Has The Crypto Bull Run Of 2024 Officially Started? Insights And Predictions

The crypto bull run in 2024 ranks among the strongest in Bitcoin’s history. What evidence supports this claim? Let’s find out.

Following its surge to $73,750 on Mar. 14, Bitcoin (BTC) has entered a phase of price consolidation, trading within the $68,000 to $72,000 range in subsequent sessions. This surge has sparked discussions about whether the crypto bull run has started.

The surge in Bitcoin’s price is closely linked to the upcoming BTC halving scheduled for Apr. 19-20. During this event, the block reward for miners will be halved from 6.5 BTC to 3.25 BTC, which historically has impacted Bitcoin’s supply and, subsequently, its price.

According to James Check, a leading on-chain analyst at Glassnode, the crypto market is transitioning from an “enthusiastic bull” phase to a potentially euphoric one. This shift began in October 2023 and gained momentum as BTC soared to its all-time high earlier this year.

Check suggests that the current bull market ranks among the strongest in Bitcoin’s history, citing minimal corrections throughout the rally.

Moreover, the surge in crypto prices is not only impacting trading but also job markets within the industry. Despite the bearish stagnation observed in previous years, the number of vacancies in the crypto industry reached an annual high in March.

Similarly, data from CryptoJobsList reveals a major uptick in job postings and applicants, reaching an annual record in March with 5,843 job applicants.

What really is happening? Has the crypto bull run of 2024 officially started? Let’s find out.

What is crypto bull run?

A crypto bull run refers to a period of sustained upward movement in the prices of crypto assets, particularly Bitcoin and other major digital assets.

During a bull run, investor confidence and buying activity increase, driving prices higher. This surge often leads to new all-time highs for various cryptos and attracts large-scale attention from both retail and institutional investors.

The current bull run is fueled by positive market sentiments, such as the U.S. SEC’s approval for spot BTC ETFs and the anticipation around the upcoming BTC halving.

However, it’s important to note that bull runs are not indefinite, and they are often followed by periods of price correction or consolidation.

Crypto bull run history

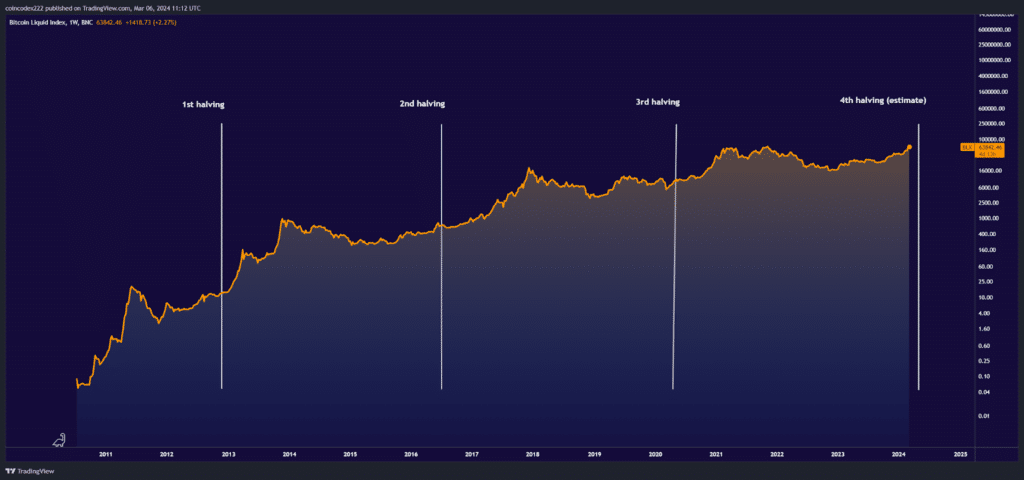

The first notable bull run occurred after Bitcoin’s first halving in 2012. This event reduced the block reward for the first time from 50 to 25 BTC, decreasing the rate at which new Bitcoins entered circulation.

Despite Bitcoin’s relatively low profile at the time, its price surged from double digits to over $1,000 in 2013, capturing mainstream attention and marking the beginning of its journey into the financial spotlight.

However, this rise was followed by a swift correction, with prices plummeting back to around $200 by 2015.

The second bull run also coincided with Bitcoin’s second halving event in 2016. As the block reward halved from 25 to 12.5 BTC, Bitcoin’s price exhibited bullish behavior, climbing from around $430 to over $750 by early June 2016.

Despite some volatility leading up to the halving, Bitcoin ultimately surged to new highs, surpassing $19,000 by December 2017.

The third major bull run occurred after the 2020 halving event, against the backdrop of the COVID-19 pandemic.

Despite global economic uncertainty, Bitcoin’s price witnessed a bullish momentum following the halving, reaching around $15,000 by November 2020 and eventually peaking near $69,000 in November 2021.

Throughout these years, Bitcoin’s price patterns adhered to established crypto bull run cycles, characterized by surges leading up to halving events, followed by corrections and consolidation phases before reaching new all-time highs.

Cues that we are in next crypto bull run

Let’s delve into the cues that signal the onset of the crypto bull market in 2024 and their implications.

Inflows into spot BTC ETFs

Since their inception in January 2024, spot BTC ETFs have experienced rapid growth, reaching a staggering market cap of $81 billion as of Apr. 10.

Leading the charge are Grayscale Bitcoin Trust (GBTC) and BlackRock iShares Bitcoin Trust (IBIT), collectively commanding over 70% of the assets under management (AUM).

These large inflows into BTC ETFs indicate a growing interest and confidence among investors in BTC, portraying a bullish sentiment.

Moreover, the consistent increase in inflows, coupled with mild volatility, suggests a strong appetite for BTC investment, further reinforcing the narrative of a bull run.

Price stability

Another prominent cue indicating the commencement of a bull run is the observed price stability in BTC.

Despite market fluctuations, BTC has maintained a relatively tight trading range, with prices consistently staying above $65,000 since reaching their all-time high.

Notably, BTC has repeatedly tested the $69,000 to $70,000 mark in recent weeks, finding strong support levels and potential for further upward movement.

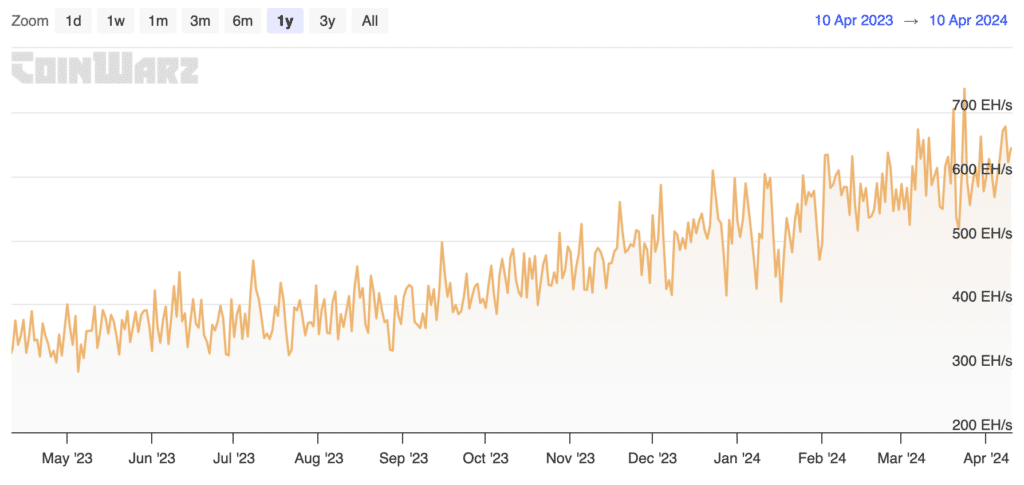

BTC hash rate

The anticipation surrounding the upcoming BTC halving event adds further fuel to the bullish narrative.

With the BTC hash rate steadily climbing, reaching 653 EH/s as of Apr. 10, the impending halving event gains significance.

As a result, the growing hash rate coupled with the approaching halving event strengthens the bullish outlook for BTC.

Fear and greed index

The BTC fear and greed index consistently registering above 75, and even touching 90 at the time of BTC’s all-time high in March, serves as another compelling indicator of the prevailing bullish sentiment.

High levels of investor optimism, as reflected by the fear and greed index, often correlate with upward price trends.

Rise in crypto stock prices

The surge in prices of crypto-related stocks, such as Coinbase (COIN), Marathon Holdings (MARA), and Microstrategy (MSTR), further reinforces the bullish outlook for the crypto market.

These stocks have witnessed strong gains, with MSTR surging by over 300% and COIN by over 200% in the last six months alone, highlighting the underlying bullish sentiment prevailing in the market.

Crypto bull run prediction: what do experts think?

According to Michaël van de Poppe, Bitcoin’s surge to all-time highs before halving is a positive sign. He suggests the continuation of the four-year cycle, indicating upward potential for the market.

Van de Poppe also suggests that if Bitcoin maintains its momentum, altcoins could experience substantial growth as well.

Another analyst highlights the ongoing strength of BlackRock’s spot Bitcoin ETF, as a growing interest from long-term investors.

With over 500K BTC held by new investors and 250K by IBIT, there’s a shift towards a long-term investment approach spanning decades. He suggests this as a multi-decade bull run in the making.

While these predictions are encouraging, it’s essential to approach them with caution. Market fluctuations and unforeseen events can impact the direction of crypto assets.

You should conduct thorough research and seek advice from financial professionals before making investment decisions. Never forget the golden rule of investing: never invest more than you can afford to lose.

FAQs

How long does a crypto bull run last?

Crypto bull runs can vary in duration, but they typically last for several months to a few years. While the exact duration of a bull run is difficult to predict, it is influenced by factors such as market sentiment, investor activity, and external events.

Why is the crypto bull run every four years?

The crypto bull run often coincides with Bitcoin halving events. This process occurs every 210,000 blocks, roughly every four years, gradually reducing the rate at which new Bitcoins are created. The scarcity created by halving events has historically led to increased demand and upward pressure on Bitcoin’s price, contributing to the occurrence of bull runs.

What causes a crypto bull run?

Several factors can contribute to the onset of a crypto bull run. Positive market sentiment, driven by factors such as regulatory clarity, institutional adoption, technological advancements, and macroeconomic conditions, often plays a key role. However, it’s essential to note that bull runs are not indefinite and are typically followed by periods of price correction or consolidation.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more