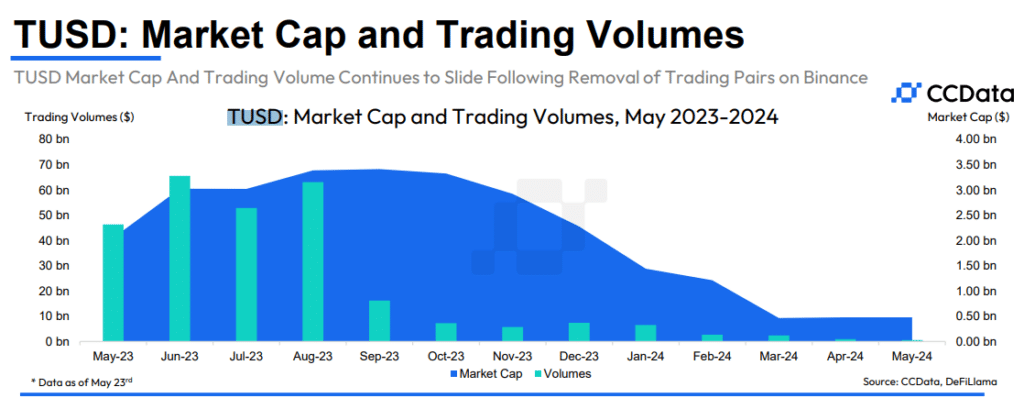

TrueUSDs Crashes 79% Following Binance Delisting

Stablecoin TrueUSD (TUSD) affiliated with Justin Sun lost nearly 80% in market capitalization after crypto exchange Binance removed several trading pairs with it.

TrueUSD (TUSD), a stablecoin issued by the TrustToken platform, which currently operates as Archblock, declined by 78.9% after several TUSD pairs were delisted on Binance, analysts at CCData revealed.

In its latest stablecoin research report, CCData says the monthly trading volume for TUSD pairs on centralized exchanges has dropped to $569 million, representing a decline of nearly 99% since May 2023.

“Binance remains the dominant exchange that trades the most TUSD pairs with a market share of 68.2%. WhiteBit and BitMartfollow with a market share of 13.4% and 5.32%. The stablecoin has recently introduced a zero-fee trading promotion for TUSD/TRY pair on Bitci to boost its adoption.”

CCData

Analysts noted that in May, the total market value of stablecoins rose by 0.63% to $161 billion, marking the eighth consecutive month of growth and reaching the highest level since April 2022. This increase signifies a recovery in the stablecoin market, which had been in a seventeen-month downtrend following the collapse of TerraUSD, according to CCData.

TrueUSD was launched in March 2018 by TrustToken, a firm co-founded by Rafael Cosman, Stephen Kade, Jai An, and Tory Reiss. The stablecoin was designed to provide a transparent and legally protected stablecoin that is fully collateralized by the U.S. dollar, ensuring its value remains stable. However, following its removal from Binance and issues with custodian Prime Trust, TUSD has several times lost its peg to the U.S. dollar, raising concerns about the stablecoin’s reliability.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more