NFT Lending Volume Reaches Quarterly High With $2.1B In Q1, Data Shows

The NFT lending market hit a record $2.13 billion in Q1, up 43.6% quarter-over-quarter, with five of six top platforms seeing increased volumes.

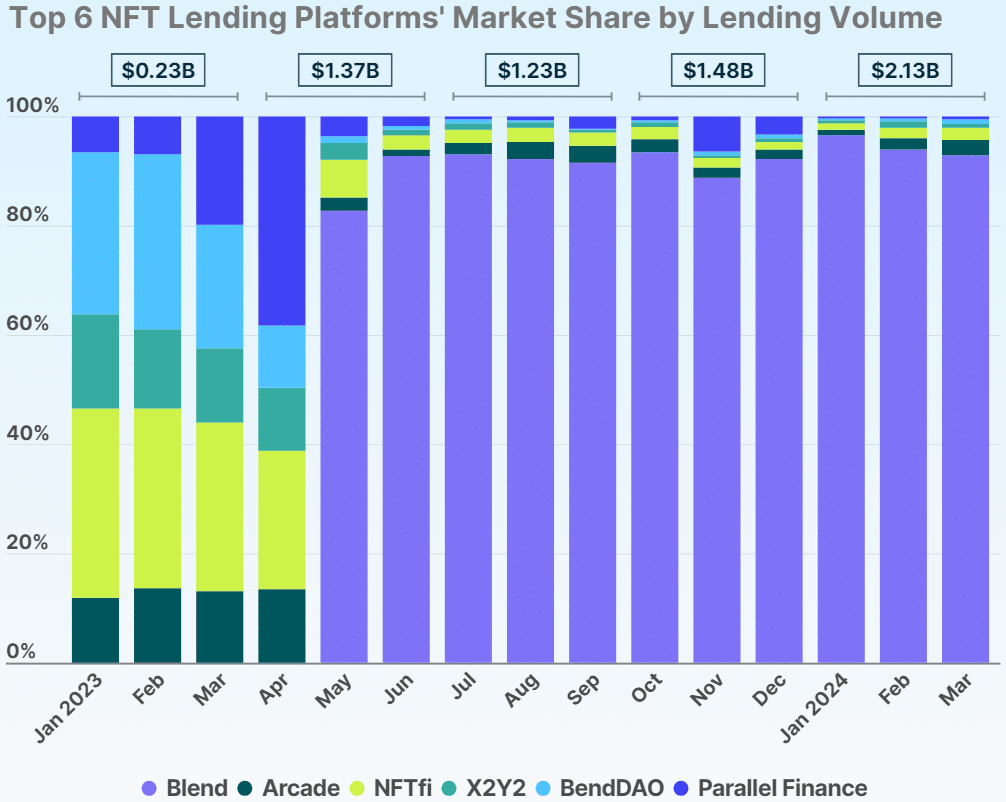

The lending market of non-fungible tokens (NFTs) has witnessed its leaders solidifying their positions, with the total NFT lending volume surging to a quarterly high of $2.13 billion in Q1, representing a 43.6% quarter-over-quarter growth, according to data published by CoinGecko.

The data shows that January witnessed a record-breaking $0.90 billion in total monthly NFT lending volume, surpassing the previous peak of $0.85 billion in June 2023. Among the top gainers, Blend emerged as the leader, capturing a staggering 92.9% share of the market with a monthly lending volume of $562.33 million in March alone.

“Despite Ethereum NFT collections dominating NFT loan originations, the potential impact of the rising popularity of Bitcoin Ordinals on the NFT lending market remains an area of interest.”

CoinGecko

Other players in the NFT lending arena, such as Arcade and NFTfi, have also witnessed growth, although they represent significantly lower market share capturing 2.8% ($16.94 million in volume) and 2.2% ($13.3 million in volume) respectively. Further down the hierarchy, X2Y2, BendDAO, and Parallel Finance (formerly ParaX) hold smaller market shares of 0.8%, 0.8%, and 0.5%, respectively.

To encourage more user engagement, NFT lending platforms are rolling out new incentives to boost trading volumes. For instance, in late February, Pantera Capital-backed Arcade unveiled its “Clash of Clans” airdrop initiative, aiming to distribute ARCD tokens among 4,000 wallets, each eligible to claim 750 ARCD tokens. Similarly, other marketplaces like X2Y2 and BendDAO have also launched their own tokens for their community members.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more