Consensus 2024: A16z Crypto Boss Confirms $25m Lobbying Donation

Web3-focused venture firm A16z Crypto nearly doubled its donation to major blockchain super PAC Fairshake.

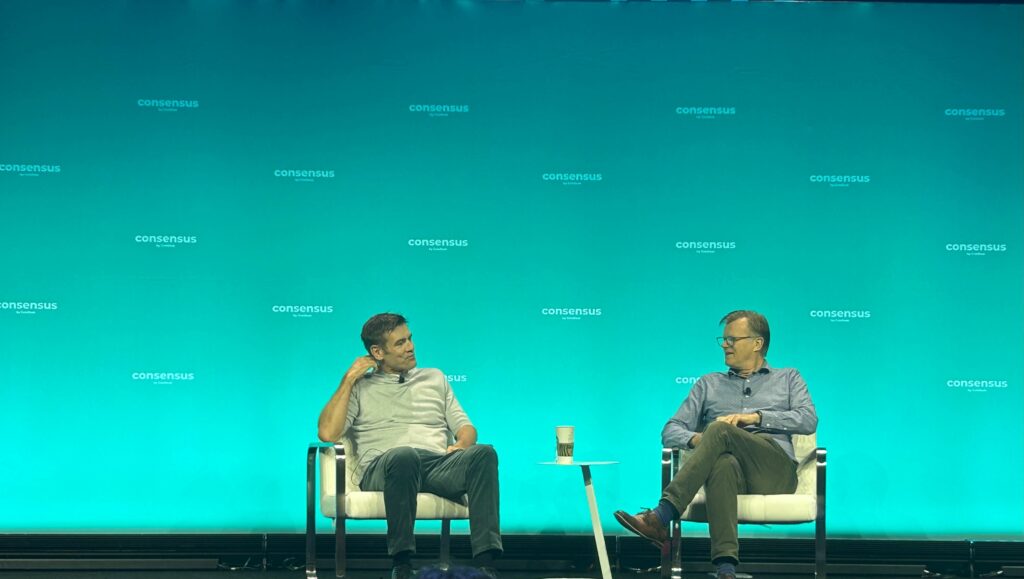

A16z Crypto founder and managing partner Chris Dixon confirmed his company’s $25 million donation to Fairshake, a super political action committee (PAC) focused on lobbying pro-crypto regulations on Capitol Hill.

The financial support will cushion campaign efforts for political candidates dedicated to protecting internet freedom, open-source blockchain development, and cryptography in the U.S., Dixon said at Consensus 2024.

The latest donation increased a16z Crypto’s contribution to Fairshake and its affiliated PACs to $47 million, joining other digital asset heavyweights like Coinbase and Ripple in deploying financial resources against anti-crypto rhetoric in Washington.

“As an industry, we need to keep up the momentum and show that the U.S. can lead in creating the next wave of blockchain innovation,” Dixon wrote on X.

https://twitter.com/cdixon/status/1796203749171765483

Fairshake backs bipartisan aspirants and lawmakers, a decision that Uniswap Labs CLO Marvin Ammori said the nascent industry should emulate. During a debate with Messari CEO Ryan Selkis at the blockchain conference, Ammori emphasized that crypto must not tie itself to any political party. A nonpartisan stand could also be the best case for the industry, Ammori said.

Following a record high for crypto lobbying last year, Fairshake has received tens of millions in donations from blockchain industry leaders and digital asset providers in 2024.

XRP issuer Ripple pledged $25 million to the Super PAC on May 29, matching last year’s $25 million allocation. Fairshake also received $4.9 million from Gemini exchange co-founders Cameron and Tyler Winklevoss in April.

Crypto companies are flowing millions of revenue into super PACs and their affiliates during an election year that could shape future U.S. digital asset policies. The crypto voting block has become prominent as nearly half of American voters either own digital assets or consider blockchain a motivating factor when considering candidates, according to a poll cited by crypto.news in March.

Digital asset adoption is also at a crossroads, with regulators like the U.S. SEC and policymakers like Senator Elizabeth Warren cracking down on service providers. Meanwhile, spot Bitcoin ETFs have clearly shown a demand for these virtual currencies and their underlying technology.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more