Japanese Yen Goes To Zero Against Bitcoin

Yen, the third-most traded fiat currency in foreign exchange markets, has fallen flat against Bitcoin.

The Japanese yen crashed to a 34-year low as authorities struggled to stem hyperinflation in the economy. According to Bloomberg, Japan’s sovereign fiat money suffers mainly due to a difference between local interest rates and U.S. Federal Reserve rates.

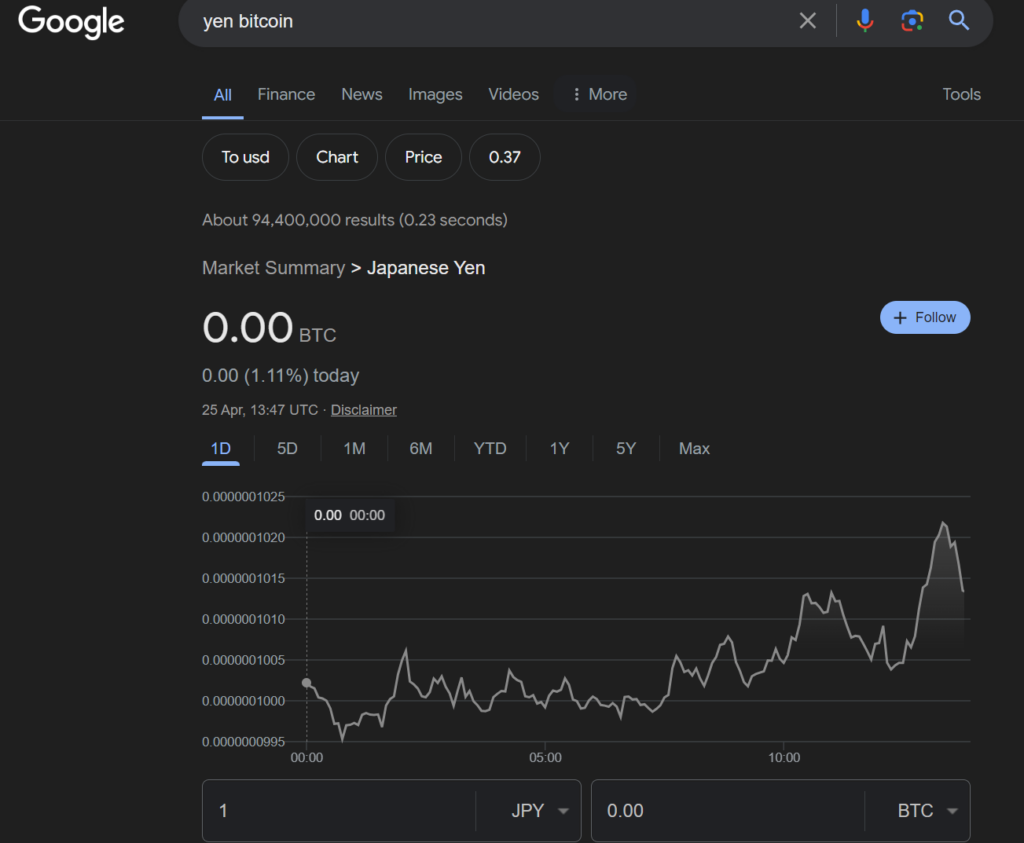

While the Japanese government navigates this conundrum, Bitcoin (BTC) has outstaged the yen in direct monetary value. On April 25, Google Finance showed that one Japanese yen equaled zero BTC.

In February, BTC rallied against several fiat currencies and achieved all-time highs in some 14 countries as the industry buoyed off euphoria from the newly approved spot BTC ETFs.

Following the news, much of the sentiment on social media praised Bitcoin as “sound money” and innovation capable of fostering financial freedom from the global traditional economic bubble.

Users reiterated what BTC maxi Michael Saylor describes as “Bitcoin’s superior design,” a nod to Satoshi Nakamoto’s system that ensured that only 21 million BTC would exist.

It is impossible to exceed this cap as it is hard-coded into BTC’s blockchain. A halving ensures that inflation is controlled by reducing the number of new tokens in circulation. The halving occurred last week, with Bitwise CIO Mat Hougan opining that the event would largely benefit BTC’s market value in the long term.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more