent QR codes were used to steal login credentials, payment information, and other sensitive data. These cases highlight the need for heightened awareness and vigilance, as well as stronger security measures to combat this growing problem.

The Risks of Quishing Scams for Consumers and Businesses

The rise of quishing poses serious risks for both individuals and organizations.

Personal Data Theft: For consumers, the primary risk is the theft of personal information. When users scan a malicious QR code, they may be directed to a website that mimics a legitimate service and prompts them to enter sensitive data, such as banking details, passwords, or social security numbers. This information can then be used for identity theft or financial fraud.

Corporate Security Breaches: Businesses are also vulnerable to quishing, particularly if employees are tricked into scanning malicious QR codes. This can lead to broader security breaches, giving hackers access to corporate networks, customer data, and proprietary information. Such breaches can be costly, both financially and in terms of reputational damage.

Financial Losses and Reputational Damage: Companies, especially those in the financial sector, face significant financial risks if they fail to adequately address the threat of quishing. Banks and businesses that fall victim to these scams may incur costs related to fraud detection, legal fees, and customer compensation, not to mention the damage to their reputation that can erode customer trust.

Strategies to Protect Against Quishing Scams

Given the increasing prevalence of quishing, it is crucial to adopt strategies to protect against these scams.

Consumer Awareness and Education: Banks and companies must play a role in educating users about the dangers of quishing. Customers should be advised to verify the source of any QR code before scanning it, especially if it is received via email or appears in an unexpected place. Clear guidelines on how to identify suspicious QR codes can help users stay safe.

Enhanced Cybersecurity Measures: Businesses should implement more robust security protocols to detect and block malicious QR code links. This can include tools that verify the destination of a QR code before allowing it to be scanned, as well as employee training programs to raise awareness about potential threats.

Regulatory Guidelines and Industry Collaboration: Regulators like the FTC can encourage collaboration between financial institutions and cybersecurity firms to develop industry-wide standards for dealing with quishing threats. This might involve the creation of a centralized database for tracking known scams or the development of new technologies to scan and verify QR codes in real time.

Conclusion

The emergence of quishing as a prominent cyber threat underscores the need for vigilance and adaptability in cybersecurity. Unlike traditional phishing scams, quishing leverages QR codes to bypass existing defenses, making it a particularly effective tool for cybercriminals. The warnings from major banks and regulators highlight the urgency of addressing this issue through consumer education, stronger security measures, and industry collaboration.

As technology evolves, so too do the tactics of cybercriminals. Staying informed about new threats and adopting proactive security strategies will be essential to keeping sensitive information safe. By understanding how quishing works and implementing the recommended safeguards, consumers and businesses can better protect themselves against this growing cyber threat.

Author: Brett Hurll

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more