JSW Steel Q4 Profit Rises 13% To Rs 3,664 Cr On Higher Sales Volume

Sequentially, revenue and net profit were higher by 20 per cent and 647.75 per cent, respectively

Ishita Ayan Dutt Kolkata

For the entire FY23, revenue at Rs 1,65,960 crore was 13.38 per cent higher YoY. Net profit at Rs 4,144 crore was down by 79.94 per cent YoY as steel spreads across regions took a hit

Listen to This Article

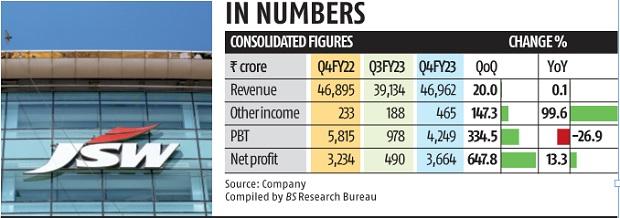

Steel major JSW Steel on Friday reported a 13.29 per cent year-on-year (YoY) rise in its consolidated net profit to Rs 3,664 crore in the March quarter of 2022-23 (Q4FY23), on higher sales volume.

The company’s consolidated revenue from operations at Rs 46,962 crore in Q4 was 0.14 per cent higher year-on-year (YoY). The revenue and profit numbers came in ahead of expectations. A Bloomberg consensus estimate had pegged revenue at Rs 44,205 crore and net income adjusted at Rs 2,069 crore.

Saleable steel sales at 6.53 mt was also the highest ever. It reflected recovery in exports after removal of export duties in November 2022 and record domestic and auto grade sales. Supplies to the auto sector were up 19 per cent YoY and sales to the appliances sector were up 50 per cent YoY. Total crude steel production in Q4FY23 was at 6.77 mt and sales at 6.70 mt.

For the entire FY23, revenue at Rs 1,65,960 crore was 13.38 per cent higher YoY. Net profit at Rs 4,144 crore was down by 79.94 per cent YoY as steel spreads across regions took a hit.

The company informed that the board had elevated Jayant Acharya as joint managing director and chief executive officer of the company with effect from May 19, from his current position as deputy managing director.

Outlining the capex for FY24, JSW Steel said it expects to spend Rs 18,800 crore primarily on completing the 5-mtpa brownfield expansion at Vijayanagar and BPSL Phase-II expansion to 5 mtpa, downstream facilities, and sustenance capex.

The 5-mtpa expansion at Vijaynagar is expected to be completed by the end of FY24, so as the Phase-II expansion from 3.5 mtpa to 5 mtpa at BPSL.

The company said that its domestic capex was Rs 3,507 crore during Q4FY23, and Rs 14,214 crore for FY23, against the (revised) plan of Rs 15,000 crore for FY23.

Net debt of JSW Steel as of March 31, 2023, stood at Rs 59,345 crore, lower by Rs 10,153 crore from the end of December 2022. The company attributed it to healthy cash generation and the release of working capital. Net debt was at Rs 56,650 crore as on March 31, 2022.

First Published: May 19 2023 | 6:45 PM IST

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more