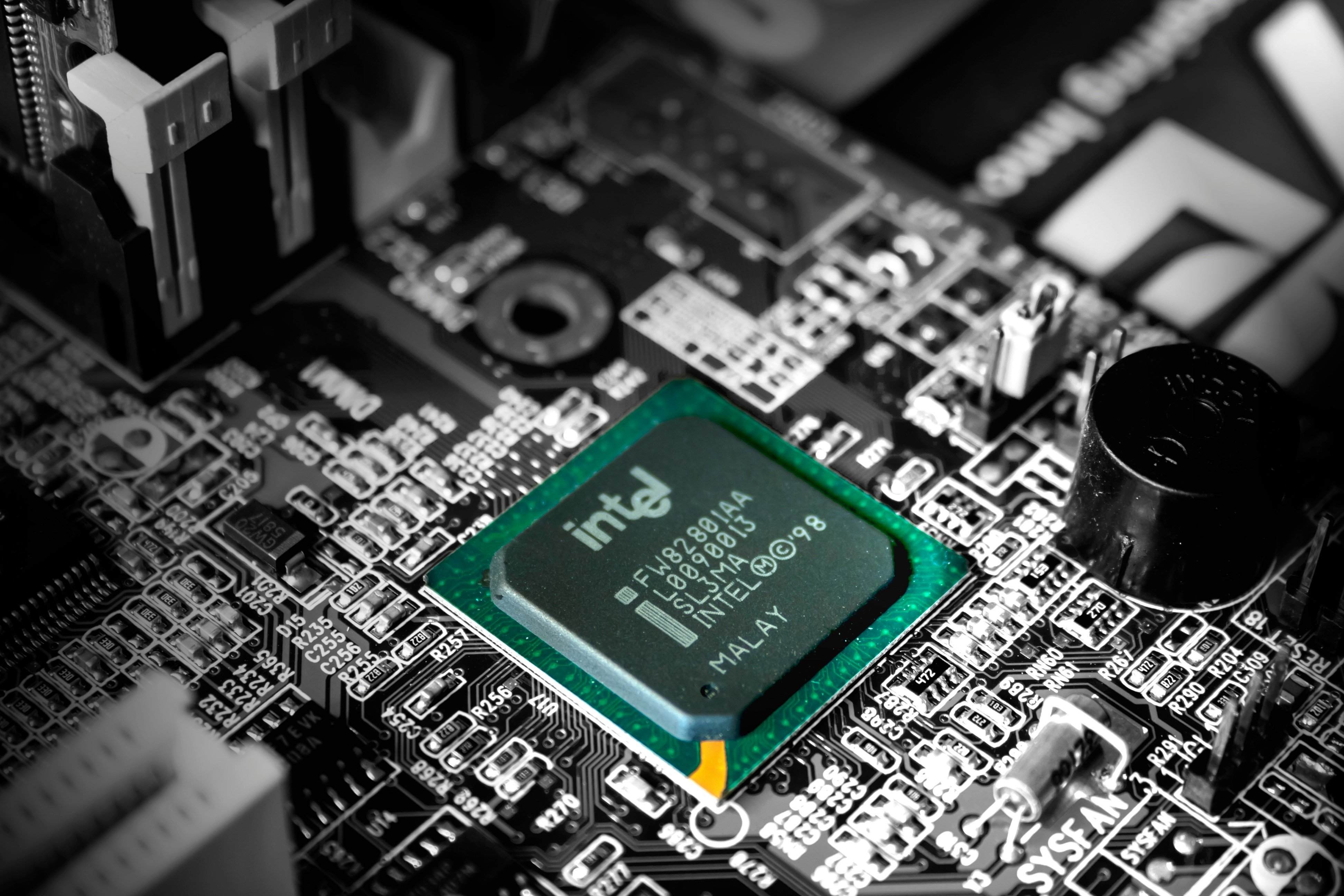

Intels China Investments Raise Red Flags In Washington

Intel's venture arm has made significant investments in over 40 Chinese start-ups, raising alarms among U.S. lawmakers and officials. These investments, aimed at leveraging global innovation, come at a time when Intel is also receiving billions in U.S. grants intended to bolster domestic semiconductor capabilities. The dual strategy has sparked a debate about the potential risks and benefits of such investments.

Background

Intel's venture arm, known for its strategic investments in cutting-edge technology companies worldwide, has targeted a diverse array of Chinese start-ups. These investments span sectors such as artificial intelligence (AI), autonomous driving, and advanced manufacturing. By investing in these areas, Intel aims to tap into China's burgeoning tech scene and enhance its competitive edge in the global market.

Intel's broader strategy involves maintaining a presence in key international markets to foster innovation and technological advancements. This global approach is seen as essential for staying ahead in the highly competitive semiconductor industry.

Concerns Raised in Washington

Despite Intel's strategic rationale, U.S. officials are increasingly concerned about the implications of these investments. There is a fear that Intel's support for Chinese tech firms could inadvertently bolster China's technological capabilities, potentially undermining U.S. efforts to maintain a technological edge.

The situation is particularly sensitive given the substantial U.S. government funding Intel has received to enhance domestic semiconductor production. Critics argue that these investments may conflict with the strategic objectives of U.S. grants, which are designed to reduce reliance on foreign technologies and strengthen national security.

Intel's Position

In response to the concerns, Intel maintains that its global investments are crucial for driving innovation. The company emphasizes its commitment to complying with all U.S. regulations and ensuring that its actions align with national interests. Intel argues that a global approach to investment is necessary to sustain technological leadership and that fostering innovation across borders ultimately benefits the global tech ecosystem, including the U.S.

Intel also highlights that its investments are not solely focused on China but are part of a broader strategy to engage with emerging technologies worldwide.

Implications for Innovation and Security

The tension between Intel's global investment strategy and U.S. national security concerns highlights the complexities of maintaining technological leadership in an interconnected world. On one hand, fostering global innovation is essential for technological advancement and competitiveness. On the other hand, there is a legitimate need to protect national security and ensure that U.S. strategic interests are not compromised.

Intel's investments in China could potentially enhance U.S. competitiveness by integrating advanced technologies from a leading global tech hub. However, they also pose risks if these technologies are used to strengthen China's strategic capabilities in ways that could challenge U.S. interests.

Conclusion

The debate over Intel's investments in Chinese start-ups underscores the delicate balance between fostering innovation and protecting national security. As Washington scrutinizes these investments, the broader implications for U.S. policy and the global tech landscape remain uncertain. Finding the right balance will be crucial for ensuring that the U.S. maintains its technological leadership while safeguarding its national security interests. The outcome of this debate will likely shape the future of Intel's investment strategy and U.S. policies on international tech collaboration.

Author: Gerardine Lucero

Ai Beginning To Deliver On Promise

For all the excitement surrounding artificial intelligence, its most immediate impact in the workplace has been measured... Read more

Parallel Banking: Stablecoins Are Now Global

Parallel Banking: How Stablecoins Are Building a New Global Payments SystemStablecoins—digital currencies pegged to tr... Read more

Reassessing AI Investments: What The Correction In US Megacap Tech Stocks Signals

The recent correction in US megacap tech stocks, including giants like Nvidia, Tesla, Meta, and Alphabet, has sent rippl... Read more

AI Hype Meets Reality: Assessing The Impact Of Stock Declines On Future Tech Investments

Recent declines in the stock prices of major tech companies such as Nvidia, Tesla, Meta, and Alphabet have highlighted a... Read more

Technology Sector Fuels U.S. Economic Growth In Q2

The technology sector played a pivotal role in accelerating America's economic growth in the second quarter of 2024.The ... Read more

Tech Start-Ups Advised To Guard Against Foreign Investment Risks

The US National Counterintelligence and Security Center (NCSC) has advised American tech start-ups to be wary of foreign... Read more