God Candle Forms On SAFE Chart Following Upbit Listing, Correction Ahead?

SAFE, the native token of Safe Wallet surged 72% over the last day after it secured a listing on Upbit and its wallet went multichain.

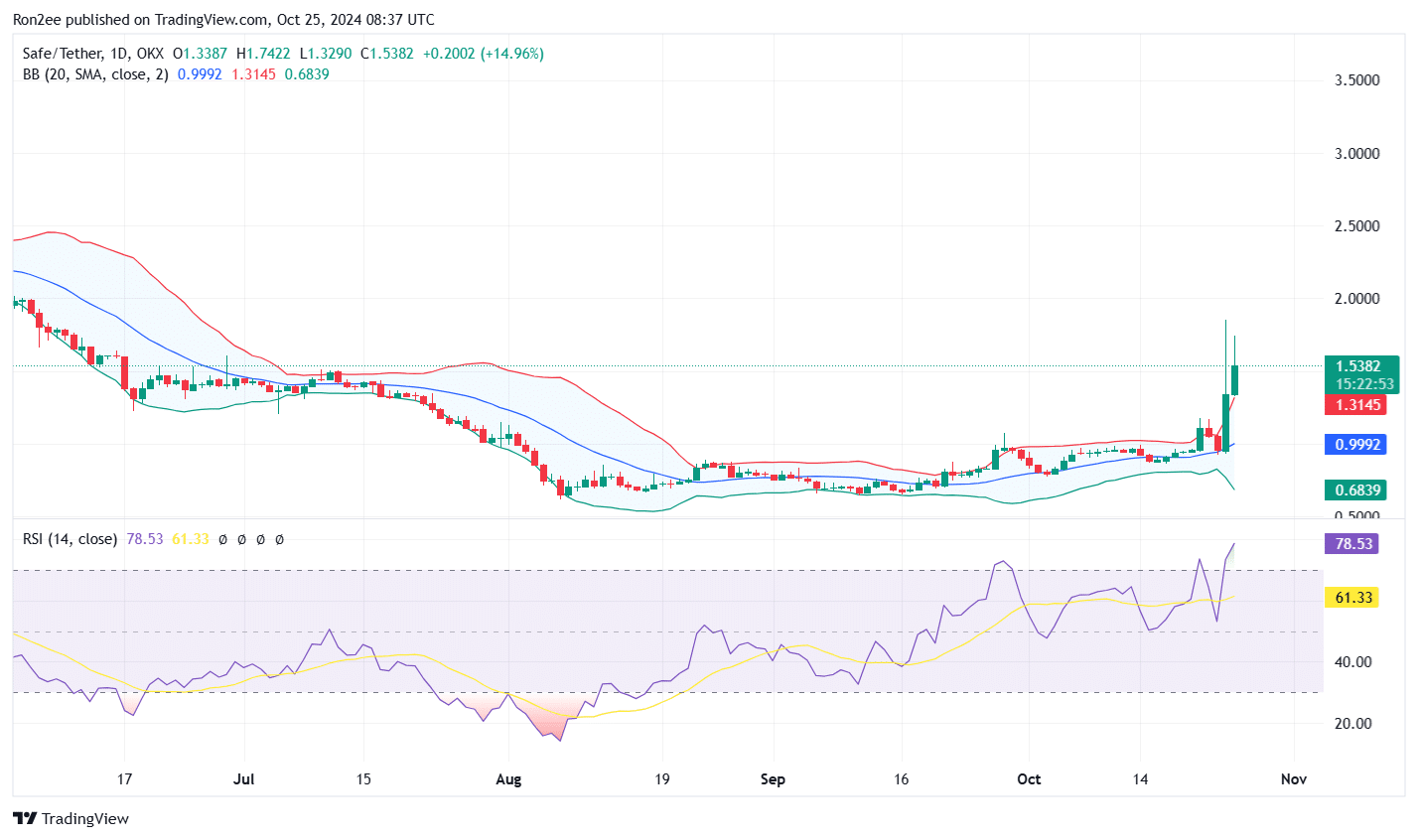

Safe (SAFE) surged to $1.65, marking a 115% increase from its September low after a “god candle” propelled the token from $0.94 to $1.70, pushing its market cap to $805 million. Despite this recent rally, SAFE remains 53.6% below its all-time high of $3.56, reached in April.

SAFE’s price rally occurred in a high-volume environment. Its daily trading volume was up 425% hovering over $114 million much higher than the $4 million seen on Oct. 24 morning.

The main driving force behind the recent rally was the token’s listing on South Korea’s largest cryptocurrency exchange, Upbit on Oct. 24, with introduced trading pairs for the token in Korean Won (KRW), Bitcoin (BTC), and Tether (USDT).

A listing on a major cryptocurrency exchange like Upbit often leads to a surge in the listed asset’s price, as it provides exposure to a new market where increased buying interest from fresh investors can drive its price higher.

According to an Oct. 24 X post by on-chain insights platform Spot On Chain, there’s been a spike in wallets buying SAFE since its Upbit listing. The top five first-time buyers alone have purchased 1.356 million SAFE ($2.24 million) from OKX, Bybit, and Uniswap, collectively gaining $150,000.

Further, Safe Wallet’s recent shift to a multichain environment has also fueled momentum by enhancing usability across over 15 networks. Users can now enjoy a unified wallet experience with a single deployment, a consistent address across chains, and gas-free transactions on major Layer 2 networks, which may have contributed to the increased demand for SAFE.

Despite the recent spike in SAFE’s price, it is worth noting that such rallies following an exchange listing often face a reversal as investors sell to lock in profits.

One community member Crypto Academic pointed to a similar situation with Injective’s token (INJ), which spiked after its Upbit listing only to see a sharp drop the next day. Crypto Academic cautioned that, as a stronger altcoin, INJ still faced substantial profit-taking, suggesting SAFE could experience a similar outcome.

Technical indicators also suggest a potential pullback in SAFE’s price, as it was positioned above the upper Bollinger Band at the time of writing, with the Relative Strength Index at 78, well above the overbought threshold.

In the event of a trend reversal, the altcoin will likely find support around the $0.9992 level, which aligns with the middle Bollinger Band on the 1-day SAFE/USDT price chart.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more