Over 30% Of Family Offices In US Actively Investing In Crypto, BNY Mellon Study Finds

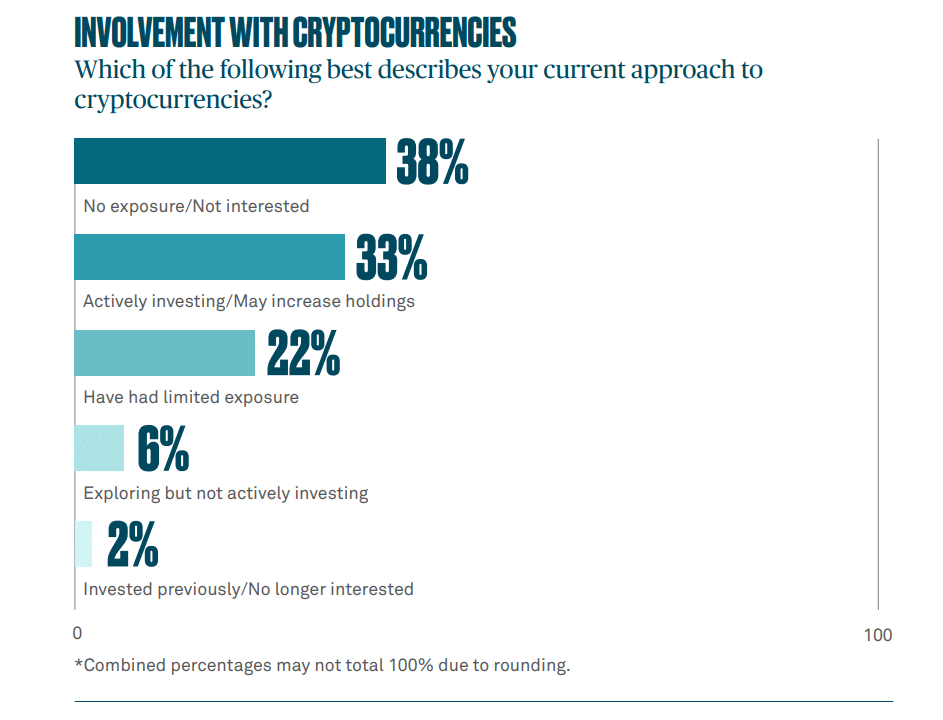

Around 55% of American family offices plan to increase their cryptocurrency investments or have had limited exposure to crypto, according to a BNY Mellon study.

More than 30% of family offices in the U.S. are actively investing in crypto and even may increase their holdings, a recent report by BNY Mellon reveals, highlighting growing interest in digital assets among wealthy families.

The report comes as the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin exchange-traded funds (ETFs) earlier in January, integrating crypto into the mainstream investing environment. According to BNY Mellon’s findings, 33% of family office professionals confirmed that they are already investing in crypto with the potential to expand their holdings.

In contrast, 38% of respondents reported having no current exposure to or interest in cryptocurrencies. The remaining 30% indicated a varied level of involvement, with some having limited exposure or currently exploring the asset class without active investment.

“True to their entrepreneurial nature, family offices are showing themselves ready and willing to move into new and emerging opportunities. […] Cryptocurrencies account for 5% of portfolios, an allocation that would have been unthinkable a decade ago.”

BNY Mellon

The motivations for exploring cryptocurrencies among family offices appear to be diverse. Over half of the respondents mentioned “keeping up with new investment trends and opportunities” as a key driver. Additionally, 30% or more cited interest from current leadership or the next generation within the family office as influential factors.

Despite the interest, the report identified the “not well-defined” regulatory environment as a significant barrier to investment. Nevertheless, 55% of family offices expressed favor for public market ETFs that own cryptocurrencies, while 54% showed a preference for trading directly on exchanges.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

BMNR Stock Slowly Prepares A Rebound As Key Ethereum Metrics Soar

The BMNR stock price was hovering at the crucial support level at $20 as BitMine continued accumulating Ethereum and as ... Read more

Michael Saylors Strategy Buys 1,142 Bitcoin As Wall Street Pros Remain Bullish On MSTR

Michael Saylor’s Strategy continued his dollar-cost averaging last week, even as Bitcoin tumbled to its lowest level s... Read more