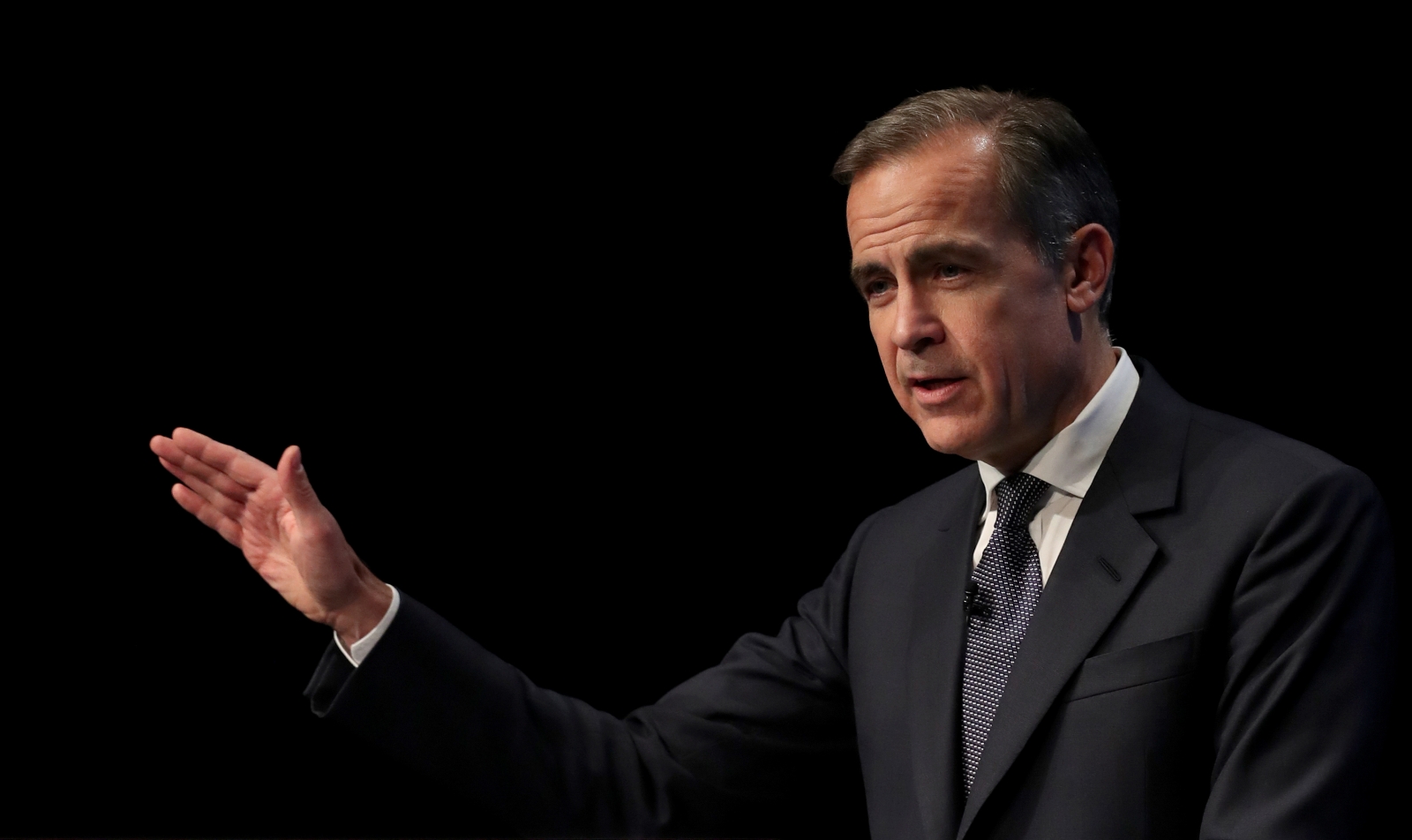

Brexit is costing Britain's economy an eye-watering £200m a week in lost growth, according to Bank of England governor Mark Carney.

Carney told business leaders at the World Economic Forum in Davos, Switzerland, that the UK had lost approximately £10bn in GDP since voting to leave the European Union in June 2016.

To ensure neutrality and avoid claims of political interference, Threadneedle Street officials have never put a detailed figure on the cost of Brexit.

However, according to The Times (paywall), the subject was put to Carney in Switzerland when a guest at a private meeting asked him to quantify the cost of leaving the EU in "Brexit buses".

That was a reference to the discredited claim used in a poster on the side of the Brexit bus that £350m a week could be returned to the NHS if the UK left the EU.

Carney reportedly told attendees that the weekly cost of Brexit amounted to between two thirds and three quarters of the £350m.

The figure cannot be directly compared with the £350m suggested by the Leave campaign as Carney's figure refers to lost growth.

The £10bn Britain has reportedly lost out on since the referendum accounts for 0.5% of Britain's GDP, although the impact on public finances would be considerably smaller.

Official data to be released on Friday (26 January) is expected to show that Britain's economy grew 1.4% year-on-year in the final quarter of 2017, a sharp deceleration from the 1.7% recorded in the previous 12 months.

On an annual basis, meanwhile, figures are expected to show the UK economy grew 1.8% both in 2017 and 2016, although the Office for Budget Responsibility (OBR) forecast the economy would expand only 1.4% this year

That figure would be in line with forecasts by the International Monetary Fund, which earlier this week forecast Britain's economy in 2018 and 2019 would grow 1.5%, despite upgrading its forecasts elsewhere.

In March 2016, the OBR had forecast Britain's GDP would grow 2% over the course of the year, before rising to 2.1% and 2.2% in the two following years.

"The UK economy is underperforming," said Bill Michael, UK chairman of KPMG, which hosted the event where Carney was present.

"There is ample evidence we risk becoming decoupled from the rest of the world," he continued.

"The UK CEOs we're talking to in Davos are very concerned. They want to be part of the actions that will address this. We can't risk Brexit widening that growth gap."