Heres Why Crypto Prices May Crash After The Trump Summit

Cryptocurrency prices rose slightly ahead of the inaugural crypto summit at the White House.

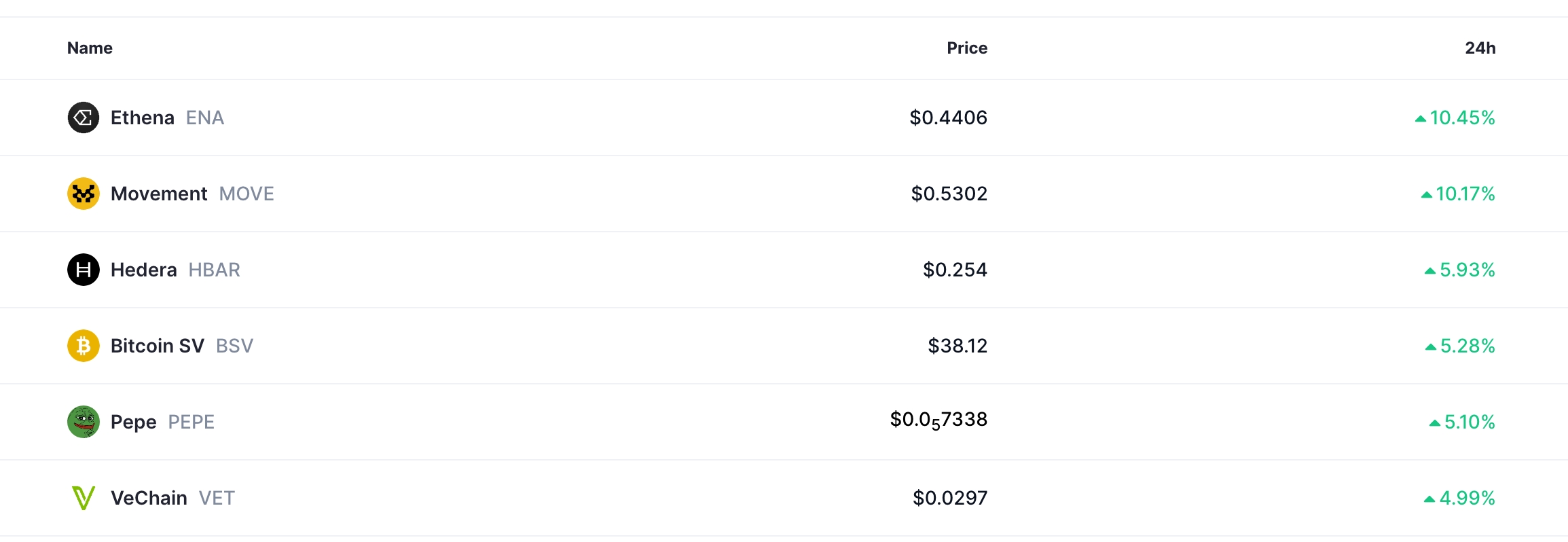

Bitcoin (BTC) rose to $90,200%, while popular altcoins like Ethena (ENA), Movement (MOVE), and Hedera Hashgraph (HBAR) jumped by over 10%. Most of these coins have rallied by double digits from their lowest levels this month.

The crypto summit comes a day after Donald Trump signed an executive order creating the Strategic Bitcoin Reserve. The order also created the US Digital Asset Stockpil, which will manage other coins. Some of the top coins to be included in the stockpile are Solana (SOL), Ripple (XRP), and Cardano (ADA).

The upcoming crypto summit will have the heads of some of the biggest players in the crypto industry. Some of the most notable confirmed guests are Brad Garlinghouse of Ripple, Michael Saylor of Strategy, JP Richardson of Exodus, and Brian Armstrong of Coinbase.

The summit will let these officials share their experience and regulatory recommendations to the Trump administration. The Trump administration has already done a lot for the industry, with the SEC ending lawsuits against several companies like Uniswap, Gemini, Kraken, and OpenSea..

Ideally, such a summit will lead to higher crypto prices because of the importance of the US government and friendly regulations.

However, there is a risk that Bitcoin and other cryptocurrencies will crash after the summit. That’s because of a situation known as buying the rumor, selling the news. In this, investors typically buy an asset after a big event and then dump it when it happens.

A good example of this is what happened when Donald Trump won the election. Cryptocurrencies surged after that and then erased these gains when he was inaugurated in January.

Similarly, the Ethereum price rose ahead of the spot ETF approvals in September last year and then dropped.

A likely reason for the post-summit dip is that there will be no new news from the summit. Besides, Trump has already signed his executive order on a Bitcoin reserve and crypto stockpile, and the SEC has started improving the regulatory environment.

Additionally, there are still significant macro-related risks, including Donald Trump’s tariffs on the biggest US trading partners.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more