Ripple XRP Ruling Sets Precedent For Retail Crypto Sales, AMLBot CEO Says

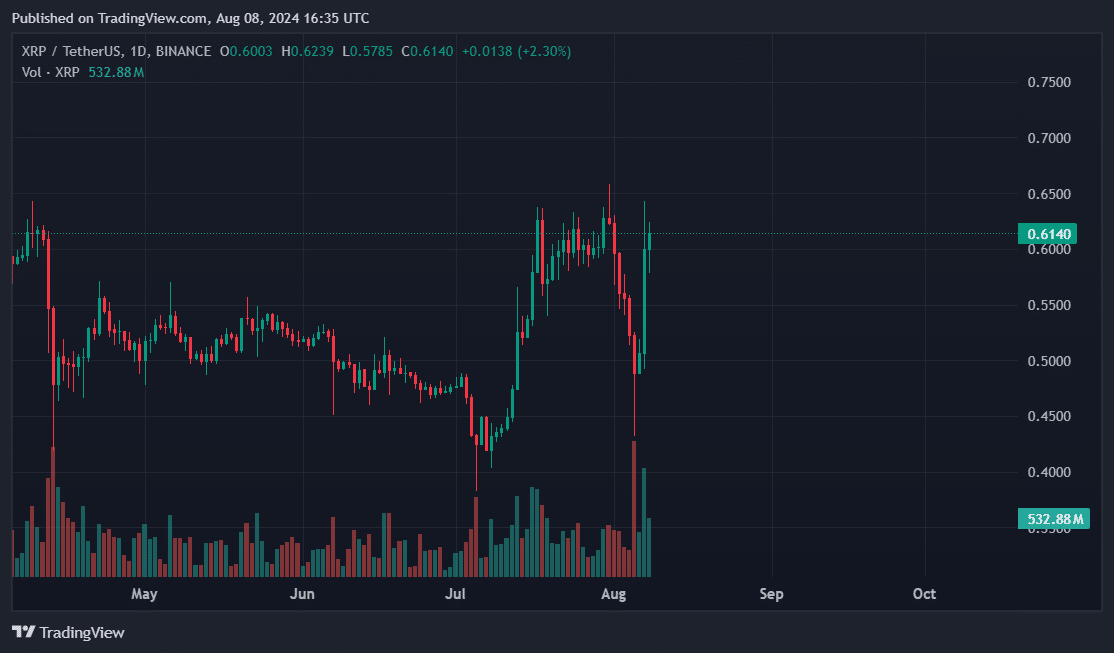

Crypto markets saw an XRP god candle after the Ripple v. SEC ruling, but AMLBot’s CEO warned that an appeal from the agency could stall price momentum.

Last year, Ripple’s (XRP) initial triumph over the SEC lifted markets. Sentiment that retail crypto investments aren’t securities flooded the nascent industry and uplifted prices. The final Aug. 7 ruling from U.S. federal judge Analissa Torres similarly affected XRP’s price standing.

Ripple was still up 23% at press time as Torres found no federal securities violations in sales to retail investors via crypto exchanges.

However, institutional XRP sales were deemed a violation, and the U.S. Securities and Exchange Commission secured a $125 million penalty against Ripple.

“If the SEC pursues the case into appeal, I think the price will drop. If not, we might see it rising,” AMLBot CEO Slava Demchuk told crypto.news on Aug. 8.

Ripple and its CEO Brad Garlinghouse applauded the verdict as a victory, but Demchuk said the SEC will likely appeal the result. Following a four-year legal tussle, an SEC appeal might throw further uncertainty on the firm’s cryptocurrency, which some argue operates as a quasi-stock.

Torres issued the final verdict roughly four months before the presidential elections in November. There is a belief that a new administration will assume the White House and reform the SEC’s crypto approach. Demchuk argued otherwise, saying the election result will not “considerably change the SEC’s approach.”

Still, the court’s decision on XRP sets the stage for the digital asset industry to challenge the SEC’s claim that most cryptocurrencies are securities.

“Based on the current case, selling tokens via crypto exchanges rather than directly might mitigate the risk of the token being classified as security,” per Demchuk.

Scrutinized crypto businesses like Uniswap Labs and MetaMask maker Consensys may adopt this precedent as ammunition against the SEC in their respective court cases.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more