The head of the International Monetary Fund is urging countries to work out their differences over trade and take advantage of a healthy world economy to reduce debt before the next downturn comes.

IMF Managing Director Christine Lagarde told reporters that "the near-term prospect for the global economy appears to be bright."

But clouds are already gathering: an intensifying standoff between the United States and China that threatens to flare up into the biggest trade conflagration since World War II. Record levels of global debt. Financial markets that are volatile — and vulnerable to an unexpectedly steep uptick in interest rates.

For now, the world economy appears to be nestled in a good place: The IMF forecasts 3.9 percent growth this year and next, the fastest since 2011, thanks to increasing investment and trade. And most of the world is sharing in the prosperity, making this the broadest economic expansion in a decade.

Lagarde warned against complacency: "More needs to be done to sustain this upswing and foster long-term growth."

Her comments came at the opening of the spring meetings of the 189-nation IMF and its sister lending organization, the World Bank.

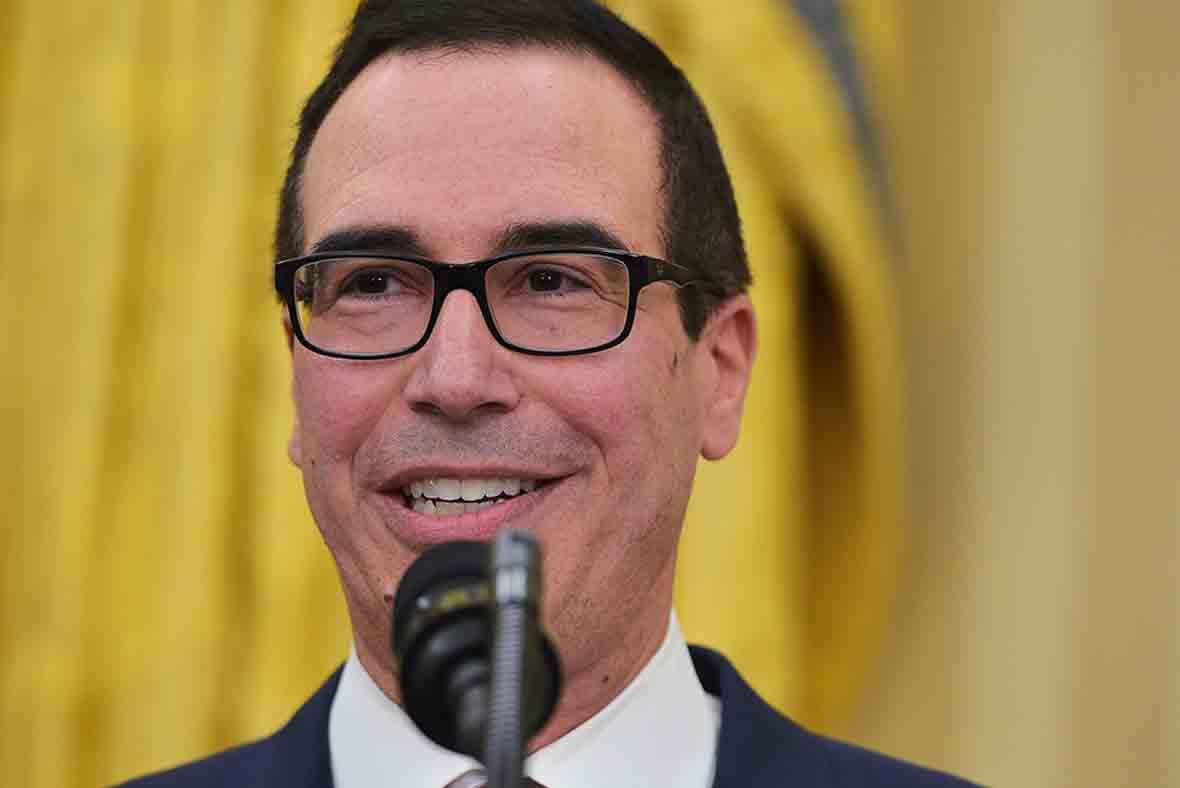

The three days of talks will also include discussions among the Group of 20 major economies, which account for more than 80 percent of global economic output. The United States is being represented by Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell.

Mnuchin insisted Thursday that the administration's imposition of tariffs on steel and aluminum imports and its consideration of penalty tariffs on up to $150 billion of Chinese imports were part of a strategy to level the playing field on trade and reduce America's huge trade deficits with China and other nations.

"Our objective with China is to have free and fair and reciprocal trade," Mnuchin said in an interview with the Fox Business Network.

Lagarde called for talks to ease tensions. Paraphrasing former British Prime Minister Winston Churchill, she said: "It is better to jaw jaw than to war war."

She cautioned that there would be considerable collateral damage in a U.S.-China trade war. "The world is so interconnected," she said. "The supply chains are involving so many different countries, regional, intraregional, interregional, that it would affect the global economy."

Rising debt levels are also clouding the global outlook. Worldwide debt has reached a record $164 trillion, Lagarde said, and advanced economies are carrying the biggest government debt burdens in decades.

Lagarde praised the United States for last year cutting its corporate tax rate, one of the world's highest and long seen as a competitive liability for corporate America. But she advised Washington to take advantage of good times to find ways to narrow the gap between federal spending and federal tax collections.

By reducing debt now, she said, countries would have more room to ramp up spending or cut taxes to combat the next recession.

The IMF chief also expressed worries about the fragility of financial markets. Stock prices are high. Markets have been volatile, partly because investors are rattled by the prospect of a U.S.-China trade war. And the Federal Reserve is steadily ratcheting up U.S. interest rates from the record low levels where it kept them for most of the decade since the 2008 financial crisis.

While the Fed has been raising rates at a gradual pace, Lagarde expressed concern about the consequences if the Fed had to accelerate the pace of its rate hikes. A rapid succession of rate hikes could push down stock prices and potentially hurt developing countries that have come to rely on foreign investment, she said.