Fear And Greed Index Falls Back To Fear For 1st Time Since October

The sharp drop in the price of Bitcoin has led to a significant deterioration in sentiment among cryptocurrency traders.

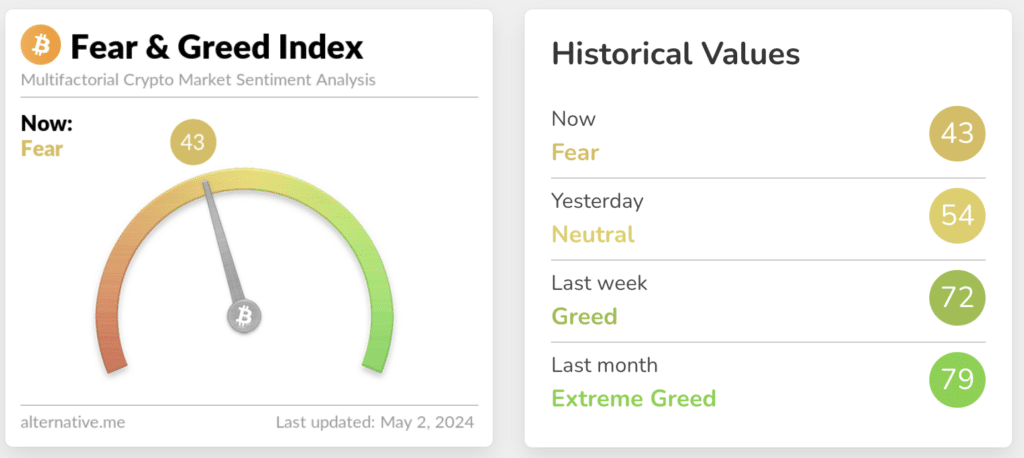

The Crypto Fear and Greed Index, which reflects the overall emotional background of the crypto market, dropped to 43, the lowest level since last October.

The indicator has moved from the greed zone, where it was just a week ago, to the fear zone, signaling growing investor anxiety. Fear is indicated on the scale by a value from 26 to 46. At these levels, bearish sentiment is assumed to prevail.

Continued capital outflows from U.S. spot ETFs are weighing on the market. The net outflow of funds from the spot Bitcoin ETF for May 1 amounted to a record $564 million — the highest amount since the products launched in January.

However, Santiment analysts remain optimistic about the future of BTC’s price. Experts noted that the market correction was predictable, given the growth in Bitcoin capitalization before the halving. Following the halving at the end of April, investors were buying on rumors and selling on news.

According to analysts, growth in the Bitcoin market in October 2023 and early spring 2024 was caused by high expectations from the halving. However, those who bought BTC at the end of March, when the price was at its all-time high, have been left at a loss.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more