Canadian Dollar, Crude Oil, Japanese Yen, US Dollar, Coronavirus – Asia Pacific Market Open

- Canadian Dollar may be at risk as crude oil prices resume steep declines

- Coronavirus concerns plunged stocks markets into the red as the Yen rose

- United Airlines and Mastercard announce downgrades in revenue estimates

Canadian Dollar Sinks with Crude Oil Prices as Stocks Tumble Across the Globe

The Canadian Dollar was the worst-performing major currency on Monday as sentiment-linked crude oil prices appeared to resume steep declines from January. Fears around the coronavirus impacting global output compounded as stock markets across the globe closed in the red. Energy is a key source of revenue in Canada. The downside impact of falling oil on local inflation could bolster the case for Bank of Canada rate cuts.

Monday began with downside gaps in equities during the Asia Pacific trading session as Wuhan virus cases increased in countries such as South Korea and Italy. The ASX 200, DAX 30 and S&P 500 closed -2.32%, -4.01% and -3.35% lower respectively. The flight to safety fueled demand for government bonds, pushing yields lower. Looking at futures, the markets are now starting to price in a third rate cut from the Fed this year.

The anti-risk Japanese Yen was the best-performing major currency with the haven-linked US Dollar only cautiously higher. The latter has more to lose from a perspective of yield should the Federal Reserve resume rate cuts from 2019. Anti-fiat gold prices aimed higher, capitalizing on prospects of further monetary easing. XAU/USD resumed its uptrend and the medium-term technical outlook is bullish.

Tuesday’s Asia Pacific Trading Session – S&P 500 Futures, Coronavirus

S&P 500 futures are now pointing cautiously higher heading into Tuesday’s Asia Pacific trading session after the worst day for the index in over two years. There could be room for a near-term pause in risk aversion though the road ahead is far from clear. Two North American companies - United Airlines and Mastercard - reported downside revenue estimates to account for the coronavirus. With that in mind, a lack of top-tier economic event risk places the focus for currencies on market mood ahead.

Canadian Dollar Technical Analysis

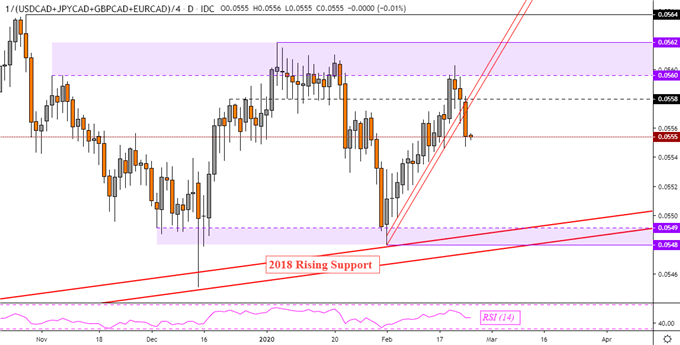

On average, the Canadian Dollar could be at risk to losses ahead. Using my majors-based Canadian Dollar index – which averages CAD against USD, JPY, GBP and EUR – the Loonie closed under rising support from the beginning of February. A further downside confirmatory close opens the door to perhaps revising lows CAD has not seen since earlier this month. This could be underscored by ongoing declines in crude oil prices.

Majors-Based Canadian Dollar Index

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter