CryptoQuant Says Miners Maintain Pre-halving Pace Despite Upgrade

Although transactions surged and fees hit records following the RUNES protocol launch, miners could still struggle with lower fees and steady hashrate after the halving, analysts say.

Despite the recent halving event, which saw the block reward drop from 6.25 BTC to 3.125 BTC, Bitcoin miners are still experiencing heightened daily revenue thanks to a spike in transaction fees, according to a recent analysis by CryptoQuant.

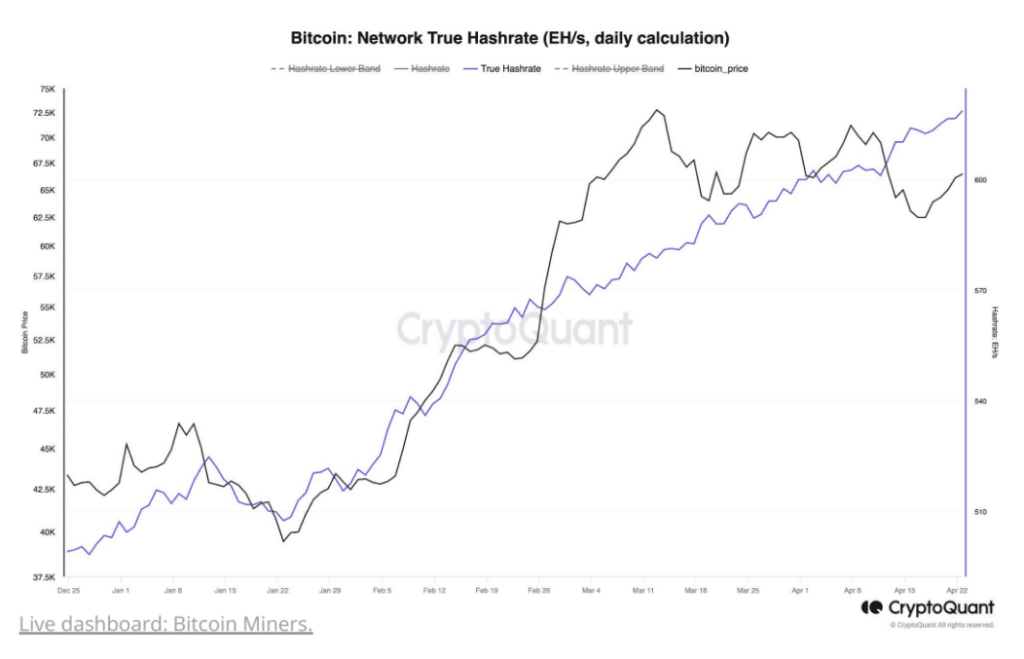

The analysts emphasized that transaction fees in the Bitcoin network increased to record-highs relative to the total miner revenue right on halving day, suggesting that miners “seem to be running operations at the same rate as before the halving.” CryptoQuant noted that despite the network’s upgrade, the total network hashrate has “remained flat to slightly higher at a rate of 617 EH/s.”

“Although it is still too early to see any long-term effects of the halving on the network hashrate, miners seem to be running operations at the same rate as before the halving.”

CryptoQuant

The analysts attributed the increase in fees to the launch of the RUNES protocol, a fungible token standard on the Bitcoin network, which allows the issuance and transfer of fungible tokens by storing data in OP RETURN codes.

Bitcoin’s fourth halving event, which occurred on Apr. 20, has sparked significant interest, particularly in its comparison to gold in terms of scarcity. Analysts at Glassnode note that the latest halving marked a historic moment where BTC issuance rates fell below those of gold for the first time, signaling a significant shift in the narrative surrounding the two assets. The next Bitcoin halving is anticipated around April 2028.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more