Margin Pressure Mounts: Hedge Funds Face Liquidity Crunch

A wave of steep margin calls has swept through the hedge fund industry as global financial markets experience renewed volatility and funding conditions tighten. With asset prices under pressure and risk models recalibrated, many funds are being forced to deleverage, raising concerns about broader market fragility and the potential for cross-asset contagion.

What’s Driving the Margin Calls?

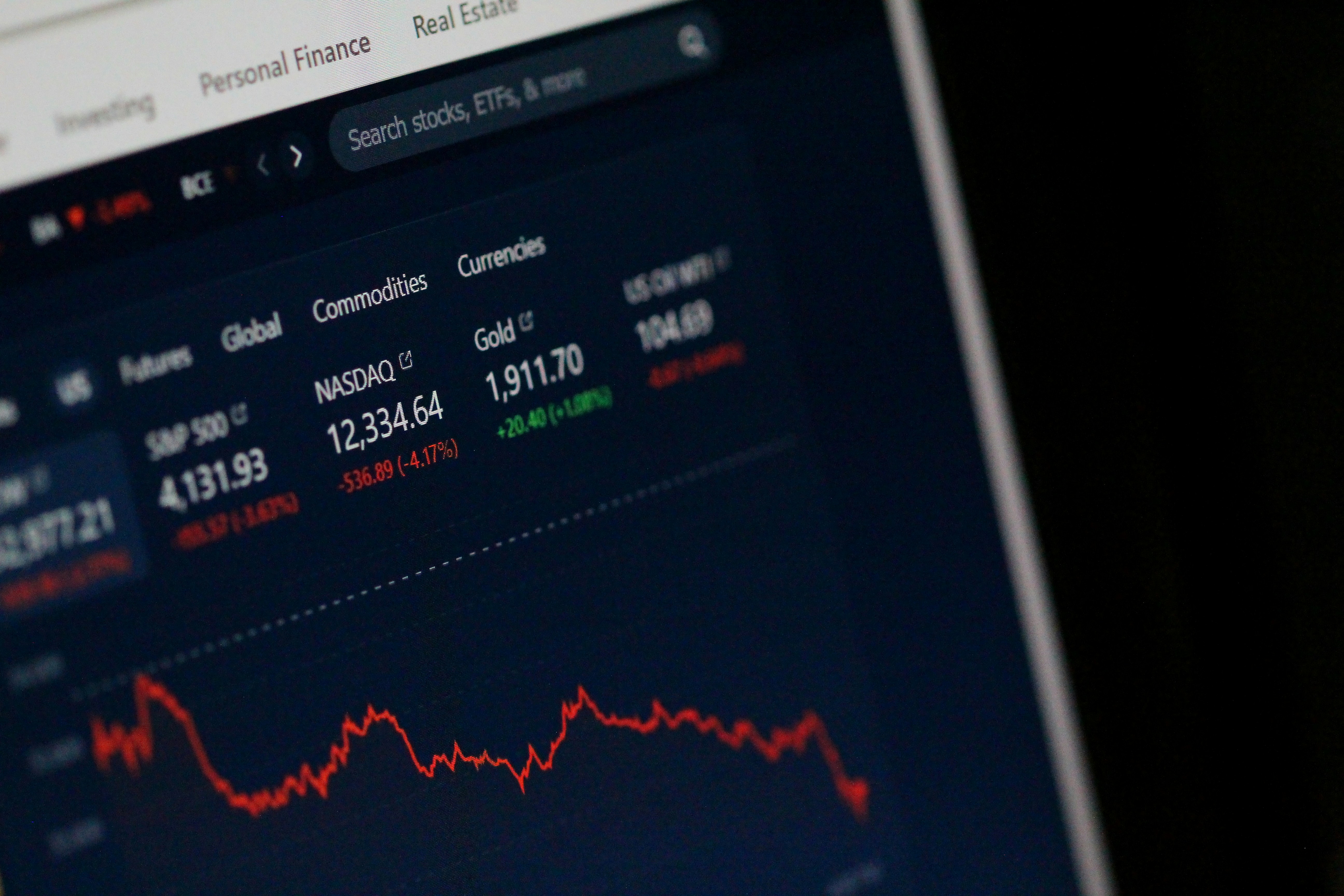

The immediate trigger has been sharp price declines across several asset classes. U.S. equities have seen a notable sell-off, particularly in high-beta and tech stocks, while bond yields have surged on expectations that central banks will maintain restrictive monetary policy longer than anticipated. This has led to a drop in the value of assets used as collateral by hedge funds, pushing margin ratios toward breach levels.

Many hedge fund strategies—especially those involving high leverage, such as long/short equity, global macro, and relative value arbitrage—have been particularly vulnerable. When market volatility rises and underlying positions decline in value, prime brokers quickly escalate margin requirements, sometimes on an intraday basis.

Banks, responding to heightened risk, have been tightening credit lines. Some are applying higher haircuts to riskier securities, increasing the amount of capital that funds must post. This is reminiscent of the Archegos Capital Management episode, where concentrated bets and insufficient margin buffers led to rapid unwinding and billions in losses across multiple counterparties.

How Funds Are Responding

In the short term, the primary response from hedge funds has been forced liquidation. To meet immediate collateral demands, funds have sold down large positions, contributing to further market pressure. This is particularly evident in sectors such as U.S. tech, leveraged credit, and certain emerging market exposures, where liquidity is already thin.

At the strategic level, funds are reducing leverage. Gross and net exposures have been cut, and many managers are shifting toward lower-volatility or more liquid holdings. This defensive repositioning is not just a short-term survival tactic—it reflects a broader reassessment of risk appetite in an environment where market swings are increasingly driven by policy uncertainty and geopolitical risk.

There is also a clear trend toward increased cash holdings. Funds are building liquidity reserves to prepare for additional margin calls, reducing exposure to instruments with complex structures or uncertain valuations. Some are revisiting their prime broker relationships, looking to diversify counterparties or renegotiate terms.

Market Impact and Systemic Risk Considerations

The effects of hedge fund deleveraging are spilling into other markets. As funds sell assets across portfolios, the resulting cross-asset flows have introduced new volatility into credit, currency, and even commodity markets. For instance, credit spreads have widened abruptly, and emerging market currencies have seen renewed pressure as investors unwind risk positions.

This feedback loop—margin calls leading to asset sales, triggering further price declines, and additional margin calls—is amplifying market stress. While not yet systemic, the pattern is familiar to those who observed similar dynamics during the 2008 financial crisis or the March 2020 pandemic sell-off.

The situation also raises questions about the resilience of market infrastructure. If margin spirals continue and redemptions rise, hedge funds could be forced into a more aggressive unwinding phase. In such a scenario, liquidity mismatches and counterparty exposure could become flashpoints for broader financial instability.

Outlook and Key Watchpoints

Several indicators will be critical in assessing the path forward. First, the pace of hedge fund redemptions will determine whether the current liquidity squeeze becomes a structural problem. Funds facing outflows may be forced into further sales, even in markets already under stress.

Second, regulatory attention is likely to increase. The Financial Stability Board and national regulators have previously flagged the use of leverage and the concentration of risk in prime broker relationships as key vulnerabilities. Renewed scrutiny may focus on disclosure standards, risk oversight, and the use of derivatives.

Finally, market conditions could stabilize if inflation pressures ease, allowing central banks to shift toward more accommodative stances. A pause in rate hikes, reduced volatility, or recovery in collateral asset prices would ease pressure on margins and allow funds to rebalance more gradually.

Conclusion

Hedge funds are entering a critical phase as steep margin calls force rapid adjustments to leverage, liquidity, and strategy. While the sector has proven resilient through past shocks, the current environment—marked by policy uncertainty, tighter financial conditions, and declining risk tolerance—has exposed underlying fragilities. Unless market volatility subsides or collateral values recover, the margin pressure will persist, with potential consequences not just for funds themselves, but for broader asset class stability.

Author: Ricardo Goulart

Global Fund Groups Set To Hit $200tn

Global fund groups set to hit $200tn in assets by 2030, says PwCThe global fund management industry is expected to reach... Read more

Underperform And Report To Office: AHL's Struggles Trigger Policy Shift At Man Group

Man Group, one of the world’s largest hedge funds, has ordered staff at its flagship systematic trading unit AHL to re... Read more

Asia's Quiet Hedge Fund Star: Arrowpoint Rides Tariff Waves To Strong Gains

While some hedge funds chase headlines and media attention, others prefer to let performance speak for itself. Arrowpoin... Read more

China's Contrarian Hedge Fund Star Bags 1,485% Return

In a year when many global investors remained wary of China’s turbulent markets, one homegrown hedge fund has delivere... Read more

Beyond The Black Box: How Hedge Funds Are Systematically Embedding AI Into Core Operations

Artificial intelligence (AI) has long been discussed in hedge fund circles as a powerful but opaque tool—useful in the... Read more

Hedge Funds Rebuild Long Positions In Oil

Brent Crude Rally Gains Momentum After Diplomatic Thaw Hedge funds have significantly increased their bullish bets on B... Read more