Novogratzs Galaxy Digital Set To Overtake Coinbase As Largest Solana Validator

Galaxy Digital, the digital bank founded by Michael Novogratz, is poised to become the largest validator in the Solana network.

Galaxy Digital, a global crypto-focused financial services firm founded by Bitcoin bull Michael Novogratz, is set to surpass Coinbase as the largest validator in the Solana network, marking a significant milestone in the competitive world of blockchain validation.

As first noted by Helius CEO Mert Mumtaz, Galaxy Digital will become the biggest Solana’s validator “almost certainly due to the FTX estate sale,” after reports emerged saying the FTX estate sold between 25 million and 30 million locked-up SOL coins at $64 apiece.

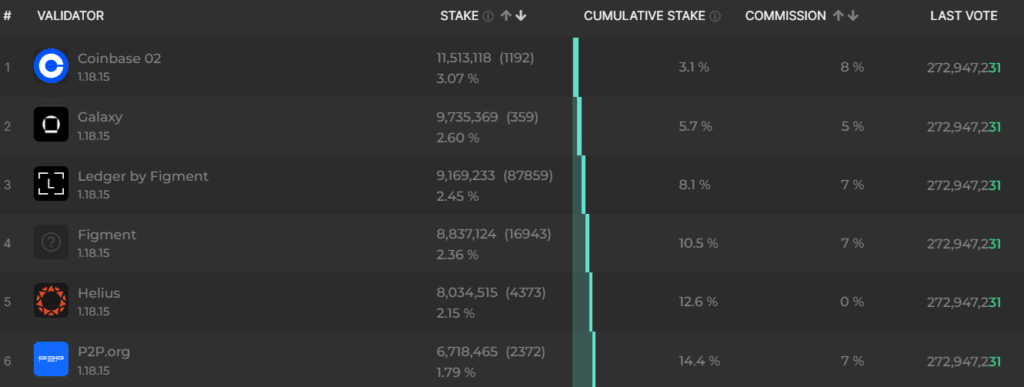

According to data from Solana Beach, Galaxy Digital currently ranks second to Coinbase with 9.7 million SOL tokens staked. Mumtaz forecasts Galaxy Digital to surpass the public crypto exchange by Jun. 22, noting Galaxy is poised to make annually $22 million from staking fees alone.

It’s unclear how much exactly Galaxy Digital holds in SOL tokens. According to a Bloomberg report, Novogratz’s Galaxy was also among the first auction buyers of FTX’s locked SOL and bought tokens on behalf of investors for a special-purpose fund that secured about $620 million. Forbes suggests Galaxy might have ended up with 9,687,500 SOL tokens, worth around $1.3 billion at current market prices.

Pantera Capital, which also participated in the bid, is now demonstrating bullish sentiment towards Solana, noting its potential to challenge Ethereum’s dominance in the blockchain ecosystem. In a recent newsletter, the Menlo Park-headquartered firm highlighted Solana’s rise as a significant development, pointing to its substantial growth over the past year and positioning it within a multi-polar model of blockchain platforms.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more