The U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, announced his resignation yesterday on X (formerly known as Twitter) and through the SEC website. He confirmed that he will be stepping down from his position on January 20, 2025, the same day Trump steps back in the Oval Office.

This announcement sent a wave of excitement through the cryptocurrency community, and according to the community members, this moves marks as a turning point for the U.S. crypto policies.

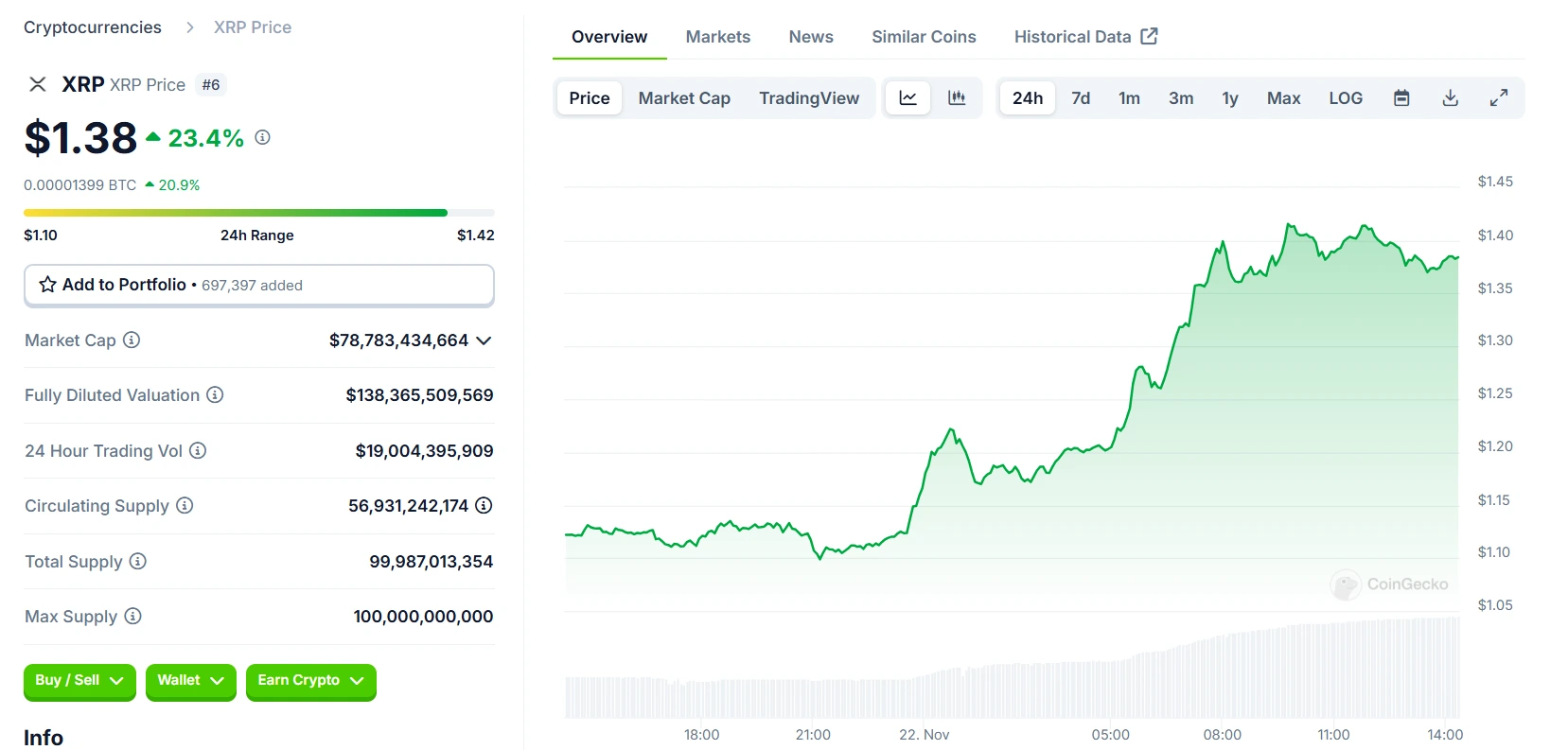

Ripple’s XRP Price Rallies

Gensler’s tenure, prominently known because of his aggressive litigation against leading crypto companies such as Ripple, has been widely criticized by the industry leaders. His departure is seen as an opportunity for regulatory clarity and fairness sparking a rally in the crypto market.

XRP, Ripple’s cryptocurrency, was the star performer following the news. the price of the token rallied by approximately 25% to hit a high of $1.41, which the token’s highest price in months.

Launch of XRP ETP

This surge in Ripple’s XRP price is not just a reaction to Gensler resigning but it also has to do with the launch of WisdomTree Physical XRP ETP (XRPW). This new investment product, now listed on Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam, offers a secure, low-cost way to gain exposure to XRP.

The WisdomTree Physical XRP ETP is fully backed by XRP, held in cold storage, and provides direct spot price exposure. Notably, XRPW is the lowest-cost XRP ETP in Europe, making it an attractive option for institutional and retail investors.

Price Prediction

Market analysts predict that by the end of November, if this rally continues, there are high chances that the token may reach $1.50-$2.0 range.

At press time, the price of XRP token stands at $1.38 with a surge of 23.4% in the last 24 hours, with a increased market cap of $78 billion.

With Gensler’s resignation on the horizon, and momentum building for an XRP ETF, the token’s bullish trajectory appears poised to continue into the new year.

Also Read: MicroStrategy to Buy Bitcoin with $3 Billion Notes Offering