India's Airlines: Both Go First And Bankruptcy Laws Need A Rescue

In the seven years that it has been around, Indian Prime Minister Narendra Modi’s signature bankruptcy reform has failed to live up to its billing.

The 2016 insolvency law was crafted when the country was just starting to tackle what would eventually rank among the worst piles of bad loans anywhere in the world: a $200 billion-plus menace. With banks garnering bumper profits in the post-pandemic high interest-rate environment, that baggage is now much lighter, and the urgency to deal with it lower.

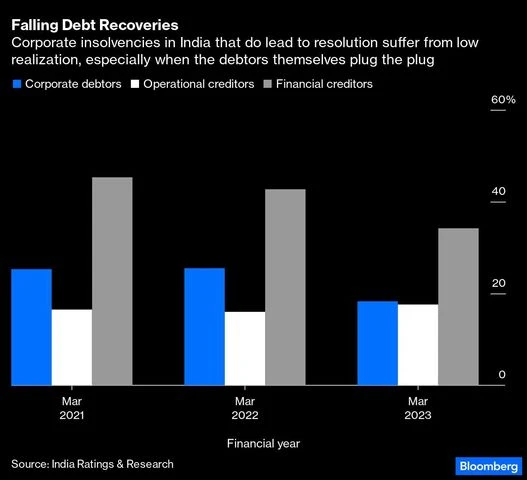

It shouldn’t be. Creditors’ recovery rates on soured advances have been low for the past couple of years — and they’re falling. Liquidations are the most common result of the bankruptcy tribunal’s proceedings, which are taking more than twice as long as the 270 days envisaged originally. When the credit cycle turns, state-run lenders may once again run crying back to taxpayers for capital. The court won’t give them back much.

In a country where savings are in short supply, the priority was always to prevent productive capital from going to waste in unviable projects. Some high-profile resolutions of defaulted steel-plant loans raised creditors’ hopes, but rampant gaming of the legal process by vested interests is dashing them.

Which is why the bankruptcy protection sought by Go Airlines India Ltd., a cash-strapped carrier controlled by the Mumbai-based Wadia Group, is so crucial. The franchise temporarily shut down earlier this month. If the court can’t quickly revive Go First, as the brand is now known, the risk is that it will be grounded forever, like Kingfisher Airlines Ltd. in 2012 and Jet Airways India Ltd. in 2019. The domestic aviation market will become even more of a duopoly than it already is.

But rescuing Go First could be seen as bailing out the billionaire Nusli Wadia by inflicting losses on SMBC Aviation Capital, ACG Aircraft Leasing Ireland Ltd., and other aircraft lessors. SMBC, which claims to have ended its lease before Go First’s filing, wants to take its jets away. The bankruptcy protection, the lessors have alleged, is a “fraudulent exercise.” On Monday, the appellate authority rejected their challenge: They need to approach the tribunal to repossess the planes with expired leases, or go to the apex court.

But those nuances are irrelevant for Go First creditors: Regardless of whether the airline was incompetent, undercapitalized or unlucky, its shareholders must pay a price before the lenders and lessors are asked to make sacrifices.

)

What will be the fate of Go First? Air travel has come back as suddenly as it was halted by Covid-19, and Pratt & Whitney has a queue of customers to service. But assuming that the engine-maker would eventually get around to delivering 10 spares a month to Go First until December, as it has been directed to do by the Singapore arbitrator, this airline can fly again.

But it should return as an operation that can sustain its debt, leases, salaries — and delays in fleet repair. One solution may be to leave the corporate structure of Go Airlines behind with a chunk of the 115 billion rupees owed to financial and operations creditors that is now unsustainable, and all of its equity. This is the part that can die. After that, the creditors can invite bids from anyone who wants to inject fresh capital into a new avatar of Go First. If the next owner happens to be Wadia, that’s fine. If it’s not, that’s good, too.

Go First has so far been current with repayments to banks, and has only recently defaulted to lessors and operational creditors. Had any of its debt been nonperforming for a year before the resolution plan kicked in, the Wadia Group would have been ruled out as a prospective bidder.

That is just faux puritanism. A practical bankruptcy code will be agnostic about “promoters,” as the controlling shareholders are known in India. Give them back their insolvent firms if they so badly want them, but close out the options for gaming the outcomes, such as by forcing lenders to accept lowball out-of-court settlements: Let them take haircuts, stand in line with everyone else and bid.

Leaving planes with a borrower that isn’t selling flight tickets isn’t ideal. It will jack up leasing rates even for those that are. Still, the tribunal’s intervention may be worth it. Consumers will pay a lot more if InterGlobe Aviation Ltd.’s Indigo and the three Tata airlines end up as the only viable options for domestic air travel. After all, Go First isn’t the only one in trouble. SpiceJet Ltd., a carrier with a similar market share, has seen its stock lose half its value over the past year. The lessor Aircastle (Ireland) Ltd. is trying to push it into insolvency. That case will be heard May 25.

The promoters have been the driving force of Indian capitalism for far too long to just walk away because of a bankruptcy law. (HMS Minden, on which the Star-Spangled Banner was composed, was made in a Wadia shipyard for the British navy.) Yet, the exceptionalism that business families take as their right must end.

There is a difference between protecting the capital in a business, and saving the capitalist behind it. After some initial successes, Modi’s bankruptcy reform has often been unable to find that fine line. It’s up to the court to show that this time will be different.

Disclaimer: This is a Bloomberg Opinion piece, and these are the personal opinions of the writer. They do not reflect the views of www.business-standard.com or the Business Standard newspaper

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more