Japanese Yen, USD/JPY, Dow Jones, Coronavirus, Fed – Asia Pacific Market Open

- Japanese Yen soars as Dow Jones prolongs selloff amid coronavirus fears

- U.S. Treasury bills saw yields tumble at auction as investors sought shelter

- USD/JPY downtrend in focus, Asia Pacific equities may follow Wall Street

Japanese Yen Soars as Dow Jones Tumbles and Investors Preserve Capital

The anti-risk Japanese Yen and similarly-behaving Swiss Franc were some of the best-performing major currencies on Thursday as a selloff in global stocks picked up pace again. On Wall Street, the Dow Jones, S&P 500 and Nasdaq closed -3.58%, -3.39% and -3.58% to the downside respectively. There were a couple of fundamental developments that could help to explain today’s dismal performance in equities.

Coronavirus fears were in focus as senators reported that the U.S. will miss on virus test rollout goals. This is as the U.K. reported its first death of the Wuhan virus. The selloff on Wall Street also picked up pace after a couple of Treasury auctions. Yields on 4-week and 8-week bills tumbled to 0.93% and 0.82% from 1.53% and 1.50% prior respectively. This likely spoke to investors prioritizing preserving capital, undermining stocks.

The US Dollar continued being battered by tumbling bond yields, reflecting rising expectations of rate cuts from the Federal Reserve. Futures markets are fully pricing in 3 more reductions by the end of this year. That would bring the target range to 0.25% to 0.50%. Prospects of diminishing return in cash boosted anti-fiat gold prices as XAU/USD continued setting new highs for 2020. The “pro-risk” AUD and NZD fell.

Friday’s Asia Pacific Trading Session

A relatively quiet economic docket during Friday’s Asia Pacific trading session places the focus for currencies on risk trends. In early hours, reports crossed the wires from Maryland which reported its first 3 cases of COVID-19. Regional equities such as the Nikkei 225 and ASX 200 may follow Wall Street lower. That may bode well for the Japanese Yen at the expense of the Australian Dollar and New Zealand Dollar.

Japanese Yen Technical Analysis

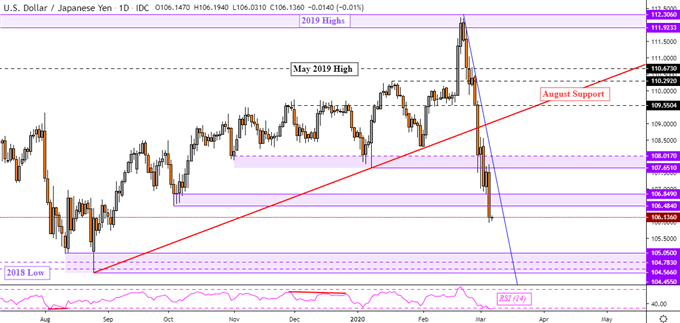

USD/JPY extended its selloff from 2019 highs after taking out rising support from August – as expected. Prices have now closed under October lows, exposing last year’s trough at 104.45. From here, a further downside close may solidify the pair’s downward trajectory. This is as falling resistance from February is maintaining the downtrend.

USD/JPY Technical Analysis

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter