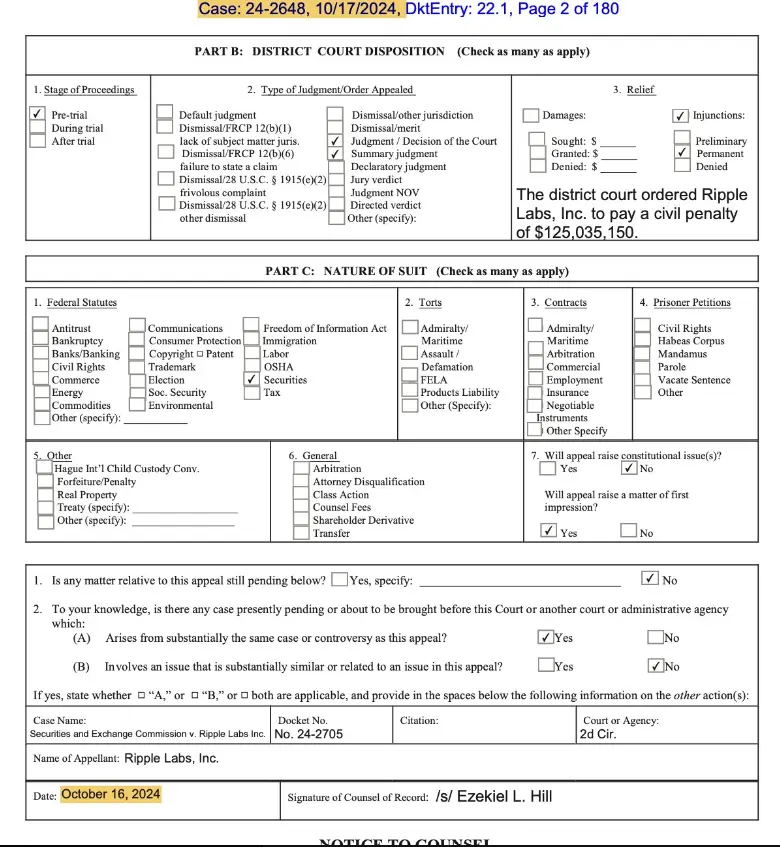

The cryptocurrency community is abuzz with speculation after the recent developments in the Ripple vs. SEC case. The court filed the docket on October 17, fueling rumors that the appeal may be dismissed due to the SEC missing the deadline. According to experts, the SEC’s Form C filing, dated October 16, was officially stamped by the court on October 17, raising questions about the timeline. This discrepancy has led many to believe that the judge may still dismiss the appeal.

The SEC’s appeal against Ripple Labs has been a long ongoing battle, with the agency challenging the court’s decision that XRP sales on cryptocurrency exchanges are not securities. However, with the deadline potentially missed, this might turn in favor of Ripple.

????RUMORS: Rumors circulating on X that the judge can still dismiss the appeal because the SEC has clearly missed the deadline! ???? #XRP pic.twitter.com/JpnZUVcQMH

— JackTheRippler ©️ (@RippleXrpie) October 18, 2024

SEC’s Missed Deadlines: A Key Factor

The crux of the speculation lies in the assertion that the SEC has clearly missed its submission deadlines. Legal experts note that sticking to the deadlines is important as the judge might throw out the case entirely if the deadlines are not met. The SEC had initially informed the deadline to be October 16, but the document was stamped by the court on October 17, indicating that the deadline has been missed. This could lead to a dismissal of the appeal.

Implication of the Dismissal On Ripple

If the appeal is dismissed, it could have far-fetched implications for both the SEC and the other regulatory bodies. A dismissal would halt this case altogether and will also lead to more lenient enforcements on the regulations applicable to the crypto space. It would also affect the future appeals involving regulatory compliance and help the cases that are facing similar issues. Additionally, while some legal experts caution that appellate courts often grant leniency to federal agencies, a missed deadline could still weaken the SEC’s position significantly.

For Ripple, there would finally be a regulatory clarity in terms of XRP token not being classified as a security. The uncertainty has caused significant amount of fluctuations with the pricing of the XRP token. If the appeal is dismissed, there would be a surge in the pricing and it is expected to reach up to $0.60.

Community Response and Anticipation

The legal community is closely monitoring developments as rumors circulate about when a decision might be announced. Investors and legal practitioners are keenly aware of the potential implications. Many are calling for greater transparency in the judicial process to ensure all parties understand their rights and obligations under current law.

As discussions continue and anticipation builds, all eyes remain on the court for an official announcement regarding the appeal’s status. The outcome will likely shape not only this case but also future interaction between regulatory agencies and those they oversee.

Also Read: Trump Launches WLF Token, Family Set to Reap 75% of Revenue