IMX Price Hits Key Support As Immutable Passport Signups Surge

Immutable X token is on track for its first weekly loss in four weeks despite strong performance of its ecosystem.

Immutable X (IMX) retreated to $1.4655 on Oct. 4, its lowest level since Sep. 9, and 22.4% below its highest level this month.

Passport users hit 3 million

In an emailed statement, Immutable X developers said that its ecosystem was doing well, with the number of sign-ups to Immutable Passport crossing the 3 million mark. That is a big increase since the platform had less than 300k sign ups in January.

The ongoing trend is mostly because of three titles that have continued doing well. RavenQuest has attracted over 200k monthly active users while games like SpaceNation and Immortal Rising 2 are seeing more traction.

A recent report by Messari also confirmed that Immutable X’s network was growing. Its daily active addresses jumped by 91,900% in the second quarter to 282k, mostly because of the Main Quest rewards program launch.

According to Messari, the number of NFT buyers in Immutable rose by 56% QoQ while sellers rose by 18%.

However, data by CryptoSlam shows tha NFT sales and users have retreated in the last 30 days. Sales dropped by 14.6% to over $14.5 million while buyers and sellers fell by over 82%.

Its total value locked in the Decentralized Finance industry has also stalled, remaining at $14.5 million in the last few months.

Immutable X is one of the biggest layer-2 networks in the crypto industry. Unlike other layer-2 blockchains like Polygon (POL) and Arbitrum (ARB), it has focused on the gaming and NFT industries.

A key challenge is that it is facing substantial competition from the TON Blockchain, which has become a major player because of the tap-to-earn industry growth. Other top competitors are Gala Games (GALA) and Ronin (RON).

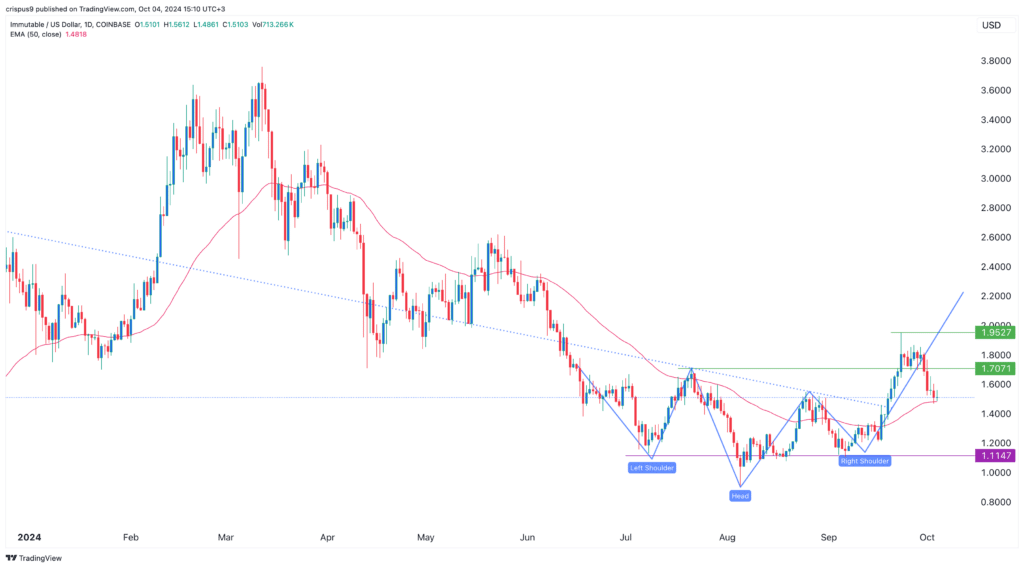

Immutable X finds support at the 50 EMA

The IMX token found substantial resistance at $1.9527 on Sep. 23 and has dropped sharply this week. This decline is mostly because of the ongoing sell-off in the crypto industry amid rising geopolitical risks.

It has dropped below the key support at $1.70, its highest swing in June. On the positive side, it has found support at the 50-day moving average and formed an inverse head and shoulders pattern, raising possibility of a rebound to the next resistance point at $1.70.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more