Miners Capitulation Looms If Bitcoin Fails To Recover Significantly, CryptoQuant Says

As summer looms, CryptoQuant warns that Bitcoin miners could face significant challenges ahead, particularly if prices fail to recover substantially during the warmer month.

Despite Bitcoin‘s price dipping below the $58,000 mark and prompting weaker investors to sell at current levels, major capitulation among Bitcoin miners has yet to begin. CryptoQuant head of research Julio Moreno said in an interview with crypto.news that the network hashrate remains slightly higher than pre-halving levels, noting that miners “can still make a profit” with “relatively efficient equipment.”

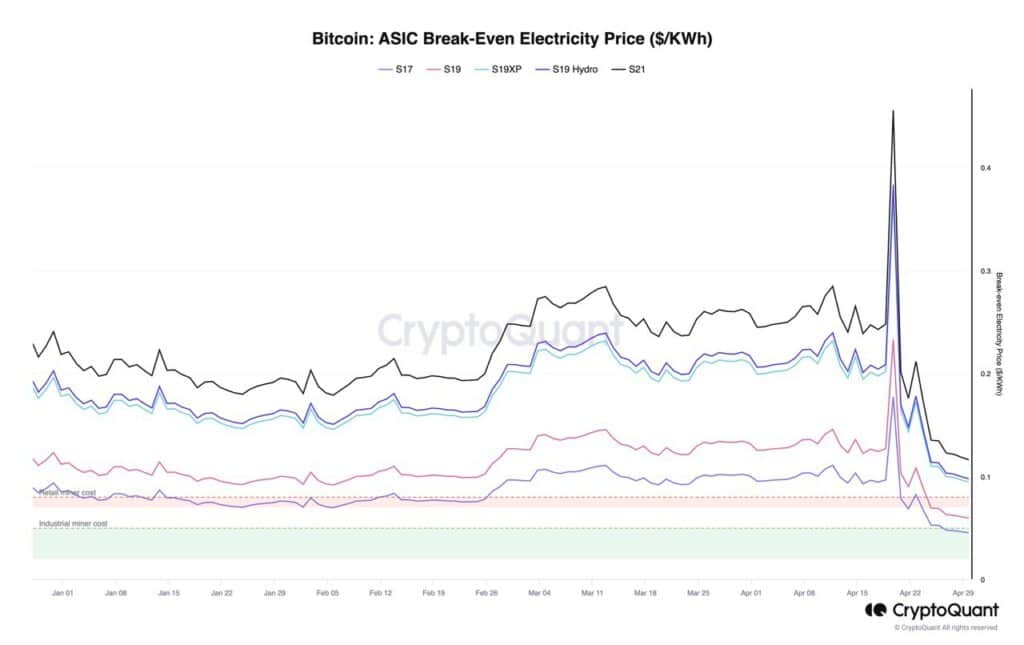

Moreno says the profitability is still can be seen in the break-even electricity price for ASIC models S19 and S21, which remain above the electricity cost of large industrial miners (green area).

However, he also noted that some retail miners, particularly those using older ASICs like S17 and S19, may be experiencing negative profits “due to higher electricity costs,” adding a capitulation event “will depend on how network hashrate and prices evolve in the next few weeks.”

Addressing concerns about potential price volatility during the summer trading slowdown, Moreno emphasized that miners typically respond to price movements rather than the other way around. Yet, he didn’t rule out the possibility that Bitcoin could see more selling pressure in the coming months.

“[The market is] more likely to see a miner capitulation if prices don’t recover significantly during the summer. Especially with the hashprice (average miner revenue per hash) making new lows.”

Julio Moreno

As crypto.news reported earlier, Bitcoin miners are not selling their crypto holdings at current prices even though their revenue has dropped to levels last seen in early 2023 due to the recent halving, which reduced fixed block rewards from 6.25 BTC to 3.125 BTC. According to CryptoQuant CEO Ki Young Ju, miners now have two options: capitulate or wait for a rise in Bitcoin’s price, which is currently trading below the $58,000 mark.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more