Credit Scores: A System Built For Lenders, Not Consumers

Credit scores play a pivotal role in modern financial systems, determining access to loans, housing, and even job opportunities. Among these, the FICO score dominates, acting as the standard benchmark for creditworthiness. While credit scores are marketed as tools to help consumers achieve financial stability, their design primarily serves the interests of lenders. This imbalance raises critical concerns about fairness, transparency, and the impact on consumers' financial well-being.

What Are Credit Scores and How Do They Work?

Credit scores are numerical representations of an individual’s creditworthiness, used by lenders to assess the risk of lending money. FICO, developed by the Fair Isaac Corporation, remains the most widely used scoring model.

The FICO score is calculated using five key factors:

Payment History (35%) – Tracks whether past payments were made on time.

Credit Utilization (30%) – Measures the ratio of used credit to available credit.

Length of Credit History (15%) – Considers how long accounts have been active.

Credit Mix (10%) – Evaluates diversity in credit types (e.g., credit cards, loans).

New Credit (10%) – Reflects recent credit inquiries or new accounts.

While these metrics aim to provide a snapshot of financial reliability, their design inherently favors lenders.

How Credit Scores Serve Lenders

Risk Assessment for Lenders

Credit scores simplify the process of evaluating a borrower’s likelihood of repaying a loan. This reduces lenders’ risks and costs, allowing them to make quick, data-driven decisions.

Increased Profitability

Lenders use credit scores to set interest rates and loan terms. Consumers with lower scores often face higher interest rates, generating more revenue for lenders while penalizing those who can least afford it.

Encouragement of Debt Dependence

To maintain a strong credit score, consumers are incentivized to take on and manage debt actively. This dynamic creates a cycle of dependency on credit, which benefits lenders by ensuring a steady stream of borrowers.

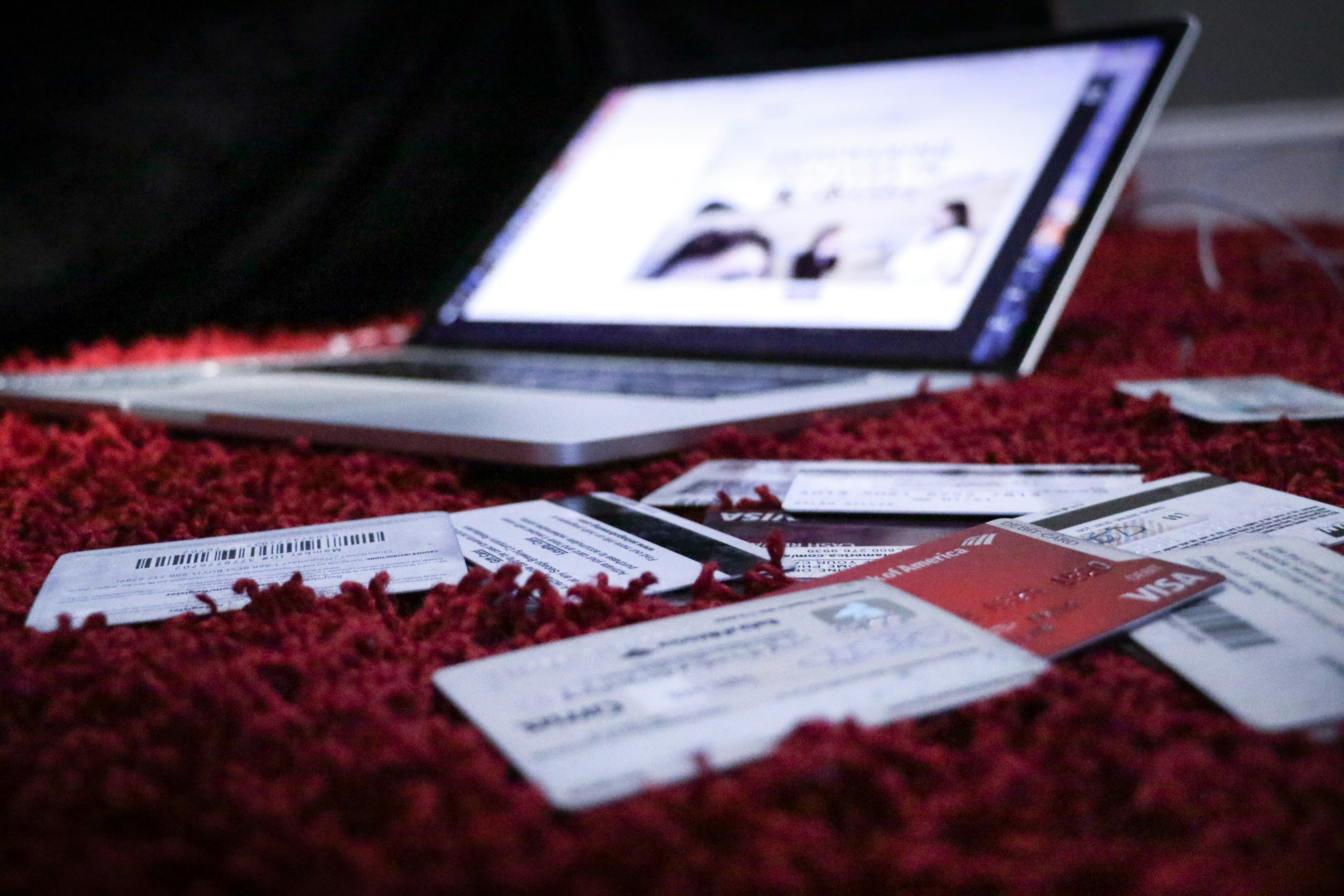

The Consumer Perspective: Why Credit Scores Are Problematic

Opaque Algorithms

Credit scoring algorithms are proprietary, making it nearly impossible for consumers to fully understand how their scores are calculated or how to improve them effectively.

Punitive Structure

The scoring system penalizes behaviors such as closing old accounts or applying for new credit, even when these actions align with sound financial planning.

Exacerbation of Inequalities

Low-income individuals often lack access to traditional credit, making it difficult to build or maintain a good score. This creates systemic barriers, perpetuating financial inequality and limiting economic mobility.

Real-Life Consequences for Consumers

The flaws in the credit scoring system have tangible effects on consumers:

High-Interest Rates: Borrowers with lower scores often pay significantly higher rates on loans, costing them thousands over time.

Barriers to Essentials: Poor credit scores can make it difficult to secure housing, obtain insurance, or even pass pre-employment screenings.

Credit Report Errors: Mistakes on credit reports, which are common, can take months or even years to correct, causing significant financial harm in the meantime.

Alternatives to the Current System

A growing movement seeks to replace or complement traditional credit scoring models with fairer, more inclusive alternatives:

Incorporating Non-Traditional Data: Using rent payments, utility bills, and subscription services to provide a more accurate picture of financial responsibility.

Focus on Financial Stability: Developing models that prioritize savings, consistent income, and financial health over debt management.

International Examples: Countries like Germany and Canada use different approaches to credit assessment, providing insights into more consumer-friendly systems.

Conclusion

While credit scores are often viewed as tools for financial empowerment, their design disproportionately benefits lenders, leaving consumers vulnerable. The lack of transparency, punitive structure, and systemic biases highlight the urgent need for reform.

Creating a fairer system requires a shift in focus from rewarding debt management to fostering overall financial health. By advocating for transparency and exploring alternative models, consumers and policymakers can challenge the status quo and pave the way for a more equitable financial future.

Author: Ricardo Goulart

Stablecoin The Future Of Currency?

The payments system is undergoing a quiet but consequential shift. What was once the exclusive preserve of central banks... Read more

BoE Loosens Capital Rules

The Bank of England has taken a significant step towards easing post-crisis regulation by lowering its estimate of the c... Read more

Monzo Looks For US Banking License

Monzo is preparing a renewed push to secure a US banking licence, four years after abandoning its first attempt when tal... Read more

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

JPMorgan Deploys AI Chatbot To Revolutionize Research And Productivity

JPMorgan has deployed an AI-based research analyst chatbot to enhance productivity among its workforce, with approximate... Read more