Storj Crypto Rallies As A Golden Cross Pattern Nears

Storj, a blockchain network focused on storage and decentralized graphical processing units, continued its strong rally.

Storj (STORJ) price soared to a high of $0.6660, its highest level since April, making it one of the best-performing tokens in the market. It has risen by over 157% from its lowest level in August.

The uptrend occurred in a high-volume environment. Data from CoinGecko shows that the 24-hour volume was over $128.8 million. It had a daily volume of $174 million and $238 million on Thursday and Wednesday, respectively. Before that, Storj had less than $30 million in daily volume, marking its highest point since February.

Storj’s futures open interest continued rising, reaching a high of $63 million, its highest point since December 2023.

This rally happened as investors moved back to artificial intelligence assets in the cryptocurrency and stock market. Stocks like Nvidia and Palantir have soared, bringing their valuations to over $3.2 trillion and $100 billion, respectively.

AI cryptocurrencies like AI Companions (AIC), Akash Network (AKT) and Bittensor (TAO) have also continued rising.

Storj is seen as an AI coin because of the services it offers, including storage and GPU leasing. Its storage solution allows users to share their free storage and earn money when others use it. According to its website, its solution is significantly cheaper than popular cloud computing platforms like AWS, Azure, and Google Cloud.

Storj also owns Valdi, a platform that lets users lease GPUs like NVIDIA H100, A100, and GeForce RTX. Users can now lease the 8x NVIDIA H100 SXM5 80GB, which costs over $260,000, for just $2.29 per GPU hour.

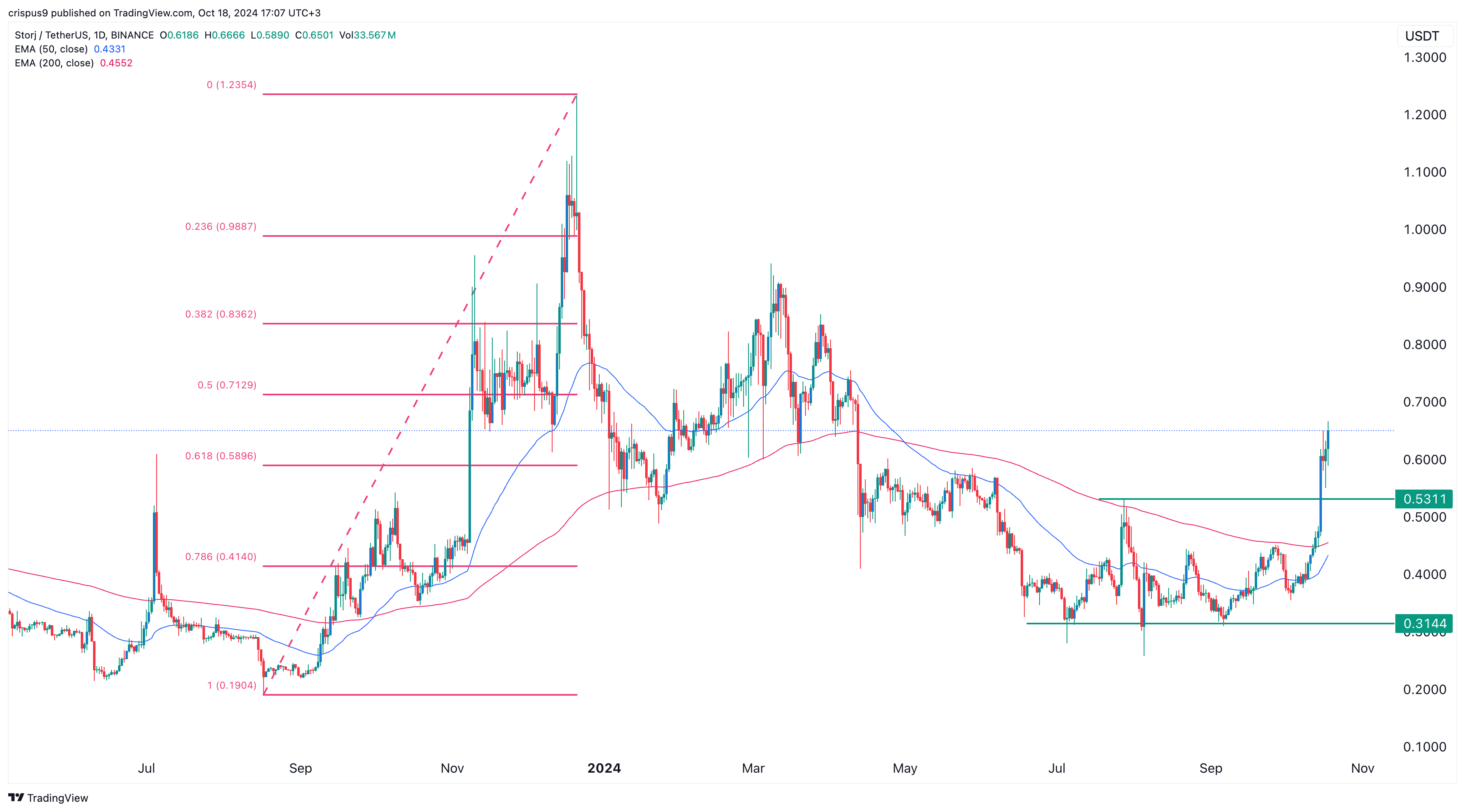

The Storj token price formed a triple-bottom at $0.3145 between July and September. It has now soared above the neckline at $0.5310, its highest point on July 29.

The token is about to form a golden cross as the 200-day and 50-day moving averages near their crossover. It is also approaching the 50% Fibonacci Retracement level.

Therefore, the path of least resistance for the token is upward, with the next point to watch being the 50% retracement point at $0.7130. The other possible scenario is a retest of support at $0.5310 before resuming the bullish trend.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more