S&P: Stablecoin Bill Could Improve U.S. Participation, Challenge Tether Dominance

According to an S&P report, a bipartisan stablecoin bill may give banks an advantage over other institutions and incentivize competition in the digital asset custody business.

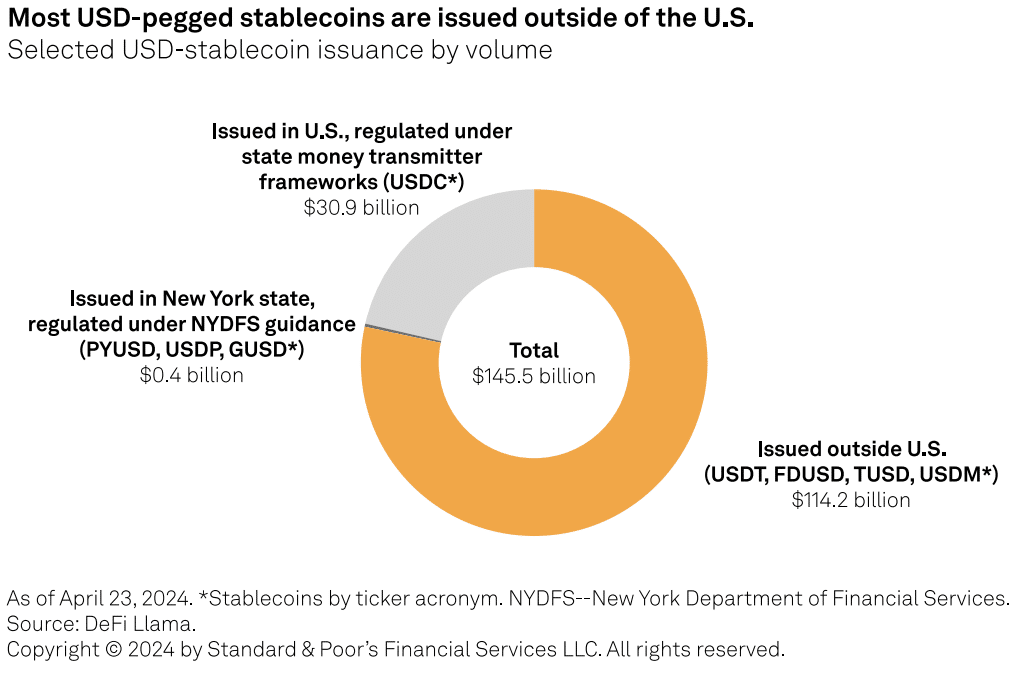

If approved, the Lummis-Gillibrand Payment Stablecoin Act proposed on April 17 seems positioned to introduce regulatory clarity for the $157 billion-strong stablecoin market currently dominated by Tether (USDT).

Stablecoins are fiat-pegged cryptocurrencies that offer stability in an otherwise volatile financial market. Such assets are typically tied to sovereign currencies like the U.S. dollar, such as Circle’s USD Coin (USDC), serving as gateways to on-and-off ramp liquidity.

The bill would permit U.S. banks to issue fiat-pegged tokens with no threshold, but require service providers without a banking license to maintain a market cap under $10 billion.

According to Andrew O’Neil, Managing Director and Co-Chair of S&P Global’s Digital Assets Research Labs, the regulatory framework will give banks an edge over other market participants and incentivize blockchain adoption in the financial sector through asset tokenization and digital bond issuance.

O’Neil said on-chain payment rails offer real-time and efficient settlement, citing BlackRock Ethereum-based fund as an example.

“Investment group Blackrock’s BUIDL fund provides a recent use case. The tokenized fund, which uses the Ethereum blockchain and invests in U.S. treasuries, has a liquidity pool denominated in the USDC stablecoin, for which investors can redeem share tokens via a smart contract, instantaneously and 24/7.”

Andrew O’Neil, Managing Director and Co-Chair of S&P Global’s Digital Assets Research Labs

Although the Lummis-Gillibrand bill will not impact existing U.S.-based products like PayPal USD, the framework does not authorize offshore entities like Tether. The terms could shake USDT’s presence in the market, but O’Neil noted that Tether’s activities and volume are predominantly out of the United States.

Additionally, decentralized stablecoins are not included in the regulations, so offerings like Maker’s DAI and Frax Finance’s FRAX fall out of the proposal’s purview. Policymakers likely prefer centralized systems like USDC as they mirror existing financial operations, O’Neil explained.

Finally, the S&P report predicted an influx of new providers in the digital asset custody industry, especially with an update to SEC rules which no longer require custodians to report crypto-assets on their balance sheet. crypto.news reached out to O’Neil and the S&P for further comment on the bill and its impacts.

“That policy not only differs from the general treatment of financial assets held in custody, which are generally off-balance sheet, but creates a capital requirement that likely discourages financial institutions from providing digital asset custody in the U.S. The new rules would remove that barrier and could lead to greater competition.”

Andrew O’Neil, Managing Director and Co-Chair of S&P Global’s Digital Assets Research Labs

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more