Ripple President: Stablecoin Likely This Year

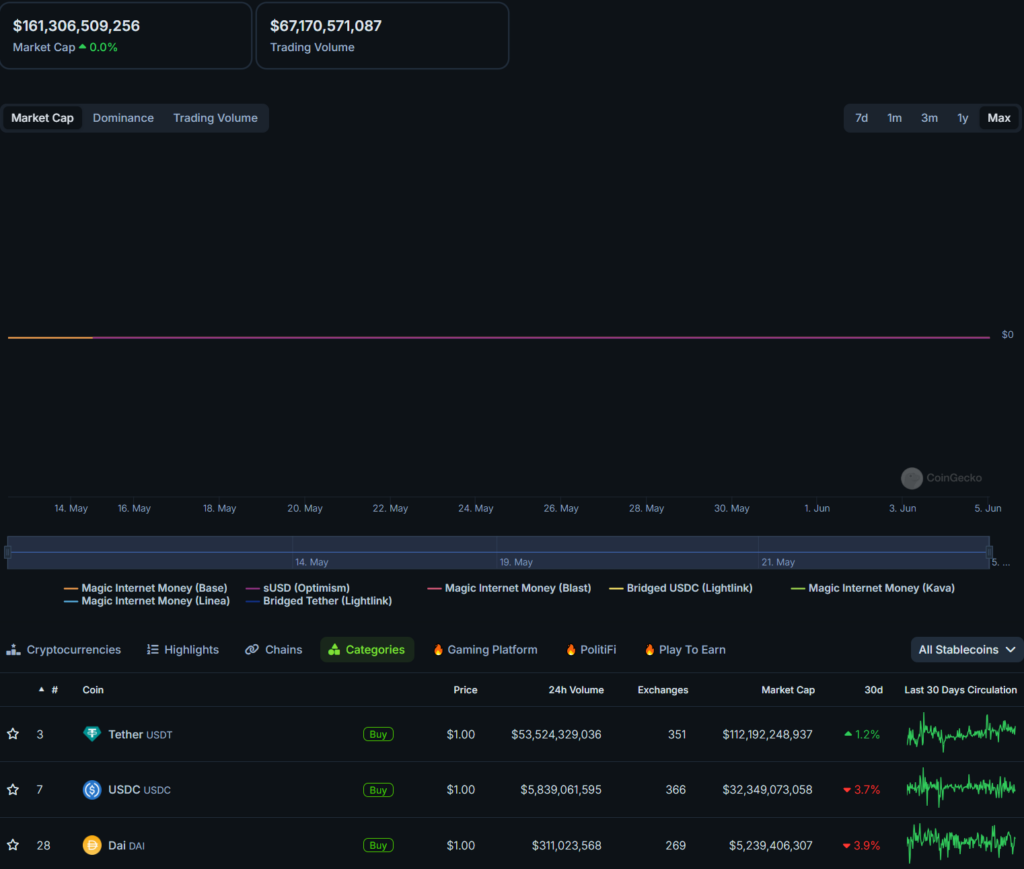

Ripple president Monica Long said the XRP issuer is likely to enter the $161 billion stablecoin market before the end of the year.

The stablecoin market is growing in leaps and bounds as experts predict a multi-trillion ecosystem for U.S. dollar-pegged tokens in the next three to five years, Ripple’s Long stated in an interview with CNBC at Money 20/20 in Amsterdam.

According to Ripple’s president, the stablecoin market is primarily driven by demand for access to U.S. dollars and an efficient global fiat-denominated payment system powered by blockchain technology.

“We are currently focused on everything needed to bring a stablecoin to market, including regulatory compliance and institutional relationships,” Long explained. The XRP issuer plans to debut its offering in 2024. Ripple CEO Brad Garlinghouse shared similar remarks at Consensus last week, albeit without a launch timeline.

Despite a jump into the stablecoin market, Long emphasized the long-term relevance and use case for XRP. She noted that retaining XRP as a bridge asset for a wide range of currency pairs is a viable long-term strategy. The decentralized ledger will continue to provide liquidity and power real-world asset tokenization, a sector experiencing growing interest from financial stakeholders.

Following the success of spot Bitcoin (BTC) ETFs in the U.S., issuers submitted bids to list the same product backed by crypto’s second-largest asset, Ethereum (ETH).

Debates abound regarding whether spot ETH ETFs will garner similar success to BTC counterparts. Some argue that Ethereum is only the second cryptocurrency and might be more difficult for investors, both retail and institutional, to understand.

Due to improved crypto education and industry titans like BlackRock leading the charge, Long believes worries that spot Ether ETFs could fail are unfounded.

Long opined that Ethereum ETF tracking spot markets will be a significant crypto adoption catalyst, as the blockchain is primed for securities asset tokenization and a decentralized finance economy ready to intake large capital inflows.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more