GitLab Files To Go Public

The coding repository and devOps platform GitLab on Friday filed to go public on the Nasdaq Global Market under the symbol GTLB.

The company did not disclose the terms of its offering. Late last year, it was valued at $6 billion.

In its S-1 form filed with the US Securities and Exchange Commission, GitLab showed that its revenue is growing but it continues to incur losses.

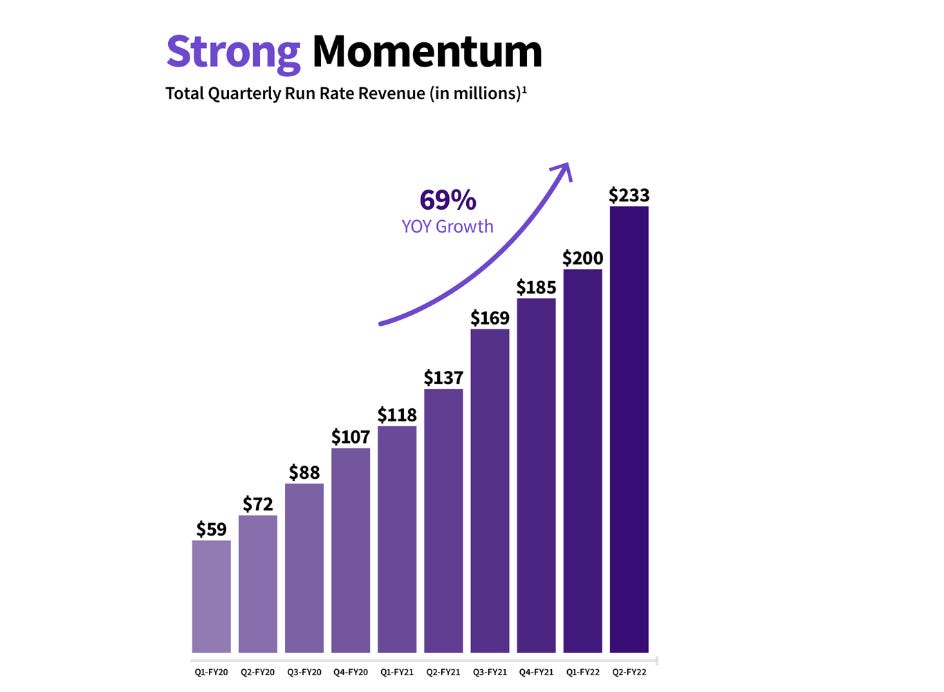

For the second quarter of FY 2022, GitLab says it had a quarterly revenue run rate of $233 million. For the six months that ended July 2020 and July 2021, the company generated revenue of $63.9 million and $108.1 million, respectively. That represents year-over-year growth of 69%.

GitLab's net loss was $130.7 million in FY 2020 and $192.2 million for FY 2021. Its net loss was $69 million for the six months ended July 31, 2021.

By the end of July 2021, the company says it had 3,632 customers with more than $5,000 of ARR (annual recurring revenue) in a given period. It had 383 customers with $100,000 of ARR.

GitLab also has more than 2,600 contributors in its open source community, which it lists as a competitive strength.

"Our dual flywheel development strategy leverages development spend and community contributions," it said in its filing. "It creates a virtuous cycle where more contributions leads to more features, which leads to more users, leading back to more contributions."

GitLab estimates the current addressable market opportunity for the DevOps Platform is approximately $40 billion. According to Gartner, the total addressable market for Global Infrastructure Software is estimated to be $328 billion by the end of 2021 and $458 billion by the end of 2024.

"We believe that we can serve $43 billion of this market by the end of 2021 and $55 billion by the end of 2024," the filing says.

Its listed risk factors include "intense competition" as well as security and privacy breaches.

GitLab's workforce has been fully remote since its 2014 inception. As of July 31, it had approximately 1,350 team members in over 65 countries.

"Operating remotely allows us access to a global talent pool that enables us to hire talented team members, regardless of location, providing a strong competitive advantage," the company said.

Reassessing AI Investments: What The Correction In US Megacap Tech Stocks Signals

The recent correction in US megacap tech stocks, including giants like Nvidia, Tesla, Meta, and Alphabet, has sent rippl... Read more

AI Hype Meets Reality: Assessing The Impact Of Stock Declines On Future Tech Investments

Recent declines in the stock prices of major tech companies such as Nvidia, Tesla, Meta, and Alphabet have highlighted a... Read more

Technology Sector Fuels U.S. Economic Growth In Q2

The technology sector played a pivotal role in accelerating America's economic growth in the second quarter of 2024.The ... Read more

Tech Start-Ups Advised To Guard Against Foreign Investment Risks

The US National Counterintelligence and Security Center (NCSC) has advised American tech start-ups to be wary of foreign... Read more

Global IT Outage Threatens To Cost Insurers Billions

Largest disruption since 2017’s NotPetya malware attack highlights vulnerabilities.A recent global IT outage has cause... Read more

Global IT Outage Disrupts Airlines, Financial Services, And Media Groups

On Friday morning, a major IT outage caused widespread disruption across various sectors, including airlines, financial ... Read more